In recent times, under the leadership of the Party, the close supervision of the National Assembly , the drastic, close and timely direction and management of the Government and the Prime Minister, the work of practicing thrift and combating waste in the management and use of the state budget has been promoted and has achieved important results.

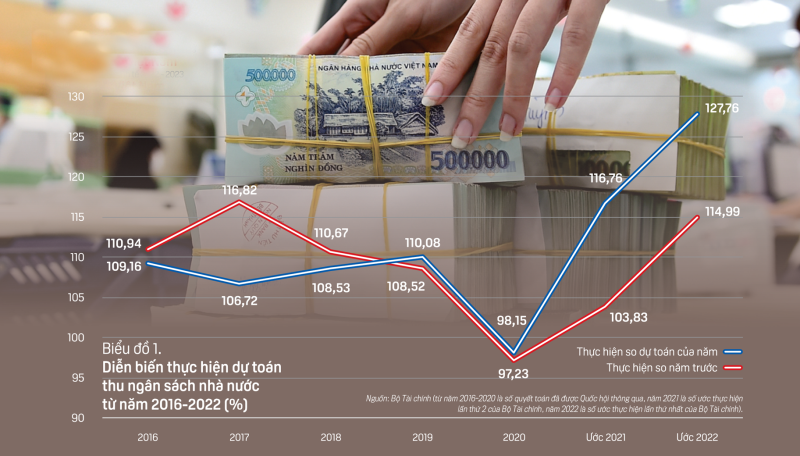

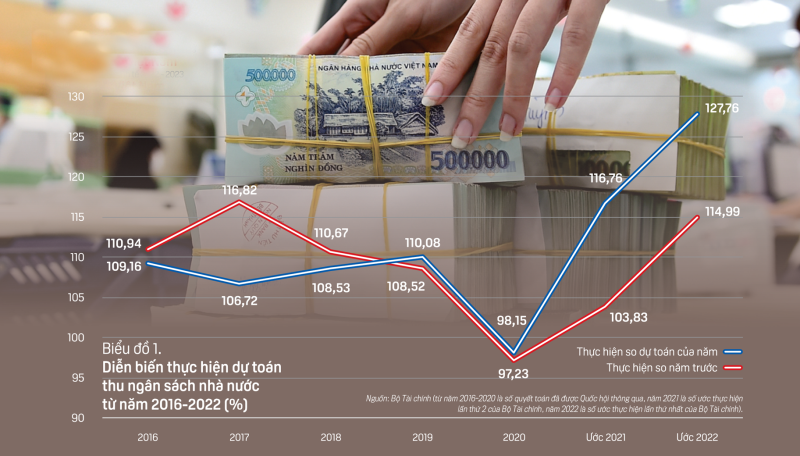

However, according to the results of the National Assembly's supervision of the implementation of policies and laws on practicing thrift and combating waste, the conclusions of inspection agencies, the State Audit, and through the synthesis of reports and annual state budget settlements, it is shown that there are still shortcomings, limitations, and waste in the management and use of the state budget, public assets, etc., affecting administrative discipline and the efficiency of using state budget resources. [caption id="attachment_1239937" align="aligncenter" width="800"]

Photo Collection[/caption] To overcome the above shortcomings and limitations,

the Government requires focusing on researching and proposing amendments

to the Law on Practicing Thrift and Combating Wastefulness and related laws and legal documents, overcoming overlapping situations, ensuring consistency of the legal system related to practicing thrift and combating waste. Continue to review, develop and perfect the legal system on state budget expenditures, the autonomy mechanism of public service units, and management and use of public assets according to the law-making program of the National Assembly and the Government. The Ministries of Planning and Investment, Construction, and Transport, according to their assigned functions, tasks, and authorities, continue to review, perfect, and promulgate appropriate norms and unit prices; direct strict management of public investment, saving costs right from the stage of project establishment, appraisal, approval, and design and construction cost estimates. For ministries, central and local agencies, continue to review and submit to competent authorities for full promulgation of regulations guiding the implementation of the financial autonomy mechanism for public service units as prescribed. Increase savings in regular expenditures; promote restructuring of state budget expenditures, gradually reduce the proportion of regular expenditures associated with innovation in the mechanism of allocating regular expenditures, ensuring expenditures for people, social security, health, environment, national defense, security and the fields of education - training, science - technology... as prescribed by law.

The Ministry of Finance shall preside over and coordinate with ministries, central and local agencies to continue promoting the restructuring of state budget expenditures towards sustainability, reducing the proportion of regular expenditures; increase the proportion of development investment expenditures, debt repayment in total state budget expenditures and reduce state budget deficit as prescribed in Resolution No.

