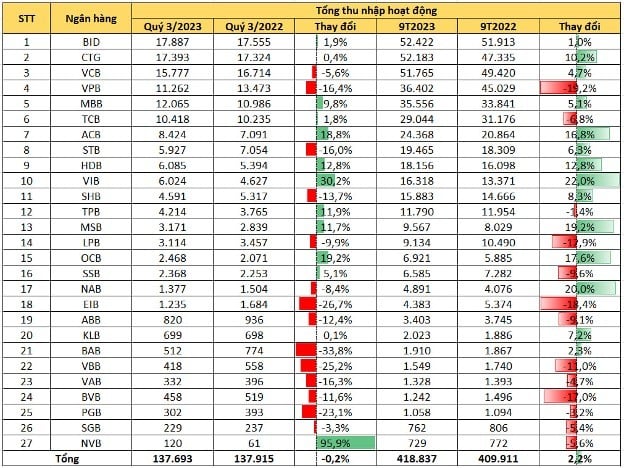

ANTD.VN - After the first 9 months of the year, the total net revenue of 27 banks on the stock exchange reached 418,837 billion VND, equivalent to nearly 17 billion USD. Of which, 14 banks grew compared to the same period in 2022.

Compared to the first 9 months of 2022, the total net revenue of these 27 banks was 8,900 billion higher (equivalent to an increase of 2.2%). Only the Top 10 banks with the highest net revenue had total operating income of 335,678 billion VND, accounting for 80% of the total net revenue of the banks on this list.

|

| Operating income (net revenue) of banks (summary from financial statements). |

Statistics show that 14/27 banks on the stock exchange recorded net revenue growth in the first 9 months compared to the same period in 2022. Of which,VIB ranked first in growth rate with an increase of 22%; in the third quarter alone, the total operating income of this bank increased by more than 30%.

VIB's main growth drivers come from its core businesses of retail banking, corporate banking and capital resources. Interest income reached VND13,000 billion, up 18% and non-interest income contributed 20% to total operating income.

In addition, the bank's CIR ratio has dropped significantly from 34% in the same period to 30% in the third quarter of this year. Meanwhile, operating expense growth increased only 4.5% over the same period.

According to VIB, the strong digital transformation in recent years has helped the bank operate effectively, shorten many procedures and processes, and increase employee productivity. Pioneering in the application of AI technology, biometrics and many other outstanding technologies such as cloud-native, augmented reality (AR), etc. has greatly supported VIB in promoting the retail banking segment. This advantage not only helps VIB increase profitability but also disperse risks and effectively control asset quality.

The outstanding growth of revenue sources along with good operating cost management has helped VIB's pre-credit provision profit grow dramatically, reaching nearly VND11,500 billion, up 31% over the same period last year, of which the third quarter alone reached VND4,300 billion - the bank's highest level ever.

Despite the exponential increase in provisions to increase risk defense, VIB's pre-tax profit in the first 9 months still reached more than VND 8,300 billion, up 7% over the same period, among the top banks with the highest profits and one of the rare banks with growing profits and following the plan, completing nearly 3/4 of the year's target.

In addition to VIB, a number of other banks also recorded net revenue growth of over 10%, including NamABank (20%), MSB (19.2%), OCB (17.6%),ACB (16.8%), HDBank (12.8%) and VietinBank (10.2%).

On the contrary, VPBank had the highest decline in net revenue in the first 9 months of 2023, up to 19.2% compared to the same period in 2022. Along with VPBank, many other banks also had a decrease of over 10% such as Eximbank (-18.4%), VietBank (-17%), LPBank (-12.9%), VietBank (-11%).

Source link

Comment (0)