Statistics of 15 securities companies with the largest operating revenue in the first 9 months of the year show that self-trading is still the largest contributor in many places with more than 50% of revenue structure such as VND, VCI, KIS, SHS, VIX.

Statistics of 15 securities companies with the largest operating revenue in the first 9 months of the year show that self-trading is still the largest contributor in many places with more than 50% of revenue structure such as VND, VCI, KIS, SHS, VIX.

Big names in the self-employed and brokerage industry

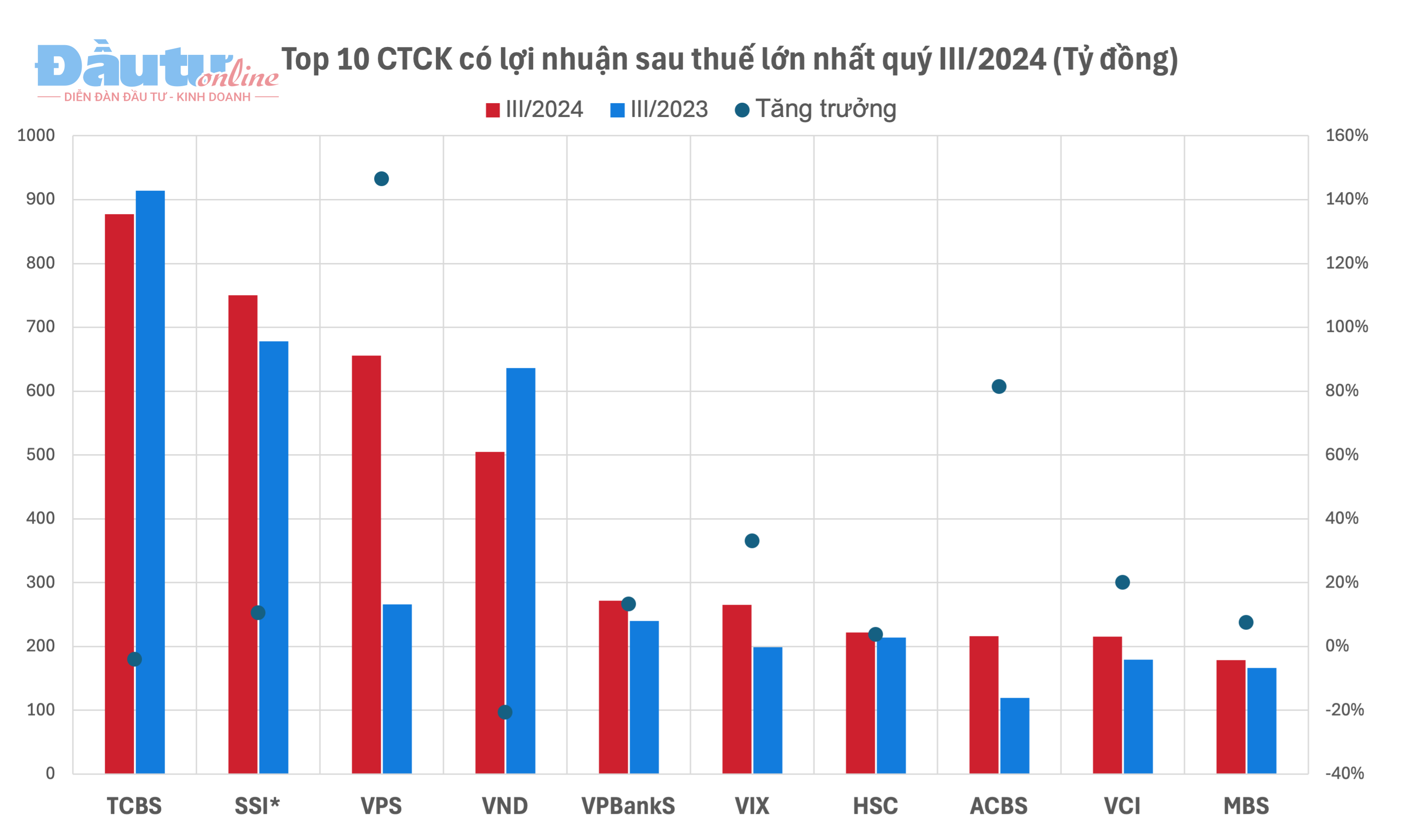

Statistics from the Investment Electronic Newspaper - Baodautu.vn on 27 securities companies with scale and reputation in the industry show that more than half of the enterprises had a decrease in profits in the third quarter of 2024 alone, however, in the first 9 months of the year, only about 30% of enterprises had a decrease in profits.

