Lack of support from the VN30 basket while selling pressure in other sectors was relatively large caused the VN-Index to drop 5.69 points in the first session of the week, down to 1,279.77 points.

Due to investors' caution, the market experienced slight fluctuations right from the beginning of the trading session on October 21.

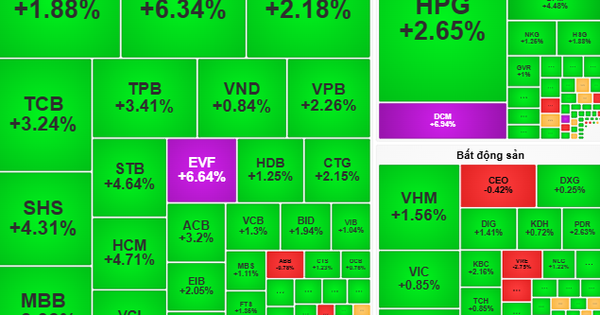

In the middle of the morning session, the VN-Index turned green thanks to cash flow disbursed at low prices. However, after the lunch break, the stock holders regained the upper hand with selling pressure gradually increasing, causing the market to be red until the close. The index representing the Ho Chi Minh City Stock Exchange closed the session at 1,279.77 points, down 5.69 points from the reference and extending the decline to the second consecutive session.

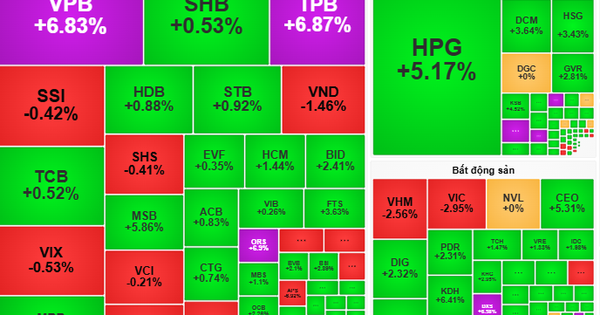

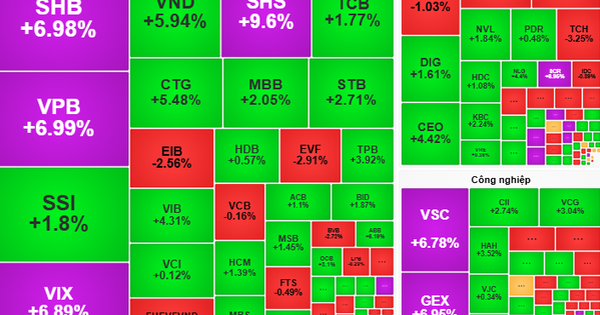

The number of stocks increasing was nearly 3 times less than the number of stocks decreasing, with only 99 stocks closing in the green while 287 stocks decreased. The large-cap basket recorded a similar situation with 23 stocks decreasing, while only 5 stocks increased.

Market liquidity improved in the afternoon session but remained low for the entire session at over VND14,347 billion, down VND1,038 billion compared to the session at the end of last week. This value came from about 623 million shares successfully transferred, down 66 million units compared to the previous session.

VHM led in liquidity in today's session with a value of approximately VND993 billion (equivalent to 21.2 million shares), followed by EIB with more than VND706 billion (equivalent to 34.7 million shares) and STB with about VND483 billion (equivalent to 13.5 million shares).

|

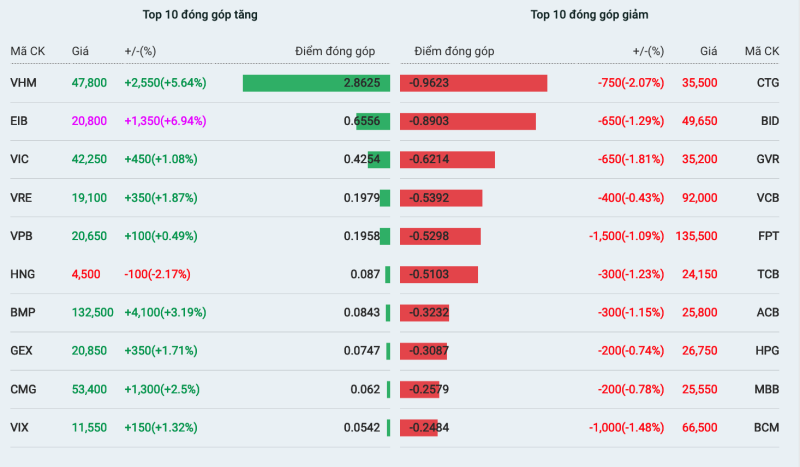

| List of stocks that have the most positive and negative impact on the market. |

The VN30 basket was under intense selling pressure. Specifically, CTG topped the list of stocks with the most negative impact on the market when it fell 2.07% to VND35,500, followed by BID with a 1.29% decrease to VND49,650. GVR ranked next with a 1.81% decrease to VND35,200, while VCB decreased 0.43% to VND92,000. Other large-cap stocks on the list were FPT, TCB,ACB , HPG, MBB and BCM.

The oil and gas group put great pressure on the market when almost all closed below the reference. Specifically, PSH decreased by 4.4% to 3,730 VND, PLX decreased by 1.8% to 41,600 VND, PVD decreased by 1.7% to 25,800 VND and PVT decreased by 1.6% to 27,500 VND.

In the steel group, HPG was sold heavily, making the already weak investor sentiment more negative and spreading to many other stocks. Specifically, NKG decreased by 1.9% to VND20,500, HSG decreased by 1% to VND20,400 and TLH decreased by 0.9% to VND5,360.

On the other hand, Vingroup shares became the pillar for today's session when VHM increased by 5.64% to 47,800 VND and led the list of stocks with the most positive impact on the VN-Index. VIC ranked next when it increased by 1.08% to 42,250 VND and VRE increased by 1.87% to 19,100 VND.

EIB was the only stock in the banking group that hit the ceiling in today's session, up to VND20,800 and closed with no sellers. Similarly, QCG of the real estate group also increased to its full range in the first session of the week, up to VND10,500.

Foreign investors continued their net selling streak for the seventh consecutive session. Specifically, this group sold nearly 43.7 million shares, equivalent to a transaction value of VND1,495 billion, while only disbursing VND1,227 billion to buy about 36.2 million shares. The net selling value was approximately VND268 billion.

Foreign investors focused on selling STB with a net value of more than VND131 billion, followed byFPT with VND63.6 billion, HPG with VND57 billion and SSI with VND56.4 billion. In contrast, foreign cash flow focused on VHM shares with a net value of more than VND104 billion. DXG ranked next with a net absorption of nearly VND53.1 billion, followed by MSN with more than VND45.9 billion.

Source: https://baodautu.vn/vn-index-giam-gan-6-diem-phien-dau-tuan-mat-moc-1280-diem-d227967.html

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)