| The United States issued the final conclusion on the final review of woven bags from Vietnam. The United States received a request for an anti-dumping and anti-subsidy investigation into molded fiber products. |

According to the Department of Trade Remedies, Ministry of Industry and Trade , on October 17, 2024, the US Department of Commerce (DOC) posted a notice initiating an administrative review of the anti-dumping duty order (CBPG) on oil country tubular goods (OCTG) from Vietnam.

The review period is from September 1, 2023 to August 31, 2024. The review list is expected to include a number of enterprises exporting oil pipe products to the United States.

In addition, any enterprise on this list that does not export oil pipe products to the United States during the review period must notify the US Department of Commerce within 30 days from the date of publication of the notice of initiation of the review (expected to be by November 16, 2024) if there is a shipment that is suspended for consideration and handling.

|

The US Department of Commerce is expected to issue its review conclusions no later than September 30, 2025. Illustration photo |

According to the regulations, within 35 days from the date of publication of the notice of initiation (expected November 21, 2024), the US Department of Commerce is expected to select enterprises as mandatory respondents in the case based on the enterprises' export volume from high to low according to data from the US Customs and Border Protection (CBP). In addition, within 90 days from the date of publication of the notice of initiation of review, the parties can withdraw their review requests (expected January 15, 2025).

In addition, the Trade Defense Department said that for countries that the United States considers to be non-market economies such as Vietnam, in order to enjoy separate tax rates, enterprises must apply for separate tax rates within 30 days from the date of publication of the notice of initiation of the review (expected on November 16, 2024). In case the enterprise does not apply for separate tax rates and is not selected as a mandatory respondent, the enterprise will be subject to the national tax rate.

To ensure the legitimate rights of enterprises, the Trade Defense Department recommends that enterprises producing/exporting related products continue to update the developments of the case; properly and fully implement the requirements of the US investigation agency, and closely coordinate with the Trade Defense Department throughout the process of the case.

Notice see here

Source: https://congthuong.vn/hoa-ky-khoi-xuong-ra-soat-hanh-chinh-lenh-ap-thue-chong-ban-pha-gia-ong-thep-dan-dau-tu-viet-nam-353830.html

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

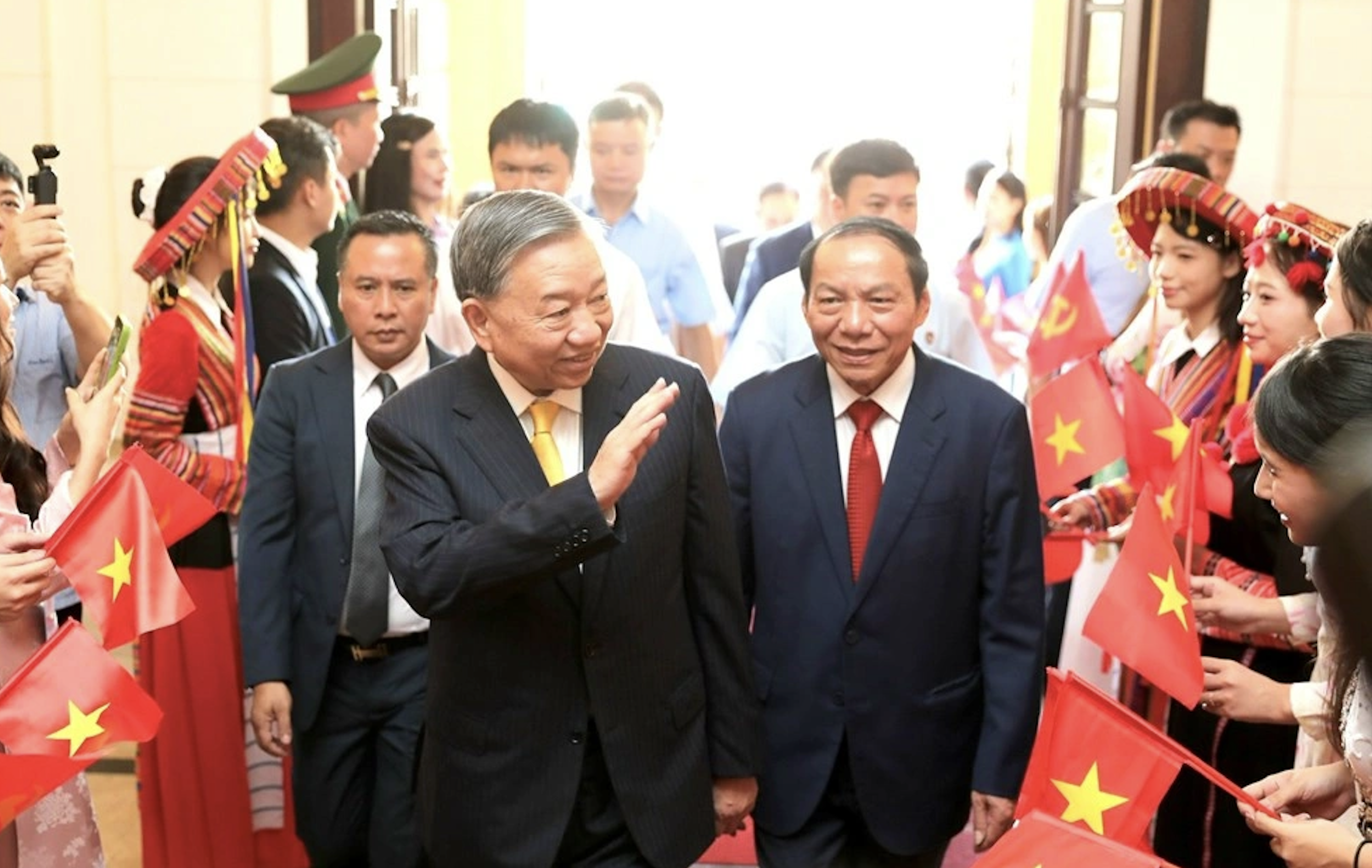

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)