Airlines massively increase fleet size, "newcomers" make moves

Vietravel Airlines announced its goal of increasing its fleet size to at least 10 aircraft this year, focusing on the Airbus A321/A320 series. The Airbus A320 is a mid-range passenger jet, popular for short and medium-haul flights. The Airbus A321 is a larger version of the A320 series, with a longer fuselage and larger passenger capacity, suitable for medium and long-haul flights.

The airline currently owns 3 private aircraft. The airline plans to open 2 new domestic routes, restore flights to Nha Trang, and launch charter flights connecting Hanoi - Anhui (China) from October 2025.

Previously, on April 9, Vietjet (Vietjet Air) signed an agreement with AV AirFinance with a total value of 300 million USD within the framework of a working trip of a Government member to promote bilateral economic and trade relations between Vietnam and the US.

The airline said this is part of a series of financial agreements worth 4 billion USD that it has made with US partners to serve the plan to develop a new fleet of nearly 300 aircraft, expected to be delivered in the period 2025-2027.

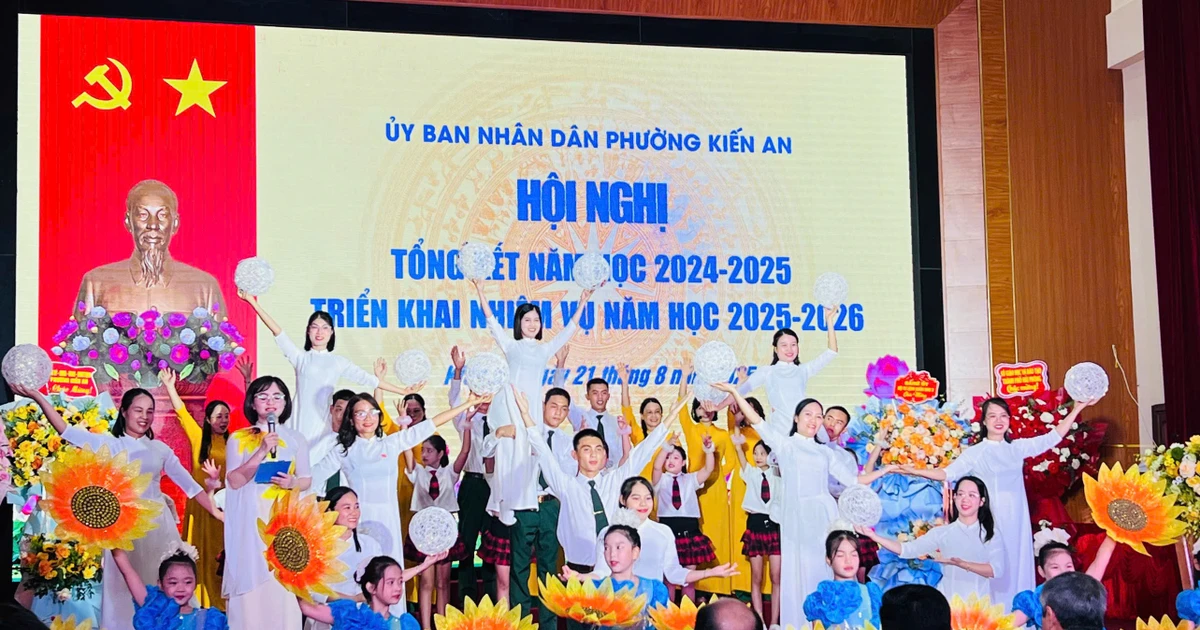

Sun PhuQuoc Airways has just welcomed its first aircraft and is expected to start selling tickets from October this year (Photo: SunGroup).

Not out of the picture, Vietnam Airlines Corporation also soon planned to invest in 50 narrow-body Airbus 320 Neo or Boeing 737 MAX aircraft and 10 spare engines. According to calculations, the airline must invest about 92,800 billion VND for the above expansion project.

In a proposal sent to the State Capital Management Committee at Enterprises before the agency ceases operations, Vietnam Airlines emphasized that strengthening its fleet of aircraft will help the unit ensure that it achieves its goals and strategic vision as a national airline in the recovery and sustainable development period.

In another development, on August 10, Sun PhuQuoc Airways, an airline under Sun Group, received its first 100% new Airbus A321NX from the Airbus factory in Hamburg (Germany). According to the plan, the airline will receive 8 aircraft in 2025 and conduct its first commercial flight in November 2025, after opening ticket sales from October.

Sun PhuQuoc Airways is a "newbie" in the industry, an airline invested and developed by Sun Group, with a total investment of 2,500 billion VND. The airline was granted an air transport business license by the Ministry of Construction last June.

Aviation "heating up"?

The entry of new airlines as well as plans to expand their fleets come as Vietnam's aviation industry is recovering strongly.

Commenting on the current wave of fleet expansion, Associate Professor Dr. Nguyen Thien Tong said that this move comes from the fact that airlines are expanding many flights, so the demand for aircraft is high. According to him, this also reflects the strong recovery of the aviation industry, which has quickly returned to the 2019 mark (before the Covid-19 pandemic broke out).

According to data from the Civil Aviation Authority of Vietnam, after 6 months, air transport recorded an improvement with passenger volume increasing by 9.1% over the same period, estimated at 59.7 million passengers. Of which, the number of international passengers reached 22.9 million, a sharp increase of 12.9%; domestic passengers reached 36.8 million, an increase of 6.9%.