TCBS continues to maintain its top position in terms of after-tax profit. TCBS's after-tax profit in the third quarter of 2024 reached VND877 billion, down slightly by 4% compared to the same period last year. The reason is that profits from financial assets recorded through profit/loss (FVTPL) decreased sharply (-27.3%). Although the company's operating revenue still grew, during the period, financial expenses, specifically interest expenses, nearly doubled, which eroded TCBS's profits.

|

SSI, VPS and VND ranked after TCBS in terms of third quarter profit, with a profit of over VND500 billion. Of these, SSI maintained a growth rate of 10% while VPS and VND had opposite developments.

In the third quarter of 2024, VPS achieved VND 656 billion in profit after tax, up to 146% over the same period thanks to the FVTPL proprietary trading segment. Although proprietary trading revenue decreased by 26%, the loss from FVTPL decreased more, down to 96%. Thanks to that, the gross profit of the proprietary trading segment increased sharply while in the third quarter of 2023, VPS had a gross loss in this segment. With a growth rate of 146%, VPS is also the securities company with the highest growth rate among the 27 companies listed.

On the contrary, on the VND side, although still in the top 5 securities companies with the highest profits in the third quarter, after-tax profit decreased by more than 20%. Not only did brokerage revenue decrease by more than 44%, but self-trading and interest from receivable loans also decreased by 26% and 12%, respectively. Therefore, after-tax profit of VND this quarter was only 620 billion VND.

Mirae Asset was named in the top 5 companies in the third quarter of 2023, but this securities company was absent from the top 10 companies with the best profits in the third quarter of this year. Instead, VPBankS appeared with a profit after tax of VND 272 billion, up 13%.

In terms of profit growth in the third quarter, VPS and ORS had the largest profit increase with growth of over 100% while FPTS and SHS fell into the group with the deepest decline with a decrease of over 50%.

The tight market situation in the third quarter has put the proprietary trading and brokerage segments of securities companies in a difficult position. These are also the two main segments that cause the companies' profits to decline.

22/27 companies recorded a decrease in brokerage revenue in the third quarter of this year, while in FVTPL proprietary trading - the segment that brings in the majority of proprietary trading revenue - 12/26 companies also recorded a decrease (Yuanta does not conduct securities proprietary trading).

|

In the third quarter of this year, SSI had the largest FVTPL profit. Revenue in the third quarter alone reached VND990 billion, up 31% during the recent difficult period. Accumulated in 9 months, SSI reached nearly VND3,000 billion from this activity. VND has been out of breath since in the same period last year (the third quarter of 2023 and the first 9 months of 2023), VND had a much higher profit than SSI, but this year, VND is only ranked 2nd.

In the first 9 months of the year, there were 5 companies with FVTPL profits of over a trillion, including SSI, VND, TCBS, VCI and HSC, a significant change as VCI and HSC replaced VPS and ORS in the rankings over the same period.

