The Ho Chi Minh City Real Estate Association (HoREA) has just proposed to the Prime Minister and the State Bank to allow buyers of commercial housing priced below VND1.8 or VND2 billion/unit to receive a 2%/year bank loan interest rate support from now until the end of 2023 to support the real estate market and consumers in need of housing.

Have a house worth 2 billion VND but can't borrow money

The reason HoREA has made the above recommendation is because the current market has almost no social housing apartments. While many investors of commercial housing projects are implementing policies to reduce house prices, with deep discounts of around 50%, leading to the selling price of apartments in some projects being around 2 billion VND/unit, buyers of commercial housing have not been able to borrow credit with reasonable interest rates.

In Official Dispatch No. 1164/CD-TTg dated December 14, 2022 of the Prime Minister, directing the timely supply of credit capital for the economy ; lending and disbursing quickly, focusing on key areas, and targeting eligible businesses and real estate projects... but there is no policy to support a 2%/year reduction in credit interest rates or loans at reasonable commercial interest rates for buyers of commercial housing priced below VND 1.8 or 2 billion/unit.

The real estate market in Ho Chi Minh City currently has very few apartments priced under 2 billion VND. Photo: TAN THANH

In addition, due to the 40,000 billion VND credit package supporting a 2%/year reduction in loan interest rates according to Decree 31/2022/ND-CP, by the end of October 2022, only about 21,000 billion VND, reaching 52.5%, has been disbursed. If not fully used, it will be a waste of support resources from the state budget.

However, according to a survey by a reporter from Nguoi Lao Dong Newspaper, there are very few houses under 2 billion VND in Ho Chi Minh City. Mr. Hoa, a real estate broker in Thu Duc City, said he is supporting the sale of a number of small apartments, priced under 2 billion VND/apartment in Vinhomes Grand Park (Thu Duc City) to a few customers. Each apartment has an area of about 30-40 m2, only 1 bedroom and no living room, priced from 1.6-1.8 billion VND/apartment.

However, these apartments are very rare and have been handed over by the investor but do not have furniture, do not have many utilities, buyers have to equip themselves to live in. "I advertised 5-6 apartments for sale but 4 of them have been sold. These apartments still have bank loans under the old contract so customers agreed to buy. The remaining apartments have smaller areas, and do not have loans so they are difficult to sell" - Mr. Hoa informed.

According to Mr. Hoa, this area only has a few apartments with such low prices, the rest are many apartments with an area of over 60 m2, 2 bedrooms, the lowest selling price is also 2.5-2.8 billion VND/apartment.

Meanwhile, apartments under 2 billion VND are currently mainly social housing far from the center, small in area, have been sold out by investors and are resold by buyers, there are no new apartments. In addition, there are commercial apartments that have been handed over for more than 10 years, far from the center (over 12 km). However, these types of apartments are not eligible for bank loans or if they are, the loan rate is very low.

The general director of a real estate company in Ho Chi Minh City confirmed that currently, new projects on the market are all in the high-end segment, with few apartments priced below VND2 billion. Most of the apartments priced below VND2 billion were sold in 2018-2019, and were supposed to be handed over in 2021-2022, but were stuck in legal issues or the investor had financial difficulties, so they could not continue. If the customer had bought before, they could transfer the purchase contract, but new customers are hesitant because the project is not completed, and the new bank loan conditions are not available...

Very difficult to borrow

Mr. Hoang Lai Do The Nguyen, a person with many years of experience in marketing in the real estate sector, said that if the proposal to reduce the interest rate by 2% for home loans under VND2 billion/unit is approved, it will only have a positive psychological impact, helping the market to be a little more excited. However, in terms of eligible products and eligible buyers, it will be very difficult to make it a reality because houses under VND2 billion have almost "disappeared" from the market.

A credit specialist at a commercial bank in Ho Chi Minh City said that at this stage, banks do not have the capital to lend long-term loans to individual customers, especially home loans. If they are loyal customers, they are only supported with short-term loans, with a loan term of only one year, after which they can be repaid depending on the bank's capital.

However, the loan conditions are also very strict, in which some banks require the purchase of life insurance... In addition, the borrower must have an income of 14-15 million VND/month actually received through the account, but freelancers with unstable incomes are not eligible for loans...

"Moreover, the mortgage product must be an apartment with full legal documents, the bank then values it at about 70% of the market price and only lends a maximum of 60%-70% above that price. As for individual houses, the alley must be wide, the area must meet regulations such as the house width must be over 3m, the total area must be over 25m2, the alley in front of the house must be over 3m... However, there is no house of this type priced under 2 billion VND, if there is, it must be very far away..." - this expert explained.

Based on the above reality, Mr. Le Hoang Chau, Chairman of HoREA, said that in the unusual situation, the State needs to issue unusual solutions to promptly and effectively handle difficulties in the real estate market. Clause 5, Article 7 of the 2014 Law on Real Estate Business also stipulates: "The State has mechanisms and policies to stabilize the real estate market when there are fluctuations, ensuring the interests of investors and customers". Therefore, Mr. Chau suggested that the State Bank should consider not keeping the credit standards unchanged in the current unusual situation but should loosen them "a little" to support businesses and home buyers.

Source: https://nld.com.vn/kinh-te/do-mat-tim-nha-duoi-2-ti-dong-20230102212650731.htm

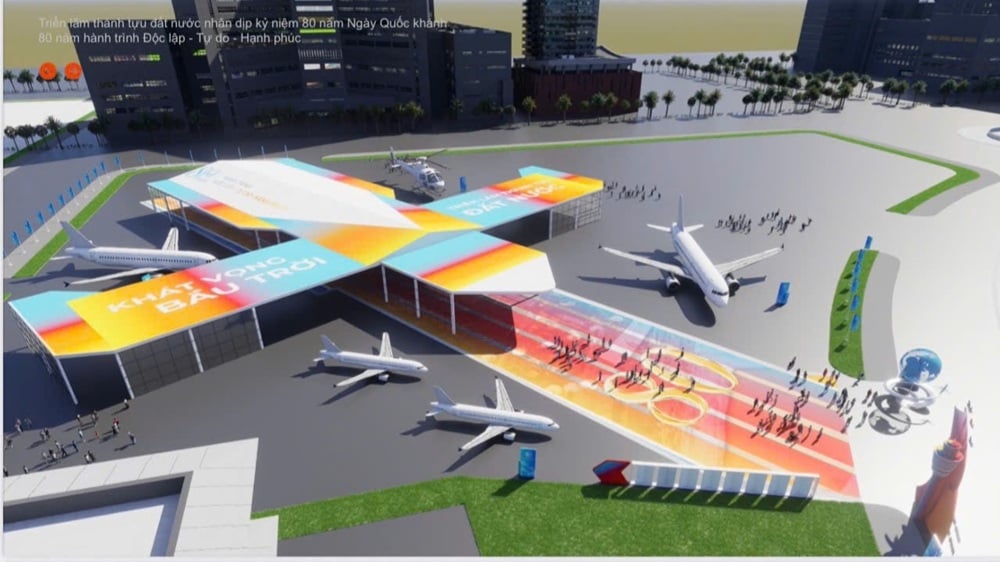

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

Comment (0)