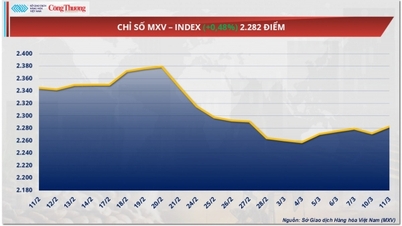

In the third quarter of 2024, world raw material prices continued to fluctuate strongly. Although the volume of commodity transactions in Vietnam decreased slightly compared to the previous quarter, the market is still developing according to the roadmap.

The "chase" of the top 5 market share

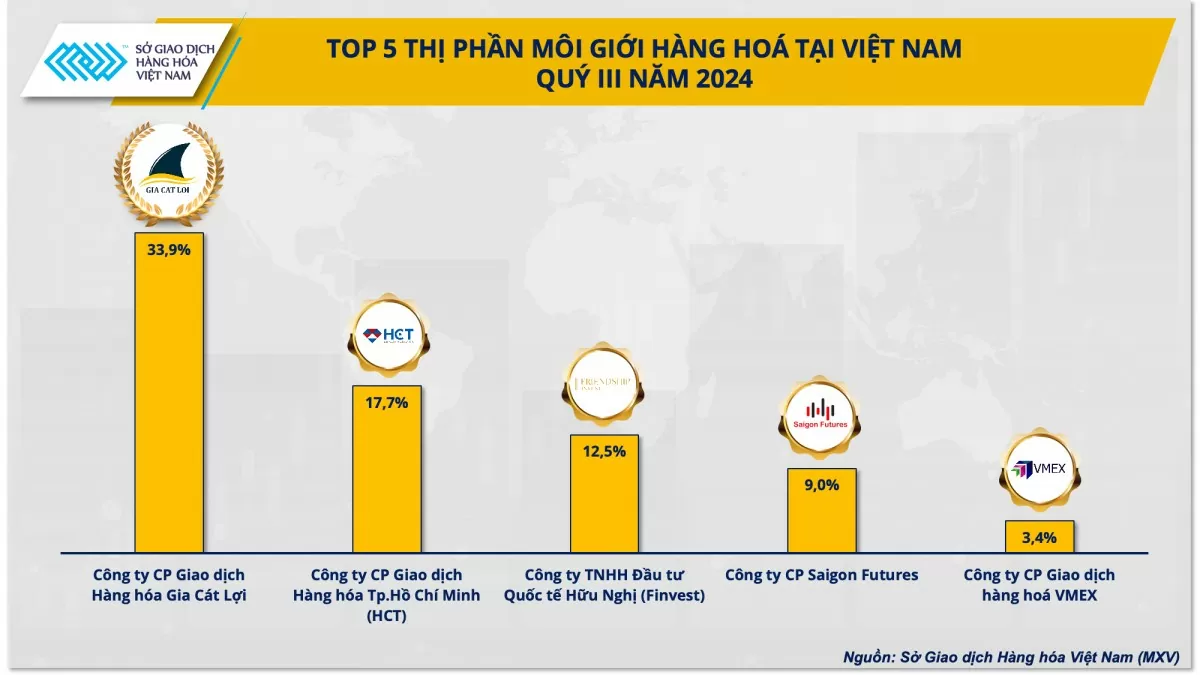

According to data from the Vietnam Commodity Exchange (MXV), the third quarter market share rankings still recorded the presence of many familiar names, however, the market share of each member has clearly fluctuated.

Gia Cat Loi Commodity Trading Joint Stock Company continues to maintain its No. 1 position in commodity brokerage market share in Vietnam, with a 2% increase in market share compared to the second quarter. This is not a surprising result, as Gia Cat Loi is one of the first members and currently has the largest scale of offices and branches in the country.

|

| Top 5 commodity brokerage market share in Vietnam Q3/2024 |

Standing at number 2, Ho Chi Minh City Commodity Trading Joint Stock Company (HCT) is occupying 17.7% of the brokerage market share. Friendship International Investment Company Limited (Finvest) is ranked number 3 with 12.5% of the market share. Saigon Futures Joint Stock Company continues to hold the number 4 position with 9% of the market share.

Making a surprise in this quarter's ranking is VMEX Commodity Trading Joint Stock Company. Thanks to its innovative business strategy, VMEX Commodity Trading Joint Stock Company has risen to 5th place this quarter, with 3.4% market share. This is also the second time VMEX Commodity Trading Joint Stock Company has been in the top 5 since the third quarter of 2023.

Closely following the top 5 is the fierce race between Southeast Asia Commodity Trading Joint Stock Company, Harami-Trade Joint Stock Company, Nhat Linh Investment, Trade and Import-Export Joint Stock Company with market shares of 3%, 2.3% and 2.25% respectively.

Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV - said: “The race for commodity brokerage market share in the third quarter was very exciting when there were changes not only in the ranking of members but also in the total market share. The top 5 currently only account for 76% of the total brokerage market share, a significant decrease compared to previous quarters, signaling a more fierce race is taking place. This is also a signal that many new potential names will rise up to make impressive breakthroughs in the final stages of 2024”.

|

| Mr. Nguyen Ngoc Quynh, Deputy General Director of MXV |

Platinum leads trading volume

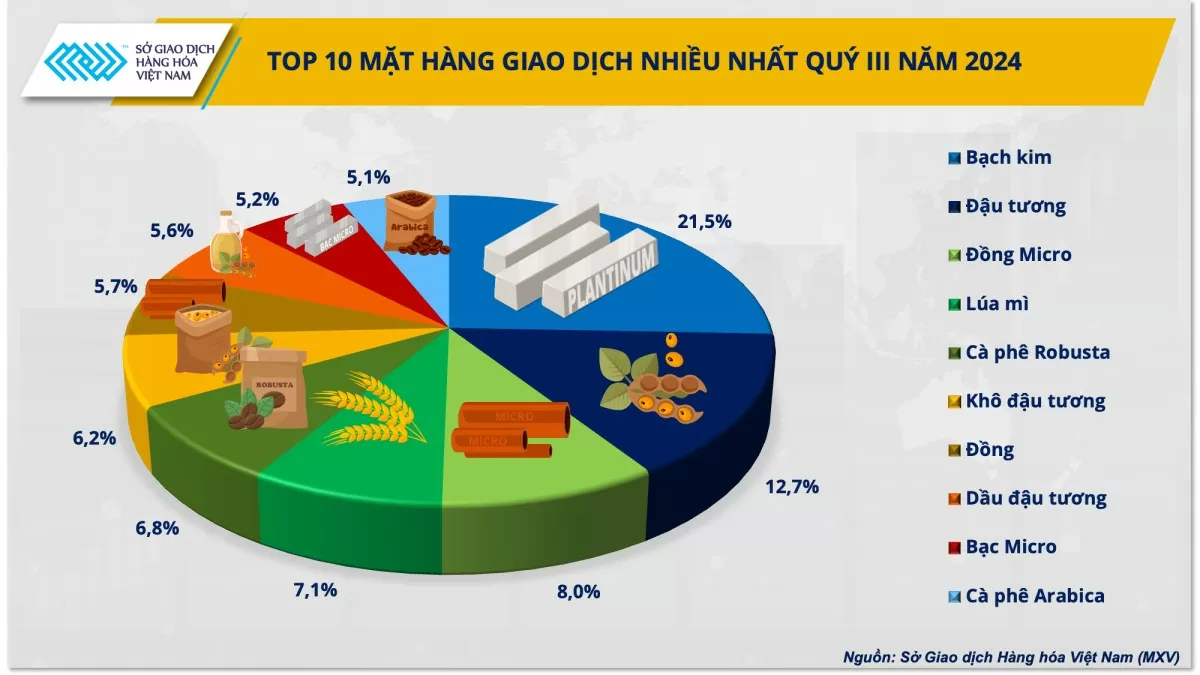

Not only did the brokerage market share witness notable fluctuations, but the trading volume of commodities in the third quarter also had surprising changes. This shift reflected fluctuations in market demand and investment strategies, when many previously stable commodities suddenly declined, giving way to new names.

|

| Top 10 most traded products in Vietnam in the third quarter of 2024 |

Accordingly, the market witnessed a strong breakthrough of metal products. Notably, the platinum product linked to the NYMEX Exchange had a spectacular acceleration when it became the most traded product in Vietnam, accounting for 21.5% of the trading volume at MXV. In addition, the Micro copper product also rose from the 6th position in the previous quarter to the 3rd position in this quarter's ranking with a proportion of 8.0%. The remaining products including copper and Micro silver also occupied the 7th and 9th positions with 5.7% and 5.2% of the volume, respectively.

“It can be seen that metal products are increasingly favored by investors when there are 4 products of this group in the top 10. In the past time, the precious metal market has benefited from the period when the market closely followed the large-scale interest rate cut of the US Federal Reserve (Fed). The low interest rate environment is expected to continue to create favorable conditions for precious metal prices to increase this year. In my opinion, this upward momentum of precious metals will likely continue into the fourth quarter when macro pressures are gradually eased and the new interest rate cut cycle will have a certain impact on financial markets and commodities globally,” said Mr. Quynh.

After platinum, soybeans, which are linked to the Chicago Board of Trade, accounted for 12.7% of the total and were the second most traded commodities in the third quarter. Finished products such as soybean meal and soybean oil also continued to make the list at No. 6 and No. 8.

The following positions continue to feature familiar items from the quarterly rankings. Wheat and Robusta coffee ranked 4th and 5th with 7.1% and 6.8% of total trading volume, respectively. Arabica coffee also returned to the race and closed the ranking of the top 10 most traded items in Vietnam in the third quarter with a proportion of 5.1%.

In the fourth quarter of this year, many experts believe that commodity prices will fluctuate strongly due to many unpredictable factors appearing in the market such as: increased geopolitical tensions, climate change, extreme weather, etc.

For agricultural products and industrial raw materials, weather conditions will be the main factor affecting the market. For coffee, in general, prices will continue to be maintained and anchored at a higher level than the same period in previous years because the supply from the two largest coffee producing markets in the world, Brazil and Vietnam, is expected to decrease due to the weather heavily affecting the crop, crop quality and harvest yield. Meanwhile, weather developments in the US and South America will also play an important role in influencing the agricultural price chart in the coming time.

The energy group continues to be affected by macro factors and escalating tensions in the Middle East. Meanwhile, metals are expected to be the bright spot of the market in the remaining period of the year. The growth momentum of commodities in the group will continue to be maintained thanks to new policies of major countries to stimulate the economy to avoid recession. The Fed has officially shifted to easing monetary policy and is likely to have another interest rate cut later this year. This will put great pressure on the USD, thereby supporting the increase in metal prices, especially the precious metal group, which is sensitive to macro factors.

Source: https://congthuong.vn/bach-kim-tro-thanh-mat-hang-duoc-giao-dich-nhieu-nhat-tai-viet-nam-trong-quy-iii2024-350004.html

![[Photo] Bustling construction at key national traffic construction sites](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)