Mr. Vo wondered when he would receive his pension and how much it would be with his conditions?

People receive pensions in Ho Chi Minh City (Illustration: Ho Chi Minh City Social Insurance).

Responding to Mr. Vo, Vietnam Social Security said that the time to receive pension is calculated based on the retirement age specified in Clause 1, Article 4 of Decree No. 135/2020/ND-CP dated November 18, 2020 of the Government .

Accordingly, from January 1, 2021, the retirement age of employees in normal working conditions is 60 years and 3 months for male employees and 55 years and 4 months for female employees; then, it will increase by 3 months each year for male employees until reaching 62 years old in 2028 and by 4 months each year for female employees until reaching 60 years old in 2035.

Based on the above regulations, in the case of Mr. Nguyen Thanh Vo, born in August 1964 and having paid social insurance for 20 years and 6 months, the time to be eligible for pension is December 1, 2025, when he is 61 years and 3 months old.

Regarding the pension level, Vietnam Social Security said that because Mr. Vo is a voluntary social insurance participant and previously paid compulsory social insurance, the monthly pension level is calculated according to the provisions of Clause 3, Article 5 of Decree No. 134/2015/ND-CP dated December 29, 2015 of the Government.

Specifically, the monthly pension is calculated by multiplying the monthly pension rate by the average monthly salary and income for social insurance contributions.

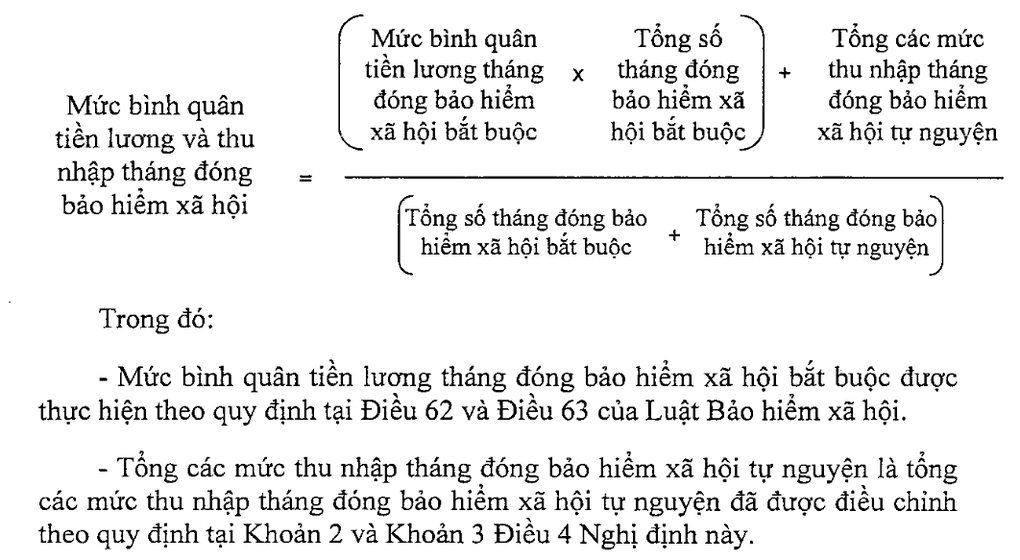

The average monthly salary and income for social insurance contributions to calculate pension and one-time allowance applicable to cases of both compulsory social insurance participation and voluntary social insurance participation is calculated according to the following formula.

Regarding the monthly pension rate, Point c Clause 2 Article 3 Decree No. 134/2015/ND-CP stipulates: For men retiring from 2022 onwards, the first 20 years of social insurance payment correspond to a pension rate of 45%, then for each additional year of social insurance payment, an additional 2% is calculated.

Compared with the case of Mr. Nguyen Thanh Vo, he has 20 years and 6 months of social insurance payment, so the pension rate is 46%.

Clause 3, Article 5 of Decree No. 134/2015/ND-CP also stipulates that in case a voluntary social insurance participant has paid 20 years or more of compulsory social insurance, the lowest monthly pension is equal to the basic salary at the time of receiving the pension.

That is, for social insurance participants in the above case, if the monthly pension after being calculated according to the above formula is lower than the basic salary, it will be calculated at the basic salary.

This regulation does not apply to the two groups specified in Point i, Clause 1, Article 2 of the Law on Social Insurance (part-time workers in communes, wards and towns) and Point c, Clause 2, Article 5 of Decree No. 134/2015/ND-CP (female workers who are full-time or part-time workers in communes, wards and towns participating in compulsory social insurance, eligible for pension but preserving the time of social insurance payment and continuing to participate in voluntary social insurance).

Source

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)