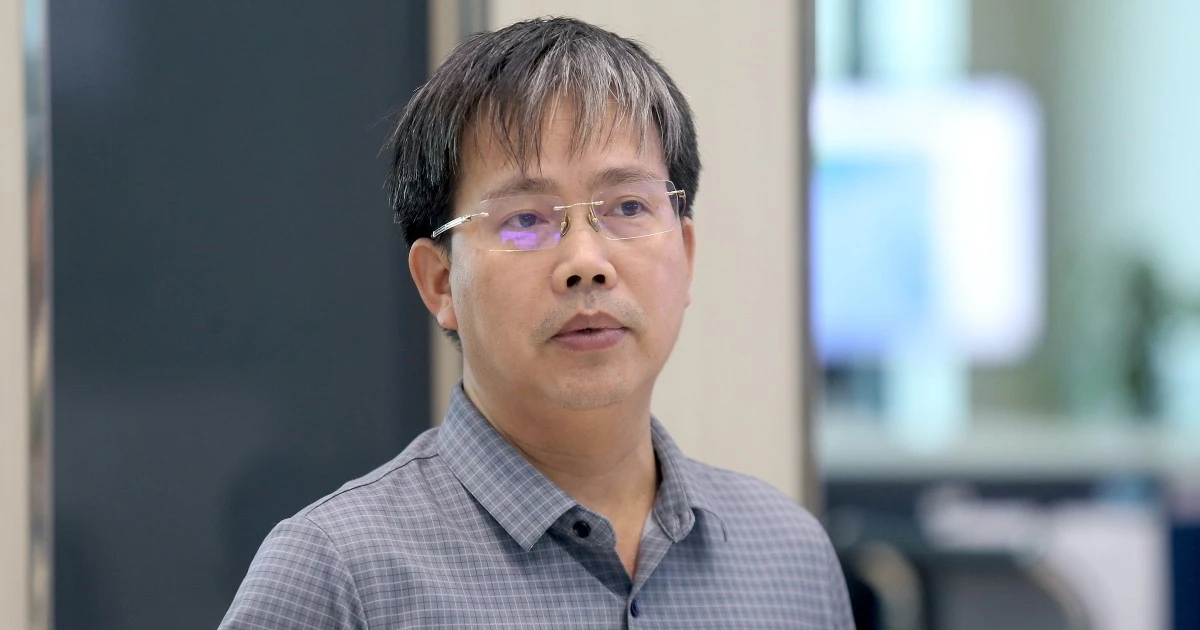

Hoang Minh Chau - author of the article "With a salary of 10 million, how did I save 3 million per month?" - Photo: NVCC

Spending, saving, the pressure of low salary but living in an expensive city are always hot topics for netizens to discuss.

Used to not have 2 million even though salary was 10 million/month

Sharing with Tuoi Tre Online , Hoang Minh Chau (24 years old, office worker in Ho Chi Minh City) - the author of the article - said that he posted the article with the purpose of sharing his experience in saving money, as well as wanting to learn other ways of saving money from everyone.

"Recently, I've seen many people sharing that their income of 10 million in Ho Chi Minh City is just enough to live on, with no extra. That's right! In the past, I also only had enough to live on a salary of 10 million, but I didn't have enough extra to fix my laptop, so I had to call my parents to ask for help," Hoang Minh Chau wrote.

It was from the time she asked her parents for money and was scolded "You're an adult and you still report to work", that Minh Chau decided to change.

To save money, Minh Chau had to give up all her previous habits and hobbies. "Like getting her nails done 2-3 times a month, and then buying random things," she wrote.

Almost before having to or wanting to buy something, Minh Chau has to think and consider whether it is okay to not buy it. This is her way of preventing herself from buying unnecessary items.

Cook for yourself, share a room to save money

To save money, Minh Chau proactively goes to the market to buy food to stock up on once a week, and cooks 3 meals a day. Because she cooks for 1 person, each trip to the market costs about 500,000 VND, which means she spends 71,000 VND on food each day.

Furthermore, to save money on rent, she proactively found and shared a room with 3 friends. From then on, the rent and electricity and water bills were only about 1.6 million VND/month.

Minh Chau's rice portions still have enough dishes, enough nutrients and are economical - Photo: MINH CHAU

As for "girly" items such as shampoo, shower gel, spices for cooking... Minh Chau only limits herself to 500,000 VND per month, "the surplus is saved for next month, saving".

"Since I started saving money, I've also started to take care of my skin in a minimalist way. Instead of doing 7749 steps, now I only use the basics, which is both economical and keeps my skin from getting clogged," Minh Chau shared.

Despite saving as much as possible, Minh Chau still spends 1 million VND on going out because "going to work means stress, and pressure means healing". She mainly uses this money to go out to eat and have coffee with friends and colleagues.

To save money, it is necessary to minimize outside appointments - Illustration: TRIEU VAN

Minh Chau's spine is "quite unstable", so she put 1 million VND into a reserve fund, in case she has to go to the doctor or buy medicine.

Any unused funds are put into savings by Minh Chau.

"I still allow myself to go out to eat and play, but only every few weeks, not every week like before," Minh Chau said.

The savings (about 3 million/month) will be deposited by Minh Chau and used to buy gold.

Netizens are buzzing about "so clever", but still lacking

Seeing Minh Chau's post, Thai Thi Duong Chau account expressed: Wow, you're so clever.

Netizen Nguyen Thu Giang wrote: It's better to consider basic spending levels and then set limits, instead of spending in panic forever.

Vu Thuy Trang shared that she doesn't see herself setting up a fund for personal development, because investing in thinking and skills will yield a lot of profit.

From there, author Minh Chau also shared that she only learned for free from videos on social networks (YouTube, TikTok). "Because I haven't determined what skills I need to invest in," Minh Chau wrote.

Source: https://tuoitre.vn/dan-mang-ban-rom-ra-cau-chuyen-co-gai-song-o-tp-hcm-luong-10-trieu-tiet-kiem-duoc-3-trieu-20240531095435272.htm

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)