The stock market has just experienced a confusing correction session - Photo: QUANG DINH

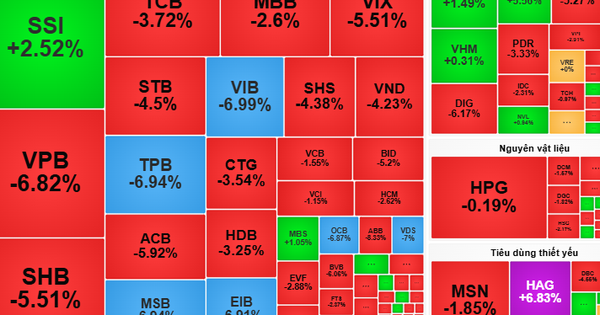

VN-Index fell more than 40 points on August 22 and closed the trading week at 1,645.47 points. Meanwhile, VN30 fell more than 60 points. So what will happen next week?

Two scenarios for the stock market

* Mr. Dong Thanh Tuan, analyst of Mirae Asset Vietnam Securities:

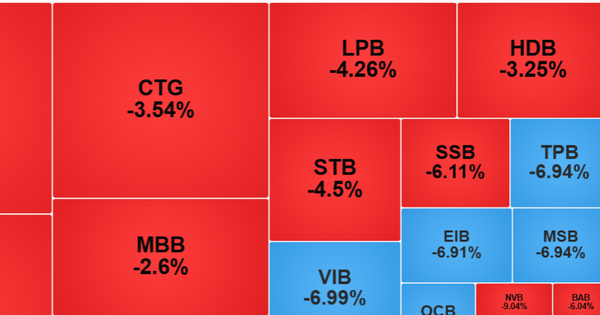

- The bright spot last week came from the explosive growth of a series of banking stocks, which helped strengthen the overall growth of the market, but these stocks also faced significant profit-taking pressure.

However, this also raises concerns about prolonged corrections with increasingly divergent developments among industry groups while liquidity continues to increase with an average trading value per session reaching VND51,300 billion.

Foreign investors net sold VND7,700 billion last week, increasing the net selling volume since the beginning of the year to VND62,000 billion. In particular, the net selling pressure last week mainly focused on some stocks such as VPB (-VND1,700 billion), HPG (-VND1,600 billion) andFPT (-VND592 billion). In contrast, this group bought SSI (VND281 billion) and PDR (VND238 billion).

We continue to maintain a cautious view in the short term, as the market's upward momentum is not yet truly sustainable, buying demand is still cautious while profit-taking pressure may increase, making concentration risks increasingly evident.

It is still relatively early to conclude that the market will enter a medium-term downtrend as the current fluctuations still reflect the usual cyclical nature after stocks or indices hit new highs.

Therefore, we give two scenarios for VN-Index next week.

In which, the base scenario: selling pressure is likely to be maintained in the first two trading sessions of the week; in which, we recommend monitoring the support zone which is expected to form around 1,580 - 1,610 points.

With a less optimistic scenario, a broad and unexpected correction aims to establish a medium and long-term support zone at 1,550 points.

Take profit with hot stocks

* Mr. Quach An Khanh - analyst of Vietcombank Securities (VCBS):

- The last session of the week, VN-Index ended with a long red candle with a small shadow, showing that the selling side was completely dominant. Liquidity reached 62,000 billion VND, confirming strong selling pressure despite efforts to support prices.

This adjustment is considered an inevitable development for the market to regulate supply and demand, and re-evaluate growth momentum after a period of hot growth.

Given the current market situation, investors are advised to realize profits on stocks that have recorded recent hot growth during the recovery sessions during the session.

At the same time, take the opportunity to look for codes that show signs of maintaining the support zone and prepare buying power to wait for disbursement opportunities when VN-Index rebalances.

"The peak of speculation, running away is the best policy"

* Mr. Phan Tan Nhat - Head of Market Strategy Department, SHS Securities:

- The market has shown signs of peaking, rotation, and speculation in most industry groups. Accordingly, VN30 is under strong selling pressure at 1,880 points, VN-Index is under selling pressure around 1,700 points.

With these developments, VN-Index may continue to be under pressure to correct to the price range around 1,600 points. "At the peak of speculation, running away is the best policy", this is the market development in the last sessions of this week.

In this week's news bulletins, we emphasized the headlines "high-priced dumping, narrowing opportunities", "banks relay, peaks and valleys" to emphasize the warning about the risk zone, the peak zone of many codes, as well as the phenomenon of strong speculation.

We recommend that investors closely monitor market developments, speculative positions, and carefully evaluate their portfolios and consider selling weakened stocks.

After a period of overheating and strong selling pressure, short-term speculative positions will decline. The market will slow down and liquidity will gradually decrease after continuously maintaining above VND50,000 billion in recent weeks.

The market will return to fundamental valuation factors and based on expectations of the upcoming Q3 business results after a period of overheating. Investors maintain a reasonable proportion. Investment targets are aimed at codes with good fundamentals, leading in strategic industries, and outstanding growth of the economy .

Source: https://tuoitre.vn/chung-khoan-tuan-moi-duy-tri-da-tang-hay-quay-dau-20250825092114039.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)