Ms. Vu Thi Chan Phuong - Chairwoman of the State Securities Commission (SSC) - recently chaired a working session and exchanged information with the delegation of FTSE Russell and Morgan Stanley on upgrading the Vietnamese stock market.

Ms. Vu Thi Chan Phuong - Chairwoman of the State Securities Commission - works with foreign investors - Photo: SSCMs. Vu Thi Chan Phuong - Chairwoman of the State Securities Commission - works with foreign investors - Photo: SSC

FTSE Russell is one of the world's top three index providers, owned by the London Stock Exchange.

Morgan Stanley provides financial market analysis tools, headquartered in New York (USA), and periodically publishes market classification results for stock markets around the world, including Vietnam.

Vietnam has made important changes, creating favorable conditions for foreign investors.

Sharing at the meeting, Ms. Vu Thi Chan Phuong updated the new policies being implemented by the Government and the Ministry of Finance , aiming to create the most favorable conditions for foreign investors to participate in the Vietnamese financial market, as well as meet the criteria for upgrading to an emerging market.

The committee chairman said that today (November 4) is also the first day that Circular 68 of the Ministry of Finance takes effect, removing the requirement that international investors must have enough money before buying securities.

Accompanied by many new regulations on securities trading, payment, securities clearing, securities company operations and information disclosure.

At the same time, Vietnam Securities Depository and Clearing Corporation has also issued new regulations related to: depository members, securities clearing and settlement activities, securities registration and transfer of ownership at the unit.

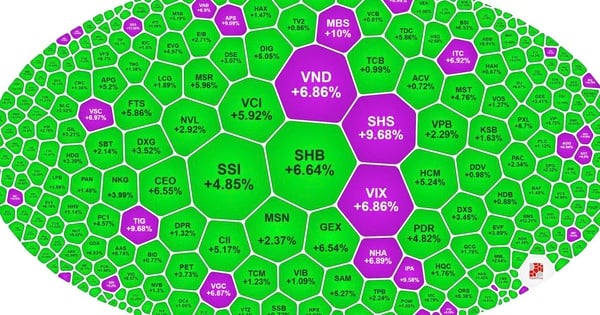

Mr. Young Lee - Managing Director of Asia Equity Business, Morgan Stanley - commented that the new regulations in Circular 68 have helped the Vietnamese stock market to be more in line with the mandatory requirements of FTSE Russell.

Accordingly, removing the requirement of having enough money when placing an order is an important requirement from investors and it takes a lot of time to amend the mechanism and policies.

In fact, Vietnam has made important changes in this criterion in just a short time, so we appreciate these efforts from the securities market management agencies in Vietnam.

Ms. Wanming Du - Head of Index Policy, FTSE Russell - discussed at the working session

Could attract billions of dollars more

Witnessing the new developments after half a year, Ms. Wanming Du - head of index policy at FTSE Russell - affirmed that she will increase exchanges and work with relevant parties.

To support the trading activities of foreign investors in Vietnam, as well as share information and trading methods of this unit's customers in emerging markets.

Regarding prospects, Morgan Stanley representatives said that if Vietnam's stock market is upgraded from frontier to emerging, it could attract $800 million from passive investors using the FTSE index, and $2 billion from passive investors using other indexes. At the same time, when the market is upgraded, active funds will participate more actively, with an expected inflow of about $4-6 billion into Vietnam.

Also at the working session, the FTSE Russell delegation and the State Securities Commission exchanged and discussed: the payment process for account deficits for failed buying and selling transactions, the registration process for foreign investors' trading assets, the total asset mechanism, the limit on foreign investors' ownership ratio, trading infrastructure, etc.

At the end of the meeting, Chairwoman Vu Thi Chan Phuong thanked the delegation for supporting Vietnam in the process of upgrading according to the criteria of the rating organization. At the same time, she affirmed that the committee is ready to exchange information through both online and direct forms to further meet the needs of foreign investors participating in the Vietnamese stock market.

Mr. Young Lee - Managing Director of Asian Equity Business, Morgan Stanley - Photo: SSC

Experts working on upgrading Vietnam's stock market - Photo: SSC

Source: https://tuoitre.vn/nang-hang-thi-truong-chung-khoan-viet-nam-co-the-hut-toi-9-ti-usd-von-ngoai-2024110421105601.htm

