This achievement is increasingly reflecting the shift from “large exports” to “value exports”, creating a clear competitive advantage. However, to maintain its position, the Vietnamese rice industry still needs to remove some bottlenecks, meet increasingly high quality standards and not let complacency slow down progress.

Recently, the Thai Rice Exporters Association said that Vietnam has surpassed Thailand to become the world's second largest rice exporter in the first 6 months of this year.

Advantage is cumulative, not a stroke of luck.

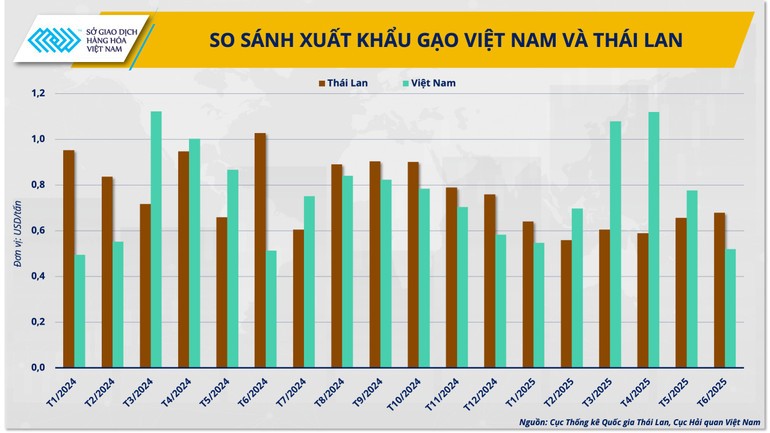

In the first 6 months of this year, Vietnam exported about 4.72 million tons of rice, up 3.5% over the same period, surpassing Thailand with 3.73 million tons (down sharply 27.3%) over the same period last year.

This achievement helped Vietnam temporarily hold the second position globally, just behind India, which sold 11.68 million tons, up 36.5% over the same period. In July, Vietnam continued to increase its total export volume for the first 7 months to 5.5 million tons, earning 2.81 billion USD. However, this value decreased by nearly 16% compared to the same period, reflecting clear pressure on selling prices even as volume increased.

Behind the change of position with Thailand are two parallel trends. On the one hand, Thai rice exports have plummeted, as the country itself has forecast that the entire year will reach only 7.5 million tons, much lower than the 9.94 million tons in 2024. The bigger risk comes from trade tensions with the US, when Washington threatened to impose a 36% tariff on Thai rice, pushing prices from around $1,000/ton to $1,400-1,500/ton. The high prices have caused many customers to switch to more competitive sources, including Vietnam.

On the other hand, Vietnam not only takes advantage of the “gap” but also proactively expands the market. With an average export price of 514-517 USD/ton, Vietnamese rice is significantly cheaper than Thai rice, thereby penetrating more strongly into areas outside the traditional market.

The Philippines remains the top importer, but exports to Ghana increased by more than 50%, to Ivory Coast nearly doubled, and to Bangladesh surged in value. This diversification reduces dependence on one market, but also places higher demands on quality standards and traceability if one wants to penetrate deeper into the EU or North America.

However, competition from India is putting pressure on. The country has increased exports sharply after easing export restrictions, causing global supplies to be abundant and prices to fall to multi-year lows. With excess supply and large inventories, the profit margins of exporters, including Vietnam, will come under significant pressure.

Holding the number two position: Pressure from both outside and inside

The race between Vietnam and Thailand for the number two position on the rice export map has lasted for many years. Thailand has a long-standing advantage in terms of brand, especially in the high-quality fragrant rice segment such as the famous Hom Mali brand favored by many high-end markets. When the weather is favorable, this country can completely quickly increase production, increasing pressure on the markets that Vietnam is exploiting.

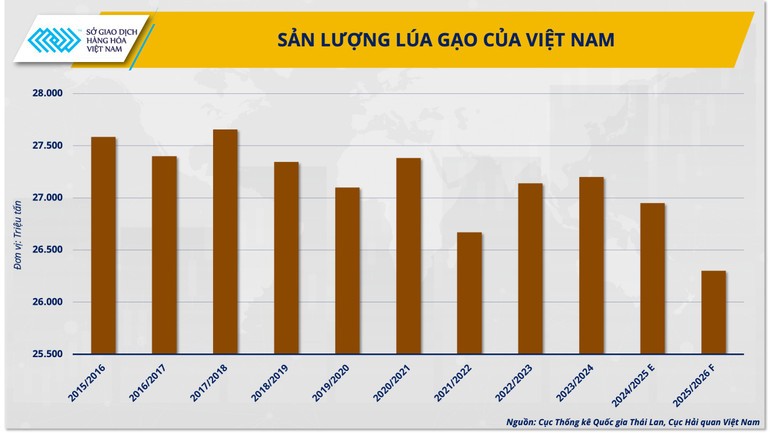

In that context, maintaining the second position is a big challenge for Vietnam. Even domestically, the rice industry still faces significant risks. The Mekong Delta - the main "rice granary" for export - is still affected by saline intrusion, drought and climate change, causing potential fluctuations in output. Just one poor harvest is enough to reverse the growth momentum.

Although fragrant rice varieties such as ST24 and ST25 have created a buzz, the “Vietnamese Rice” brand has not yet achieved global recognition and is not clearly positioned in the high-end segment like “Hom Mali”. Without a branding and deep processing strategy, Vietnam will find it difficult to maximize opportunities in the value-added segment.

The latest figures show that the pressure is increasing as last July, Vietnam exported about 750,000-782,000 tons of rice, earning 366-382 million USD. The average price for 7 months was only 514 USD/ton, down 18.4% compared to the same period last year. Profit margins have been eroded, making businesses more cautious with long-term fixed-price contracts.

In addition, export management policies and technical barriers from demanding markets such as the EU and Japan remain major challenges. In the context of weakening global demand or strong price cuts from competitors, Vietnam's price competitiveness will narrow. This requires a long-term strategy, shifting the focus from increasing output to improving product value.

In the short term (6-12 months), Vietnam can still maintain its second position thanks to stable supply and signed contracts. However, in the medium term (1-3 years), if India continues to pump goods into the market or Thailand recovers production with a flexible pricing strategy, competition will become much fiercer. At that time, the advantage can only be maintained by investing in brand, quality and product diversification.

In the long term, the sustainable direction must be to shift to exporting high-quality, organic rice, traceability and building a national brand. Otherwise, the current second position may just be a short-lived “wave peak” amid the cycle of oversupply and global climate change.

Source: https://baolaocai.vn/gao-viet-co-the-giu-duoc-vi-tri-xuat-khau-thu-hai-the-gioi-trong-bao-lau-post879582.html

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)