On that basis, the domestic aviation industry is expected to continue to maintain its recovery momentum and stable growth in the second half of the year as well as in the coming years.

The current concern is related to the shortage of aircraft. According to the Civil Aviation Authority, since the beginning of the year, the Vietnamese aviation industry has encountered some difficulties related to the decrease in the aircraft fleet due to the impact of the engine supply from the PW factory.

"A shortage of aircraft will lead to flight delays, or in cases of technical problems, there will not be enough aircraft to immediately compensate. Meanwhile, airlines often schedule flights close together, leading to frequent delays," said Mr. Tong.

Statistics for the first half of the year show that Vietjet Air is the only airline with the lowest on-time performance and below the industry average of 50.6%. Experts expect that adding more aircraft will partly resolve the current flight delays.

... or is it "inflation"?

Returning to the increase in new aircraft from Vietravel Airlines, the company's investment in large Airbus A321 aircraft, according to experts, raises current problems in the industry.

Mr. Tong said that currently, new airport plans in localities are all large-scale projects, suitable for large-body aircraft. For example, the Quang Tri Airport project with a total planned scale of up to 265 hectares, total investment capital of up to 5,800 billion VND...

“I find it strange why Vietnam does not propose small-scale projects?”, the expert asked. He said that Vietnam’s aviation industry is experiencing airport “inflation”. Meanwhile, the demand for small aircraft is very large but has not been exploited. Accordingly, he suggested focusing on developing short-haul flights and small airports that only require a few dozen hectares.

He explained that Vietnam currently has four major airports: Tan Son Nhat, Noi Bai, Da Nang and Cam Ranh. Except for these four airports, most of the remaining airports are empty. This shows that the number of passengers traveling to other provinces and cities is not much. Thus, investing in large airports as well as large-bodied aircrafts inevitably leads to waste.

He also gave an example of airports like Ca Mau, which only have one flight per day, and flights are often not filled. Meanwhile, countries like India are exploiting small airports and small aircraft for short routes very effectively. Not to mention, small-scale investment also helps save on operating and repair costs...

Quang Tri Airport construction site (Photo: Duc Tai).

High airfares and "game theory"

The issue of recovery and inflation is also reflected in ticket prices. Compared to before Covid-19, the average airfare for all routes is much higher.

In fact, ticket prices vary depending on the flight route, but the routes with high traffic frequency have higher ticket prices. In fact, domestic flights are many times more expensive than international flights.

A survey by Dan Tri reporters shows that the price of tickets from Hanoi to Phu Quoc in early July is almost twice as expensive as the Hanoi - Busan (South Korea) route. The price of tickets from Hanoi to Nha Trang is from 4 to 6 million VND, twice as expensive as the Hanoi - Bangkok (Thailand) route - 2 - 3 million VND. The highest price of a round-trip ticket from Hanoi to Phu Quoc by Vietnam Airlines is about 9 million VND/passenger, while the price of this route by Vietjet Air was at times more than 8 million VND/passenger....

Mr. Tong likened airfares to a "game theory" between airlines and consumers. There was a time when airlines raised prices during the holidays to very high levels, but no one traveled, so they had to proactively adjust them to a reasonable level. Now, it is true that they are gradually increasing ticket prices, but consumers still travel.

Not to mention, the aviation industry is not like other industries, for example, the production of a can of beer, all cans of beer are the same. In aviation, businesses will allocate ticket prices. For example, different seats on the plane will have different ticket prices. Even the time of purchase also affects the ticket price.

Airfares have been a "hot" issue recently (Illustration: DT).

However, regarding ticket prices, experts say it still depends on the passenger’s decision. If the cost is too high, the passenger has the right to choose other means of transportation.

In terms of input structure, experts said there are many reasons for the increase in ticket prices. Notably, input costs have increased sharply due to foreign currency factors. Currently, the price of Jet-A1 aviation fuel in Asia is at 100.25 USD/barrel (according to IATA on April 26, 2024) and the strong fluctuations in the USD/VND exchange rate directly affect the costs of renting aircraft, hiring foreign pilots, and maintaining aircraft.

In addition, the temporary shortage of aircraft also affects the increase in ticket prices. According to the latest statistics from the Flight Safety Standards Department (Civil Aviation Administration of Vietnam), as of August 4, the total number of aircraft in Vietnam was 254, including 226 fixed-wing aircraft and 28 helicopters, an increase of 13 aircraft compared to the same period in 2024.

A total of 25 aircraft are undergoing long-term maintenance due to lack of engines (23 A321NEOs, 1 A350, 1 A320CEO); accounting for 12.2% of the commercial aviation fleet.

Source: https://dantri.com.vn/kinh-doanh/hang-khong-viet-nam-tang-nong-hay-lam-phat-20250811103556821.htm

![[Photo] Politburo works with Standing Committees of Lang Son and Bac Ninh Provincial Party Committees](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/0666629afb39421d8e1bd8922a0537e6)

![[Photo] Prime Minister Pham Minh Chinh receives Australian Foreign Minister Penny Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/20/f5d413a946444bd2be288d6b700afc33)

![[Photo] An Phu intersection project connecting Ho Chi Minh City-Long Thanh-Dau Giay expressway behind schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/21/1ad80e9dd8944150bb72e6c49ecc7e08)

Comment (0)