|

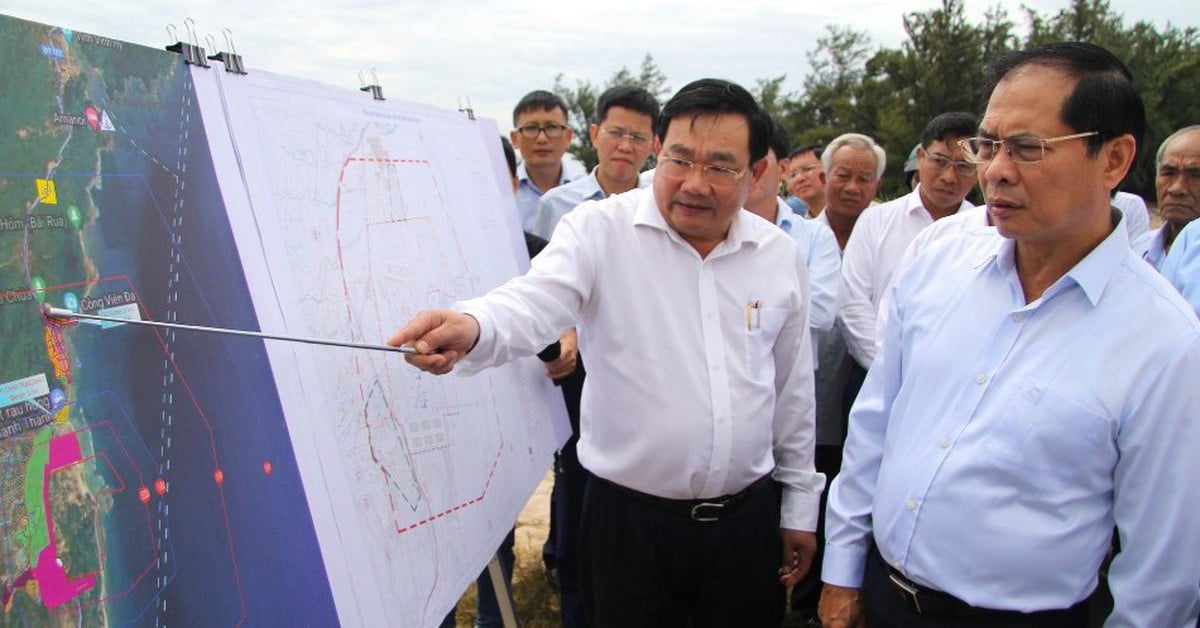

| The meeting on September 23 gave opinions on a number of important contents to be presented at the 8th session of the 15th National Assembly . |

(PLVN) - On September 23, continuing the 37th Session, the National Assembly Standing Committee gave opinions on the draft Law on Corporate Income Tax (amended).

No legislation to combat global tax base erosion

At the meeting, authorized by the Government, Deputy Minister of Finance Cao Anh Tuan presented some basic contents of the amendment of the Law on Corporate Income Tax (CIT). In particular, regarding the legalization of the provisions in Resolution No. 107/2023/QH15 on the application of additional CIT according to the regulations against global tax base erosion, through research and review, it was found that although Resolution No. 107/2023/QH15 takes effect from the 2024 tax period, the declaration and payment of additional CIT is 12 - 18 months after the end of the 2024 fiscal year.

Deputy Minister Cao Anh Tuan said that in reality, by 2026, enterprises will have reached the deadline for applying the provisions of Resolution No. 107/2023/QH15 and cannot yet assess the effectiveness and issues arising in practical implementation. Therefore, the draft Law has not yet added the content of legalizing the provisions of Resolution No. 107/2023/QH15 mentioned above to ensure the principle and viewpoint of building the Law is "legalizing clear issues that have been tested in practice as appropriate, including the contents that have been implemented stably in sub-law documents".