23/2021/QH15 of the National Assembly; Ensure that in the 2021 - 2026 period, the average regular expenditure ratio is about 62-63% of the total state budget expenditure, striving to reduce the regular expenditure ratio to below 60%. Synthesize, prepare and submit to competent authorities for decision the annual state budget expenditure estimates, plans to compensate for revenue reduction for localities, if any, according to the balancing capacity of the central budget according to the provisions of

the State Budget Law , relevant legal documents and guiding documents, ensuring strictness, thrift, efficiency, towards balancing the state budget annually and in the medium term. Proactively and thoroughly manage the state budget expenditure estimates to save regular expenditures, review and cut down on tasks that are not really necessary or slow to be implemented,... to allocate resources for

socio -economic recovery and development, prevention and overcoming of consequences of natural disasters, epidemics, climate change, implementation of social security expenditure tasks, ensuring security, national defense and reforming salary and social insurance policies. Ministries, central and local agencies shall organize the implementation of state budget expenditures according to assigned estimates, ensuring allocation and assignment of estimates to budget-using units and subordinates within the time limit and according to the provisions of

the State Budget Law and guiding documents. Review, arrange and adjust expenditure estimates according to regulations; proactively cut down on expenses that are not really necessary; reduce expenses for organizing conferences, seminars, festivals, business trips at home and abroad, especially for overseas research and surveys; In 2024, cut and save 5% of the regular expenditure estimate right from the beginning of the year compared to the assigned estimate to increase investment in strategic infrastructure, health,

education , climate change and social security; at the same time, notify agencies and units to proactively save in balancing revenue and expenditure. Thoroughly grasp the requirement to thoroughly save state budget expenditures, especially regular expenditures right from the task determination stage; ensure the unified implementation of tasks from the budget preparation stage to the allocation, management and use of the state budget. Proactively review policies and tasks, prioritize expenditures according to the level of urgency, importance and implementation capability in the current year to build estimates close to the implementation capability. Ensure the completion of tasks, programs, projects and plans approved by competent authorities on the basis of allocated state budget sources; Proactively arrange and handle to implement assigned tasks arising in the budget year; minimize additions outside the assigned budget, cancel the budget or transfer resources to the following year. Only submit to competent authorities to issue new policies, projects and tasks when really necessary and with guaranteed resources; fully estimate the funding needs to implement new policies, regimes and tasks decided by competent authorities. Handle the balance, transfer resources and settle regular expenditure tasks of the state budget in accordance with the provisions of

the State Budget Law and guiding documents; do not transfer resources to the following year for expenditure items that have expired or have expired to reduce the state budget deficit; review to recover advanced budget expenditures that have lasted for many years and have expired according to regulations. Promote the arrangement of the apparatus, streamline the payroll, and implement the autonomy mechanism of public service units on the basis of suitability with the practical situation of each sector and each unit to reduce regular expenditures and restructure the state budget. Develop a plan to increase the level of financial autonomy of public service units according to regulations; promote the participation of social components in the provision of public service services, contributing to improving the quality of public service services, while reducing pressure on the state budget. Invest in the construction and procurement of public assets in accordance with the regime, standards, and norms, ensuring savings. Organize the review and rearrangement of public assets to ensure their proper use, standards, and norms according to the prescribed regime and in accordance with the requirements of the tasks; promote the handling of assets that are no longer needed in accordance with the provisions of law, publicly and transparently; resolutely recover assets used by the wrong subjects, for the wrong purposes, or exceeding standards and norms; Do not waste or lose public assets. Along with strengthening the inspection and examination of the implementation of legal regulations on practicing thrift and combating waste; strictly handle according to regulations violations in budget management and use that have been discovered and recommended by auditing and inspection agencies. [caption id="attachment_1239938" align="aligncenter" width="650"]

Photo Collection[/caption]