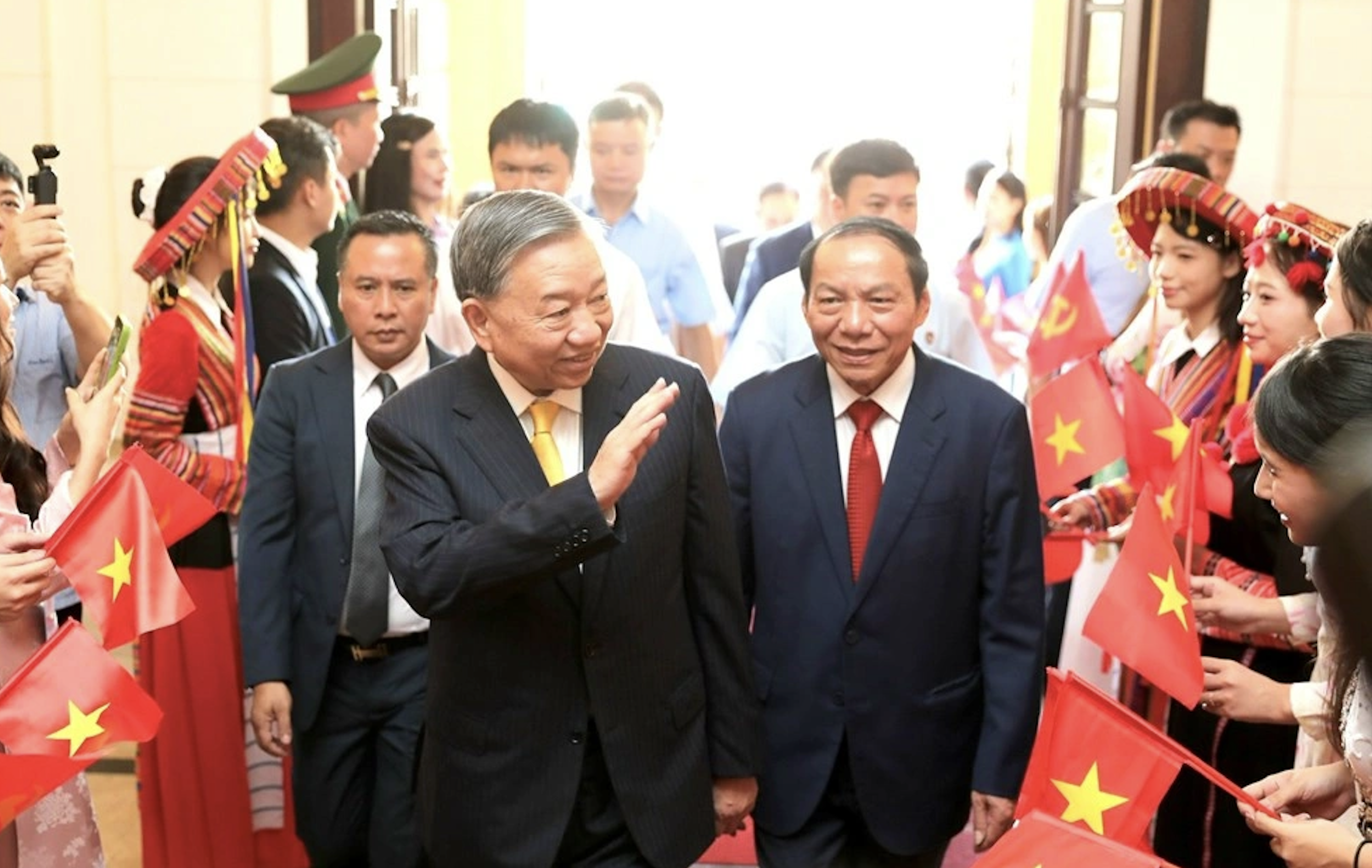

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

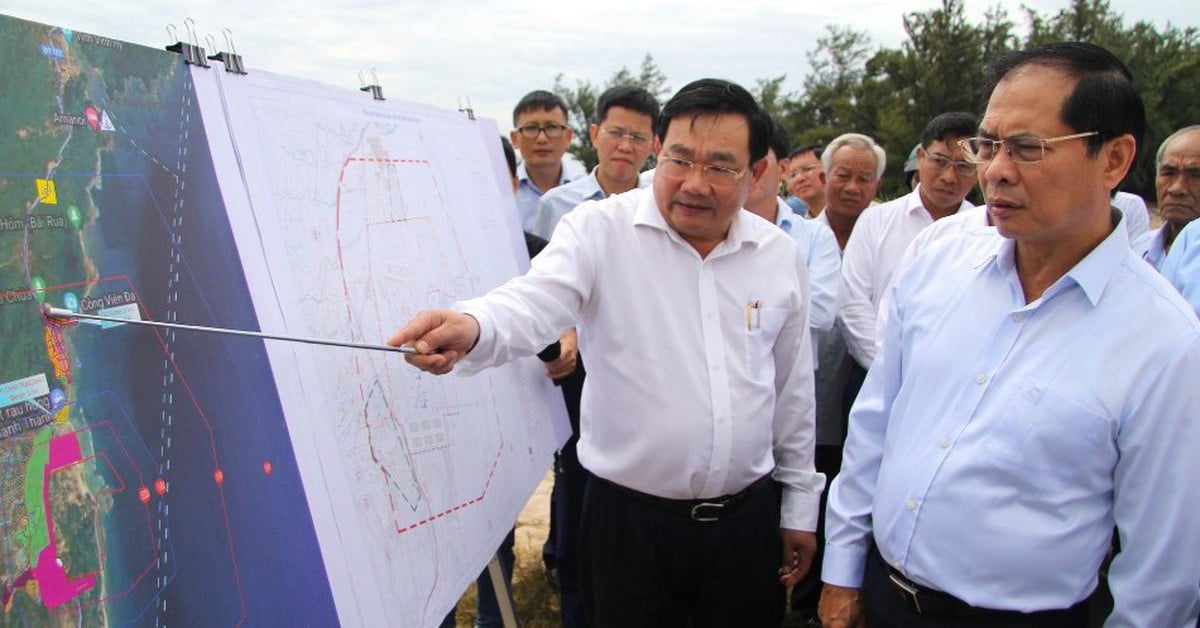

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)