This is a particularly sensitive time, as from July 1, 2025, e-wallets are officially recognized as a means of payment similar to bank accounts, cards and cash. Users can transfer money between wallets, or from wallets to bank accounts and vice versa. This has been exploited by bad guys to set up many scams.

Common scam scenarios

According to Hanoi Police, high-tech criminals are currently deploying many familiar but increasingly sophisticated tricks:

Impersonating e-wallet employees: Subjects claiming to be employees of VNPAY , ZaloPay, MoMo... call to support "updating" or "authenticating" wallet information, asking users to provide personal data, account numbers, OTP codes to steal money in wallets or bank accounts.

Illustration photo.

Fake e-wallet messages/interfaces: Victims receive messages from “ZaloPay, MoMo, ShopeePay…” with content such as “you just received money”, “confirm inter-wallet transaction”, with fake links. When clicking and logging in, all information and OTP codes will be stolen.

Enticing users to transfer money through multiple wallets: Users are lured into participating in “reward missions” and “supporting loan disbursement”. As a result, not only do they lose money, but they also run the risk of being involved in money laundering or chain fraud.

Fake winning notice: Subjects call, send emails, text messages to notify customers that they "won an e-wallet promotion", requesting information or payment to receive gifts via link, QR code or bank transfer.

Fake promotions: Promoting programs such as “Transfer between wallets and get 50% cashback”, requiring users to transfer money first to “confirm the transaction”, often spread through social networks and online buying and selling groups.

Fake apps: Launching “e-wallet” apps or “fast inter-wallet transfer” utilities to install malware. When users log in, all data and OTP codes will be stolen.

Recommendations from Hanoi Police

Faced with the above situation, the Department of Cyber Security and High-Tech Crime Prevention, Hanoi City Police recommends:

People absolutely do not provide personal information, passwords, OTP codes to anyone, including bank employees or e-wallets.

Be wary of messages, emails, and calls asking you to access strange links or scan QR codes.

When linking an e-wallet to a bank account, absolute confidentiality is required and no registration is required for someone else.

Change your password regularly, and avoid using easy-to-guess passwords like your date of birth or phone number.

Hanoi police emphasized: Early identification and prevention of scams not only helps people protect their personal assets but also contributes to preventing the increasing number of high-tech crimes.

Source: https://doanhnghiepvn.vn/phap-luat/nhieu-chieu-lua-dao-tinh-vi-nham-vao-nguoi-dung-vi-dien-tu/20250823081052661

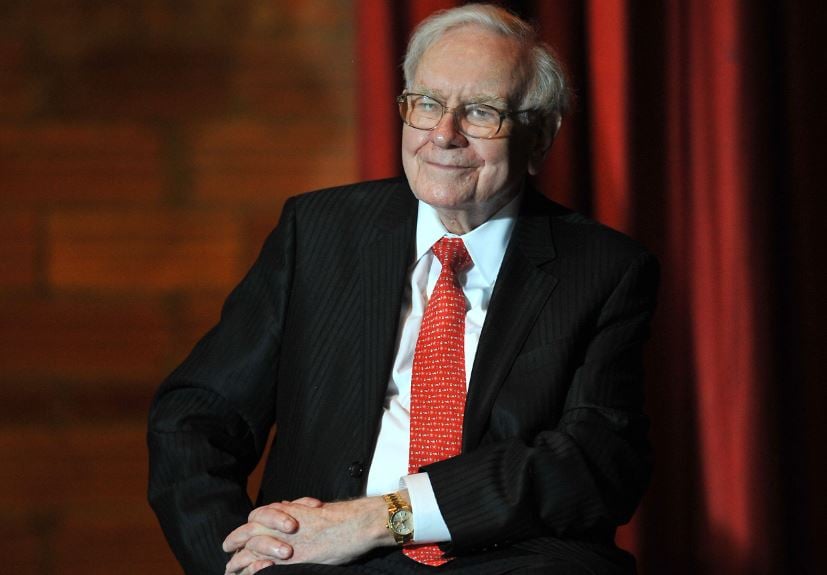

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)