Photo Collection[/caption] To overcome the above shortcomings and limitations, the Government requires focusing on researching and proposing amendments to the Law on Practicing Thrift and Combating Wastefulness and related laws and legal documents, overcoming overlapping situations, ensuring consistency of the legal system related to practicing thrift and combating waste. Continue to review, develop and perfect the legal system on state budget expenditures, the autonomy mechanism of public service units, and management and use of public assets according to the law-making program of the National Assembly and the Government. The Ministries of Planning and Investment, Construction, and Transport, according to their assigned functions, tasks, and authorities, continue to review, perfect, and promulgate appropriate norms and unit prices; direct strict management of public investment, saving costs right from the stage of project establishment, appraisal, approval, and design and construction cost estimates. For ministries, central and local agencies, continue to review and submit to competent authorities for full promulgation of regulations guiding the implementation of the financial autonomy mechanism for public service units as prescribed. Increase savings in regular expenditures; promote restructuring of state budget expenditures, gradually reduce the proportion of regular expenditures associated with innovation in the mechanism of allocating regular expenditures, ensuring expenditures for people, social security, health, environment, national defense, security and the fields of education - training, science - technology... as prescribed by law. The Ministry of Finance shall preside over and coordinate with ministries, central and local agencies to continue promoting the restructuring of state budget expenditures towards sustainability, reducing the proportion of regular expenditures; increase the proportion of development investment expenditures, debt repayment in total state budget expenditures and reduce state budget deficit as prescribed in Resolution No. 23/2021/QH15 of the National Assembly; Ensure that in the 2021 - 2026 period, the average regular expenditure ratio is about 62-63% of the total state budget expenditure, striving to reduce the regular expenditure ratio to below 60%. Synthesize, prepare and submit to competent authorities for decision the annual state budget expenditure estimates, plans to compensate for revenue reduction for localities, if any, according to the balancing capacity of the central budget according to the provisions of the State Budget Law , relevant legal documents and guiding documents, ensuring strictness, thrift, efficiency, towards balancing the state budget annually and in the medium term. Proactively and thoroughly manage the state budget expenditure estimates to save regular expenditures, review and cut down on tasks that are not really necessary or slow to be implemented,... to allocate resources for socio -economic recovery and development, prevention and overcoming of consequences of natural disasters, epidemics, climate change, implementation of social security expenditure tasks, ensuring security, national defense and reforming salary and social insurance policies. Ministries, central and local agencies shall organize the implementation of state budget expenditures according to assigned estimates, ensuring allocation and assignment of estimates to budget-using units and subordinates within the time limit and according to the provisions of the State Budget Law and guiding documents. Review, arrange and adjust expenditure estimates according to regulations; proactively cut down on expenses that are not really necessary; reduce expenses for organizing conferences, seminars, festivals, business trips at home and abroad, especially for overseas research and surveys; In 2024, cut and save 5% of the regular expenditure estimate right from the beginning of the year compared to the assigned estimate to increase investment in strategic infrastructure, health, education , climate change and social security; at the same time, notify agencies and units to proactively save in balancing revenue and expenditure. Thoroughly grasp the requirement to thoroughly save state budget expenditures, especially regular expenditures right from the task determination stage; ensure the unified implementation of tasks from the budget preparation stage to the allocation, management and use of the state budget. Proactively review policies and tasks, prioritize expenditures according to the level of urgency, importance and implementation capability in the current year to build estimates close to the implementation capability. Ensure the completion of tasks, programs, projects and plans approved by competent authorities on the basis of allocated state budget sources; Proactively arrange and handle to implement assigned tasks arising in the budget year; minimize additions outside the assigned budget, cancel the budget or transfer resources to the following year. Only submit to competent authorities to issue new policies, projects and tasks when really necessary and with guaranteed resources; fully estimate the funding needs to implement new policies, regimes and tasks decided by competent authorities. Handle the balance, transfer resources and settle regular expenditure tasks of the state budget in accordance with the provisions of the State Budget Law and guiding documents; do not transfer resources to the following year for expenditure items that have expired or have expired to reduce the state budget deficit; review to recover advanced budget expenditures that have lasted for many years and have expired according to regulations. Promote the arrangement of the apparatus, streamline the payroll, and implement the autonomy mechanism of public service units on the basis of suitability with the practical situation of each sector and each unit to reduce regular expenditures and restructure the state budget. Develop a plan to increase the level of financial autonomy of public service units according to regulations; promote the participation of social components in the provision of public service services, contributing to improving the quality of public service services, while reducing pressure on the state budget. Invest in the construction and procurement of public assets in accordance with the regime, standards, and norms, ensuring savings. Organize the review and rearrangement of public assets to ensure their proper use, standards, and norms according to the prescribed regime and in accordance with the requirements of the tasks; promote the handling of assets that are no longer needed in accordance with the provisions of law, publicly and transparently; resolutely recover assets used by the wrong subjects, for the wrong purposes, or exceeding standards and norms; Do not waste or lose public assets. Along with strengthening the inspection and examination of the implementation of legal regulations on practicing thrift and combating waste; strictly handle according to regulations violations in budget management and use that have been discovered and recommended by auditing and inspection agencies. [caption id="attachment_1239938" align="aligncenter" width="650"]