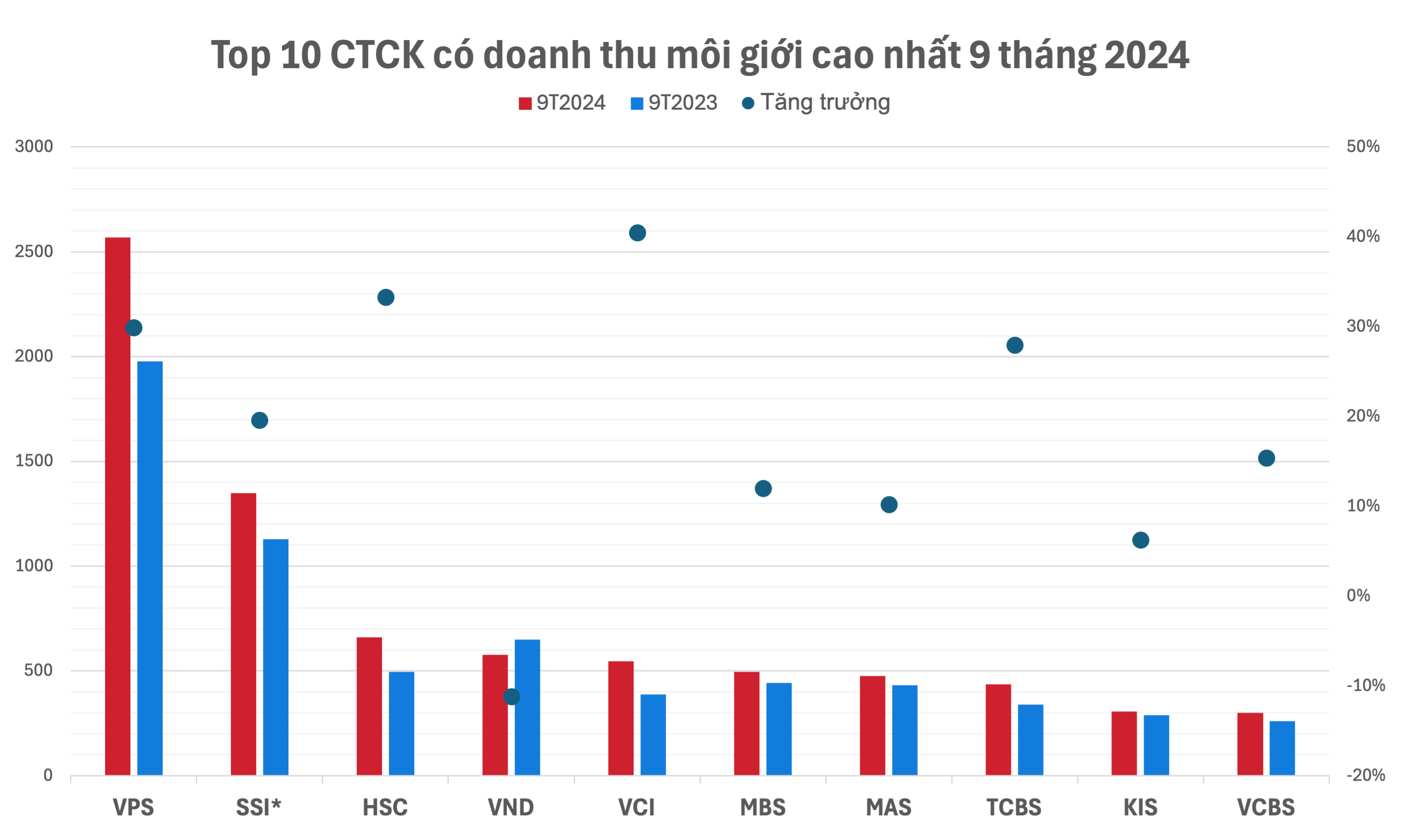

In terms of brokerage activities, VPS firmly holds the top position. This company also continuously holds the largest brokerage market share on HoSE, HNX and UPCoM. In the first 9 months of the year, VPS achieved VND 2,568 billion in brokerage revenue, up 30% over the same period last year and nearly twice the brokerage revenue of the second-ranked company, SSI.

In the top 5 securities companies with the best brokerage revenue, VND is still named, however, this is also the only company with a decrease in revenue. VND's brokerage revenue in the first 9 months of the year reached 577 billion VND, down 11% while SSI, HSC and VCI all had significant growth, respectively 19%, 33% and 40%.

|

Interest receivable is gradually becoming the "main rice pot"

Statistics of 15 securities companies with the largest operating revenue in the first 9 months of the year show that proprietary trading is still the largest contributor in many places with more than 50% of revenue structure such as VND, VCI, KIS, SHS, VIX.

