|

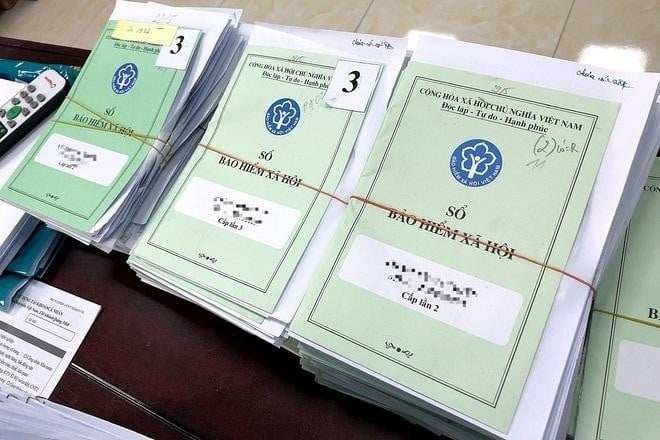

Responsibility for closing social insurance books for employees

Pursuant to Article 48 of the 2019 Labor Code, when terminating a labor contract, the enterprise and the employee have the following respective responsibilities:

- Within 14 working days from the date of termination of the labor contract, both parties are responsible for fully paying all amounts related to the rights of each party, except in the following cases which may be extended but not more than 30 days:

+ Non-individual enterprises cease operations;

+ Enterprises change structure, technology or for economic reasons;

+ Division, separation, consolidation, merger; sale, lease, conversion of business type; transfer of ownership and right to use assets of enterprises and cooperatives;

+ Due to natural disasters, fires, enemy attacks or dangerous epidemics.

- Salary, social insurance, health insurance, unemployment insurance, severance pay and other benefits of employees according to collective labor agreements and labor contracts shall be given priority for payment in case the enterprise or cooperative is terminated, dissolved or bankrupt.

- Enterprises have the following responsibilities:

+ Complete the procedure to confirm the period of social insurance and unemployment insurance payment and return it along with the original documents of other employees if the enterprise has kept them;

+ Provide copies of documents related to the employee's work process if requested by the employee. The cost of copying and sending documents is paid by the enterprise.

Thus: Based on the above regulations, when terminating a labor contract, the enterprise is responsible for confirming the period of social insurance and unemployment insurance payment (or in fact called closing the social insurance book) for the employee.

Therefore, accountants and human resources staff in enterprises need to pay attention to this regulation to perform the necessary work to close the social insurance book for employees who terminate their labor contracts.

Can employees close their social insurance books themselves?

Pursuant to Article 48 of the 2019 Labor Code, enterprises are responsible for completing the procedures for confirming the period of social insurance and unemployment insurance payment and returning it along with the original copies of other documents if the enterprise has kept them from the employee.

In addition, Clause 5, Article 21 of the Law on Social Insurance 2014 also stipulates that enterprises are responsible for coordinating with the Social Insurance agency to return social insurance books to employees, confirm the period of social insurance payment when employees terminate labor contracts, work contracts or quit jobs according to the provisions of law.

Thus, it can be seen that closing the social insurance book is the responsibility of the enterprise and is carried out with the coordination of the social insurance agency.

Therefore, employees cannot close their social insurance books at the social insurance agency after quitting their jobs, whether they quit legally or abruptly, but must return to their old company to request them to complete the procedures to close their social insurance books.

Penalties for businesses that do not close social insurance books for employees

Pursuant to Article 12 of Decree 12/2022/ND-CP, enterprises that do not complete the procedures for confirming the period of social insurance and unemployment insurance payment for employees after terminating the labor contract according to the provisions of law will be subject to the following penalties:

- From 2 million VND to 4 million VND for violations involving 01 to 10 employees;

- From 4 million VND to 10 million VND for violations involving 11 to 50 workers;

- From 10 million VND to 20 million VND for violations involving 51 to 100 workers;

- From 20 million VND to 30 million VND for violations involving 101 to 300 workers;

- From 30 million VND to 40 million VND for violations involving 301 or more employees.

In addition, businesses are also required to complete procedures to confirm the period of social insurance and unemployment insurance payment for employees according to regulations.

What should employees do when the company does not close the social insurance book?

Pursuant to Article 18 of the Law on Social Insurance 2014, employees have the right to request competent agencies, organizations and individuals to review decisions and actions of agencies, organizations and individuals when there is reason to believe that such decisions and actions violate the law on social insurance and infringe upon their legitimate rights and interests.

Therefore, in case the employee has terminated the labor contract but the enterprise does not close the social insurance book according to regulations, the employee must first contact the enterprise and request the enterprise to close the social insurance book for him/her.

If the enterprise still does not close the social insurance book according to regulations, the employee can submit a complaint to the Chief Inspector of the Department of Labor, War Invalids and Social Affairs where the enterprise is headquartered for settlement according to authority.

Procedures for closing social insurance books 2023

According to Decision 595/QD-BHXH in 2017, employers shall close social insurance books in the following order:

Step 1: Report labor reduction

Before performing the social insurance closing procedure, the employer needs to perform the labor reduction notification procedure.

- According to Article 23 of Decision 595/QD-BHXH, the dossier for reporting labor reduction includes:

+ Declaration form for adjusting social insurance and health insurance information (Form TK1-TS)

+ Declaration form for unit to adjust social insurance and health insurance information (Form TK3-TS);

+ List of employees participating in social insurance, health insurance, accident insurance, occupational accident and disease insurance (Form D02-TS);

+ Information list (Form D01-TS);

+ Valid health insurance card of employee (01 copy/person);

- The employer sends the labor reduction notification file directly to the social insurance agency where the employer participates or sends it by post.

- After successfully reporting a reduction in social insurance, you can proceed to close the social insurance book.

Step 2: Close social insurance book

- According to Article 23 of Decision 595/QD-BHXH, the documents for closing insurance book procedures include:

+ Declaration of participating unit, adjustment of social insurance and health insurance information (Form TK3-TS);

+ List of employees participating in social insurance, health insurance, unemployment insurance, occupational accident and disease insurance (Form D02-TS).

+ Information list (Form D01-TS).

+ Social insurance book

+ Social insurance leaflets.

+ Decision to terminate the labor contract (or other documents related to the termination of the labor contract).

+ Valid health insurance card of employee (01 copy/person);

- The employer submits the social insurance book closing application at the social insurance agency where the employer participates or submits it by post.

Social insurance book closing time

According to Clause 1, Article 48 of the 2019 Labor Code, within 14 working days from the date of termination of the labor contract, the two parties are responsible for fully paying all amounts related to the rights of each party, except in the following cases, which may be extended but not more than 30 days:

- The employer is not an individual who ceases operations;

- The employer changes structure, technology or for economic reasons;

- Division, separation, consolidation, merger; sale, lease, conversion of enterprise type; transfer of ownership and right to use assets of enterprises and cooperatives;

- Due to natural disasters, fires, enemy attacks or dangerous epidemics.

Thus, according to regulations, the social insurance book closing time will not exceed 14 days and in special cases according to Clause 1, Article 48 of the 2019 Labor Code, the maximum social insurance book closing time will not exceed 30 days.

Source

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)