Photo Collection[/caption] To overcome the above shortcomings and limitations, the Government requires focusing on researching and proposing amendments to the Law on Practicing Thrift and Combating Wastefulness and related laws and legal documents, overcoming overlapping situations, ensuring consistency of the legal system related to practicing thrift and combating waste. Continue to review, develop and perfect the legal system on state budget expenditures, the autonomy mechanism of public service units, and management and use of public assets according to the law-making program of the National Assembly and the Government. The Ministries of Planning and Investment, Construction, and Transport, according to their assigned functions, tasks, and authorities, continue to review, perfect, and promulgate appropriate norms and unit prices; direct strict management of public investment, saving costs right from the stage of project establishment, appraisal, approval, and design and construction cost estimates. For ministries, central and local agencies, continue to review and submit to competent authorities for full promulgation of regulations guiding the implementation of the financial autonomy mechanism for public service units as prescribed. Increase savings in regular expenditures; promote restructuring of state budget expenditures, gradually reduce the proportion of regular expenditures associated with innovation in the mechanism of allocating regular expenditures, ensuring expenditures for people, social security, health, environment, national defense, security and the fields of education - training, science - technology... as prescribed by law. The Ministry of Finance shall preside over and coordinate with ministries, central and local agencies to continue promoting the restructuring of state budget expenditures towards sustainability, reducing the proportion of regular expenditures; increase the proportion of development investment expenditures, debt repayment in total state budget expenditures and reduce state budget deficit as prescribed in Resolution No. 23/2021/QH15 of the National Assembly; Ensure that in the 2021 - 2026 period, the average regular expenditure ratio is about 62-63% of the total state budget expenditure, striving to reduce the regular expenditure ratio to below 60%. Synthesize, prepare and submit to competent authorities for decision the annual state budget expenditure estimates, plans to compensate for revenue reduction for localities, if any, according to the balancing capacity of the central budget according to the provisions of the State Budget Law , relevant legal documents and guiding documents, ensuring strictness, thrift, efficiency, towards balancing the state budget annually and in the medium term. Proactively and thoroughly manage the state budget expenditure estimates to save regular expenditures, review and cut down on tasks that are not really necessary or slow to be implemented,... to allocate resources for socio -economic recovery and development, prevention and overcoming of consequences of natural disasters, epidemics, climate change, implementation of social security expenditure tasks, ensuring security, national defense and reforming salary and social insurance policies. Ministries, central and local agencies shall organize the implementation of state budget expenditures according to assigned estimates, ensuring allocation and assignment of estimates to budget-using units and subordinates within the time limit and according to the provisions of the State Budget Law and guiding documents. Review, arrange and adjust expenditure estimates according to regulations; proactively cut down on expenses that are not really necessary; reduce expenses for organizing conferences, seminars, festivals, business trips at home and abroad, especially for overseas research and surveys; In 2024, cut and save 5% of the regular expenditure estimate right from the beginning of the year compared to the assigned estimate to increase investment in strategic infrastructure, health, education , climate change and social security; at the same time, notify agencies and units to proactively save in balancing revenue and expenditure. Thoroughly grasp the requirement to thoroughly save state budget expenditures, especially regular expenditures right from the task determination stage; ensure the unified implementation of tasks from the budget preparation stage to the allocation, management and use of the state budget. Proactively review policies and tasks, prioritize expenditures according to the level of urgency, importance and implementation capability in the current year to build estimates close to the implementation capability. Ensure the completion of tasks, programs, projects and plans approved by competent authorities on the basis of allocated state budget sources; Proactively arrange and handle to implement assigned tasks arising in the budget year; minimize additions outside the assigned budget, cancel the budget or transfer resources to the following year. Only submit to competent authorities to issue new policies, projects and tasks when really necessary and with guaranteed resources; fully estimate the funding needs to implement new policies, regimes and tasks decided by competent authorities. Handle the balance, transfer resources and settle regular expenditure tasks of the state budget in accordance with the provisions of the State Budget Law and guiding documents; do not transfer resources to the following year for expenditure items that have expired or have expired to reduce the state budget deficit; review to recover advanced budget expenditures that have lasted for many years and have expired according to regulations. Promote the arrangement of the apparatus, streamline the payroll, and implement the autonomy mechanism of public service units on the basis of suitability with the practical situation of each sector and each unit to reduce regular expenditures and restructure the state budget. Develop a plan to increase the level of financial autonomy of public service units according to regulations; promote the participation of social components in the provision of public service services, contributing to improving the quality of public service services, while reducing pressure on the state budget. Invest in the construction and procurement of public assets in accordance with the regime, standards, and norms, ensuring savings. Organize the review and rearrangement of public assets to ensure their proper use, standards, and norms according to the prescribed regime and in accordance with the requirements of the tasks; promote the handling of assets that are no longer needed in accordance with the provisions of law, publicly and transparently; resolutely recover assets used by the wrong subjects, for the wrong purposes, or exceeding standards and norms; Do not waste or lose public assets. Along with strengthening the inspection and examination of the implementation of legal regulations on practicing thrift and combating waste; strictly handle according to regulations violations in budget management and use that have been discovered and recommended by auditing and inspection agencies. [caption id="attachment_1239938" align="aligncenter" width="650"]  Photo Collection[/caption]

Photo Collection[/caption]

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![The Mystery of Buckwheat Wine [Vietnam Cultural Tourism]](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/1/18/13d3f5243eb546f692336f55268df486)

Comment (0)