SGGPO

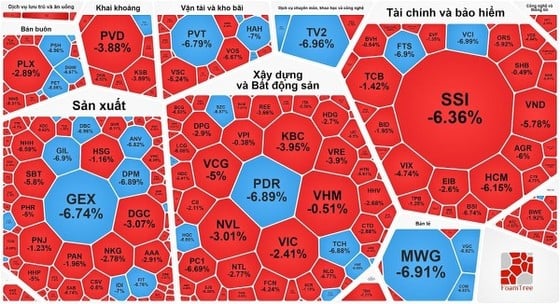

The sell-off at the end of the session caused the last trading session of October to continue to plummet. The VN-Index officially lost the 1,030 point mark after losing nearly 126 points in October 2023; in which, the trio of Vingroups , VHM, VIC and VRE, "took away" about 70 points from the VN-Index.

|

| VN-Index lost the 1,030 point mark at the end of October 2023 |

The stock market trading session on October 31 was quite negative due to the fragile sentiment of investors after the previous series of sharp declines. Although the VN-Index had a moment of green during the session, it quickly fell back due to the large supply. At the end of the afternoon session, the pressure to sell off mortgages pushed many large stocks to the floor, triggering a sell-off across the market, causing the VN-Index to fall sharply. Foreign investors who had been net buyers in the morning session also returned to sell, contributing to putting more pressure on the general market.

The group of securities stocks "fell downhill" with FTS, VCI hitting the floor, MBS down 6.98%, CTG down 6.73%, SHS down 6.52%, SSI down 6.36%, HCM down 6.15%, ARG down 6%, ORS down 5.92%, VND down 5.78%, SBS down 4.92%, VIX down 4.74%, VDS down 4.44%, BVS down 4%...

Real estate stocks maintained their green color throughout the morning session but also fell along with the market in the afternoon session: PDR, HQC, SZC, TCH, TDC hit the floor; NLG decreased by 6.77%, DXS decreased by 6.67%, ITA decreased by 5.56%, QCG decreased by 5%, DRH decreased by 4.82%, LDG decreased by 3.72%, HDC decreased by 3.41%, NVL decreased by 3.01%, IDC decreased by 2.97%, HDG decreased by 2.7%; the Vingroup trio also decreased simultaneously with VRE decreased by 3.9%, VIC decreased by 2.41% and VHM decreased by nearly 1%.

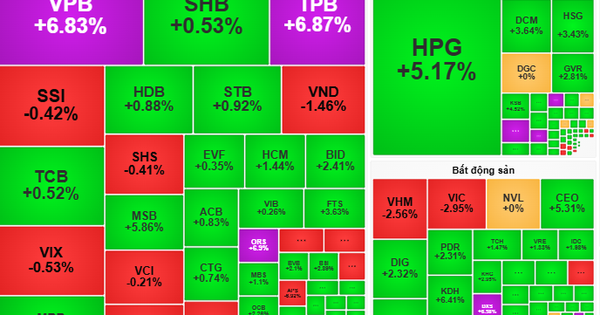

Banking stocks were differentiated with SSB up 1.78%, VIB up 1.7%, OCB up 1.59%, VCB up 1.05%, MBB up nearly 1%. On the contrary, EIB down 2.6%, BID down 1.95%, TCB down 1.42%, TPB down 1.25%;SHB , MSB down nearly 1%.

The manufacturing group, except VNM and MSN, maintained green, the rest decreased quite deeply: GEX, DPM, DBC, ANV, IDI, GIL decreased by the largest amplitude, GVR decreased by 6.11%, SAB decreased by 6.74%, MSH decreased by 6.56%... The retail group also shared the same fate with MWG and DGW, both hitting the floor....

At the end of the trading session, VN-Index decreased by another 14.21 points (1.36%) to 1,028.19 points with 448 stocks decreasing, 66 stocks increasing and 52 stocks remaining unchanged. At the end of the session at Hanoi Stock Exchange, HNX-Index also decreased by 5.17 points (2.45%) to 206.17 points with 131 stocks decreasing, 37 stocks increasing and 50 stocks remaining unchanged. Liquidity increased compared to the previous session, with total transaction value in the whole market of about 17,400 billion VND.

Foreign investors continued to dump stocks despite the market's sharp decline, continuing to net sell nearly VND307 billion on the HOSE. The stocks that were heavily net sold were VHM with nearly VND258 billion, MWG nearly VND78.5 billion, STB nearly VND47.5 billion, MSN nearly VND42.4 billion.

Source

Comment (0)