In the early 20th century, the US dollar overtook the British pound as the global reserve currency. By the middle of the last century, its dominance in the international financial and trade system was unquestionable.

In 1977, the USD became the most popular reserve currency, accounting for 85% of global foreign exchange reserves. In 2001, it still held that position, with a share of about 73%. That number has since declined to approximately 58% today.

The dominance of the USD has long been associated with the hegemony of the US economy. However, this position is unlikely to be maintained due to changes around the world, including the gradual shift of gravity from the West to the East, the complexity of US politics , as well as the growing power of China and the yuan, etc.

The Rise of the Renminbi

Mr. Andrei Kostin, CEO of VTB - the second largest bank in Russia, said that the Russia-Ukraine conflict has created profound changes to the world economy , weakening the globalization process, while China is increasingly proving its role as the world's leading economic power.

The US and the EU will suffer heavy losses after freezing hundreds of billions of dollars in Russian sovereign assets, as many countries are switching to currencies other than the US dollar and euro, according to Mr. Kostin. Meanwhile, China will gradually lift restrictions on the yuan, according to Mr. Kostin.

"The era of US dollar dominance is coming to an end," said Andrei Kostin, CEO of VTB Bank - Russia's second largest bank. Photo: NY Times

“The era of dollar dominance is coming to an end. China understands that it will not be able to become the world’s number one economic power if it continues to keep its currency inconvertible,” said Mr. Kostin, adding that China would be at risk if it continued to invest in US government bonds.

China's economy has grown spectacularly over the past 40 years, while the Russia-Ukraine conflict and debt ceiling disputes have kept the dollar under close watch.

In addition, many signs of “de-dollarization” are taking place strongly in the global economy after the US implemented sanctions, prohibiting countries such as Iran and Russia from using the USD for payments. Up to now, Washington has implemented sanctions policy with 22 countries.

Russia and a group of African countries have initiated talks to establish settlements in their own currencies, moving away from both the US dollar and the euro. The BRICS alliance of five major emerging economies (Brazil, Russia, India, China and South Africa) has also announced its intention to cooperate on creating a new currency as a means of payment.

Meanwhile, China is working to internationalize the yuan, even though the currency accounts for less than 3% of global official reserves.

"Hot war"

Mr Kostin is one of the most experienced and powerful bankers in Moscow. He was the head of Vneshekombank, now known as VEB.

After Russia launched a special military operation in Ukraine in February 2022, the West implemented the toughest sanctions ever imposed to weaken the Russian economy and punish Mr. Putin.

Mr. Koistin said these sanctions were unfair and a “counterproductive” political decision for the West.

Asked whether he thought the world was entering a new cold war, Mr. Kostin said it was a “hot war,” even more dangerous than the cold war.

Chinese President Xi Jinping, Russian President Vladimir Putin, former Brazilian President Jair Bolsonaro, Indian Prime Minister Narendra Modi and South African President Cyril Ramaphosa during a meeting in 2019. The five-nation bloc (BRICS) is seeking a common currency to eliminate the US dollar from its trade transactions. Photo: Business Insider

“It is not a cold war, because there are too many Western weapons and too many Western military services and advisers. The situation is worse than the cold war, very difficult and alarming,” Mr. Kostin affirmed.

According to Mr. Kostin, the Russian economy will not be affected by the West. In April, the International Monetary Fund (IMF) raised its forecast for Russia's GDP growth in 2023 from 0.3% to 0.7%, but lowered its forecast for 2024 to 1.3% from 2.1%.

“The sanctions are bad, and of course we have to endure them. However, the Russian economy has learned to adapt. We expect the sanctions to be tightened even more. Many doors will close, but we will find other doors,” Mr. Kostin said optimistically .

Nguyen Tuyet (According to Reuters, IPS Journal)

Source

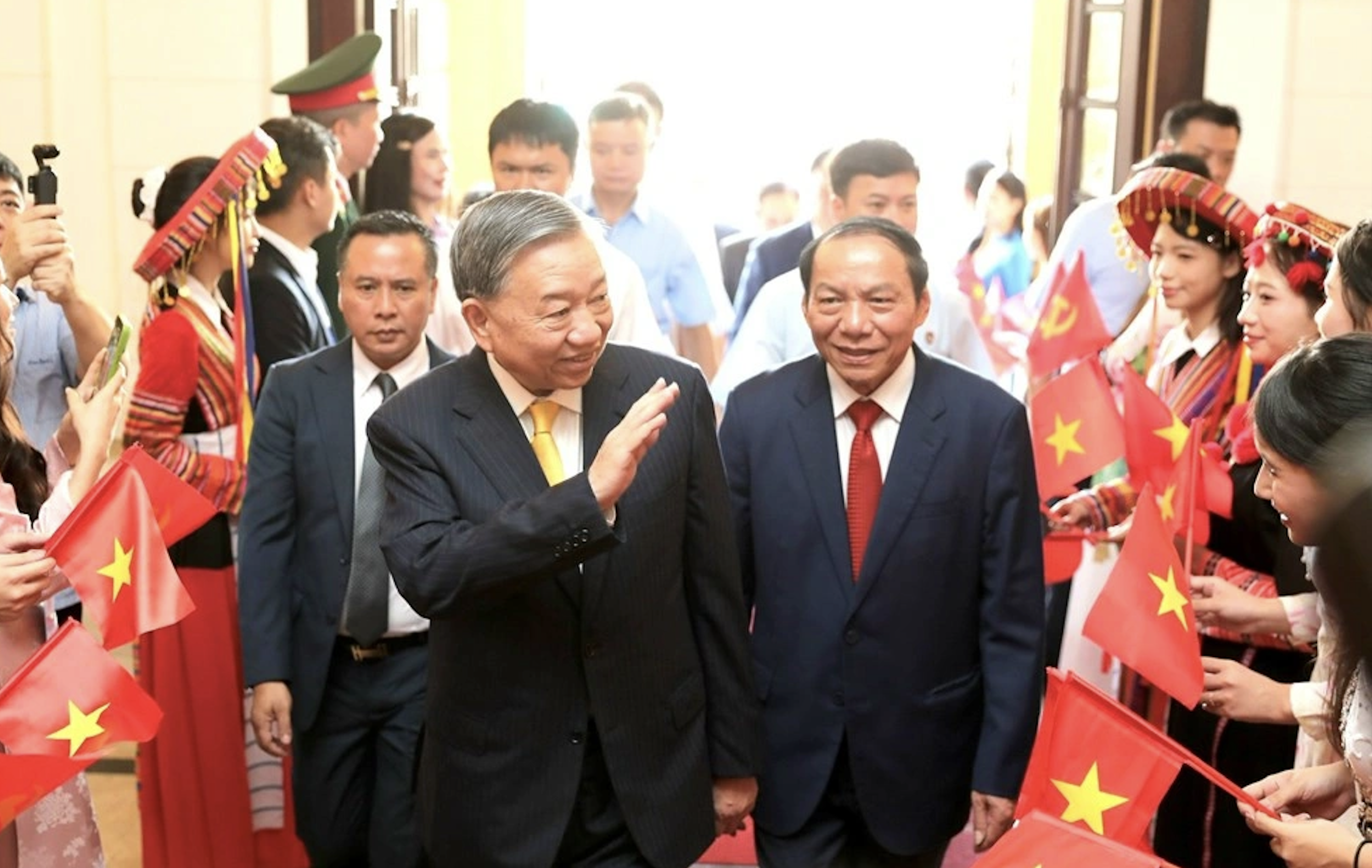

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)