Discussing the draft Law, National Assembly Chairman Tran Thanh Man emphasized that the amendment of the Law on Corporate Income Tax must ensure state budget revenue, overcome tax evasion and tax losses; and ensure compliance with international practices. Paying attention to the innovation in law-making, National Assembly Chairman Tran Thanh Man affirmed that the National Assembly will perform tasks under the authority of the National Assembly. The Government will implement tasks under the functions and tasks of the Government. This is also to ensure the best quality of the law before submitting it to the National Assembly for consideration at the 8th Session.

Concluding the discussion session, Vice Chairman of the National Assembly Nguyen Khac Dinh requested the Government to direct the drafting agency and relevant agencies to study and absorb the opinions of the Standing Committee of the National Assembly and the opinions of the examining agency to complete the draft Law dossier. Vice Chairman of the National Assembly Nguyen Khac Dinh also requested the Finance and Budget Committee to preside over and coordinate with the Ministry of Finance, the Ministry of Justice, the Law Committee of the National Assembly, and the Institute for Legislative Studies to arrange time and organize research, possibly through conferences, seminars, and scientific discussions to propose new approaches and methods in synchronously and comprehensively amending and supplementing laws in the fields of taxes and fees and laws in the fields of finance and budget in general; to meet practical requirements and innovate thinking in law-making in the new development stage of the country.

Building a lean, compact, and strong Vietnam People's Army by 2025

|

National Assembly Chairman Tran Thanh Man proposed that the amendment of the Law on Corporate Income Tax must ensure State budget revenue. (Photo in article: Nghia Duc) |

On the same day, the Standing Committee of the National Assembly heard and commented on the draft Law amending and supplementing a number of articles of the Law on Officers of the Vietnam People's Army (VPA). The Government's submission stated that since the Law on VPA Officers in 1999, which was amended and supplemented in 2008 and 2014, came into effect, many legal documents have been issued, so it is necessary to amend and supplement the Law to ensure consistency with the current legal system, in accordance with the nature and tasks of the Army "as a special labor sector".

Presenting the report on the review of the draft Law, Chairman of the National Defense and Security Committee of the National Assembly Le Tan Toi said that the National Defense and Security Committee agreed on the necessity of promulgating the Law amending and supplementing a number of articles of the Law on Officers of the Vietnam People's Army. The National Defense and Security Committee believes that the promulgation of the Law aims to fully institutionalize the Party's guidelines and policies and the State's policies on building a strong contingent of officers of the Vietnam People's Army, meeting the requirements of basically building a lean, compact, and strong Vietnam People's Army by 2025; creating a solid foundation to strive for building a revolutionary, disciplined, elite, and modern Vietnam People's Army by 2030. The amendment and supplementation of the Law aims to ensure consistency in the legal system, promptly overcome difficulties and inadequacies of the Law on Officers of the Vietnam People's Army regarding basic positions and equivalent positions and titles of officers; the highest age limit for officers to serve in active service; The highest military rank for an officer's position and title is general and some contents related to the regime and policies for officers.

At the meeting, members of the National Assembly Standing Committee gave their opinions to continue perfecting the draft Law amending and supplementing a number of articles of the Law on Officers of the Vietnam People's Army before submitting it to the National Assembly for consideration and comments at the upcoming 8th Session.

Also on September 23, the Standing Committee of the National Assembly gave opinions on the 2024 Work Report and the 2025 Audit Plan of the State Audit; reviewed the Report on the results of the National Assembly's Thematic Supervision Delegation on "Implementation of policies and laws on real estate market management and social housing development from 2015 to the end of 2023".

Source: https://baophapluat.vn/sua-doi-luat-thue-thu-nhap-doanh-nghiep-phai-khac-phuc-duoc-tinh-trang-tron-thue-that-thu-thue-post526416.html

![[Photo] The ceremonial artillery is ready to "fire" for the second parade rehearsal at My Dinh National Stadium.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/883ec3bbdf6d4fba83aee5c950955c7c)

![[Photo] Impressive image of 31 planes taking flight in the sky of Hanoi during their first joint training](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/2f52b7105aa4469e9bdad9c60008c2a0)

Comment (0)