World gold prices increased again, while domestic gold prices on the afternoon of April 15 reached a new peak of 108 million VND/tael.

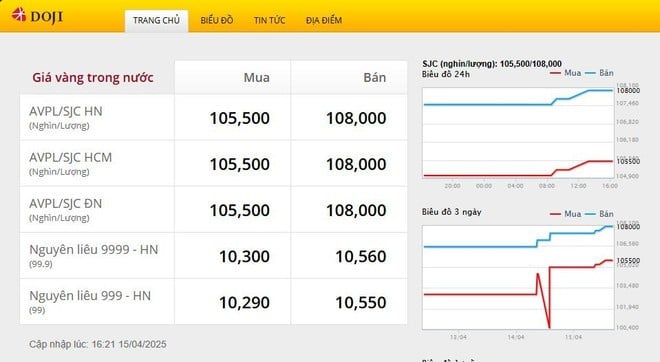

Specifically, at 4:20 p.m., DOJI Gold and Gemstone Group and Saigon Jewelry Company SJC listed the price of gold bars at VND105.5-108 million/tael (buy-sell), an increase of VND300,000/tael in both buying and selling prices compared to the early morning session (9:10 a.m.). An increase of VND500,000/tael in both buying and selling prices compared to the closing price at the end of last week.

Bao Tin Minh Chau Company listed the price of gold bars and gold rings at 104.1 - 107 million VND/tael (buy-sell), an increase of 1.5 million VND/tael for buying and an increase of 800,000 VND/tael for selling compared to the early session this morning and the closing session yesterday.

Saigon Jewelry Company SJC listed the price of gold rings at 105.5-108 million VND/tael (buy-sell), an increase of 3.5 million VND/tael for buying and 3 million VND/tael for selling compared to the early session this morning and the closing session yesterday.

Phu Nhuan Jewelry Joint Stock Company listed the price of gold bars and gold rings at 102.8-106 million VND/tael (buy-sell), an increase of 800,000 VND/tael for buying and 900,000 VND/tael for selling compared to the early session this morning and the closing session yesterday.

Asian gold prices increased in the afternoon trading session on April 15, as investors continued to be cautious about unpredictable fluctuations from US President Donald Trump's tariff policy and its spillover effects on the global economy.

In this session, the spot gold price increased by 0.5%, reaching 3,226.24 USD/ounce, lower than the record price of 3,245.42 USD/ounce set in the previous trading session. Similarly, the US gold futures price also increased by 0.5%, to 3,242.5 USD/ounce.

The rise in gold prices reflects the trend of investors continuing to seek safe assets to reduce risks in their portfolios.

According to market strategist Yeap Jun Rong of IG bank, the current situation shows the possibility that the US government will continue to expand import tariffs, making investors more worried.

The Trump administration is currently investigating imported pharmaceuticals and semiconductors, arguing that heavy dependence on foreign supplies in both sectors could pose a risk to national security.

Earlier, Mr. Trump said that he would announce tariffs on imported semiconductors within the next week. This information continues to create uncertainty in financial and commodity markets.

According to analysts, the gold price increase is likely to be maintained in the short term if the uncertainty related to US tariff policy is not clarified.

Gold prices have been hitting new highs recently, while a low interest rate environment and geopolitical risks are helping to reinforce the precious metal's safe-haven status.

In a recent speech, Atlanta Federal Reserve Bank President Raphael Bostic said that uncertainty surrounding the White House's tariff policy, combined with other factors, is keeping the US economy "in a wait-and-see mode."

Mr. Bostic recommended that the Fed maintain current interest rates until there are more clear signs about the economic policies and direction of the Trump administration./.

Source: https://baolangson.vn/gia-vang-chieu-15-4-dat-dinh-moi-108-trieu-dong-moi-luong-5044142.html

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)