|

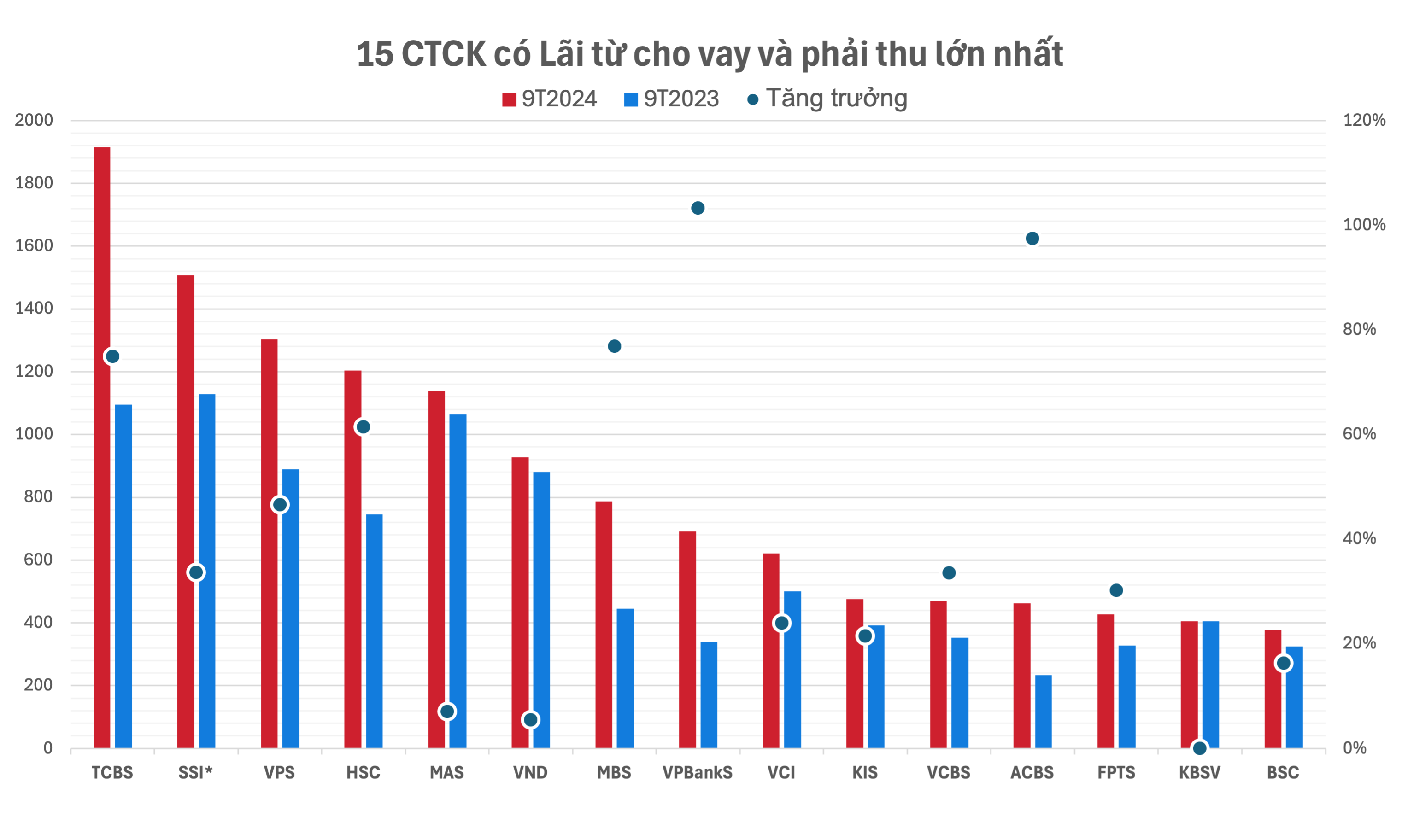

Next is the contribution of the loan interest receivable segment. After many years, margin lending has emerged and has now become the activity that contributes the majority of the revenue of securities companies, along with self-trading and brokerage. Companies with good capital support are increasingly showing their superiority in this lending market.

Currently, interest from loans and receivables is contributing a large proportion to the revenue structure of many companies such as Yuanta (63%), MayBank (61%), Mirae Asset (60%), PHS (57%), FPTS (52%) or KBSV (51%).

Interest from loans and receivables is contributing over 1,000 billion to the operating revenue of major securities companies TCBS, SSI, VPS, HSC and Mirae Asset in the 9-month business period. These are also the 5 companies with the largest interest from loans and receivables in the third quarter.

|

However, in terms of growth, the market is witnessing a strong rise from the group of mid-sized companies with the shadow of banks. In the third quarter alone, KAFI Securities was the company with the strongest increase in interest on receivables (+302%) compared to the same period, followed by ORS (+145%), ACBS (+81%) and VPBankS (+71%). KAFI is also the company with the strongest increase since the beginning of the year (+259%). VIX and VPBankS also had an increase in interest on receivables in the first 9 months of the year of over 100%.

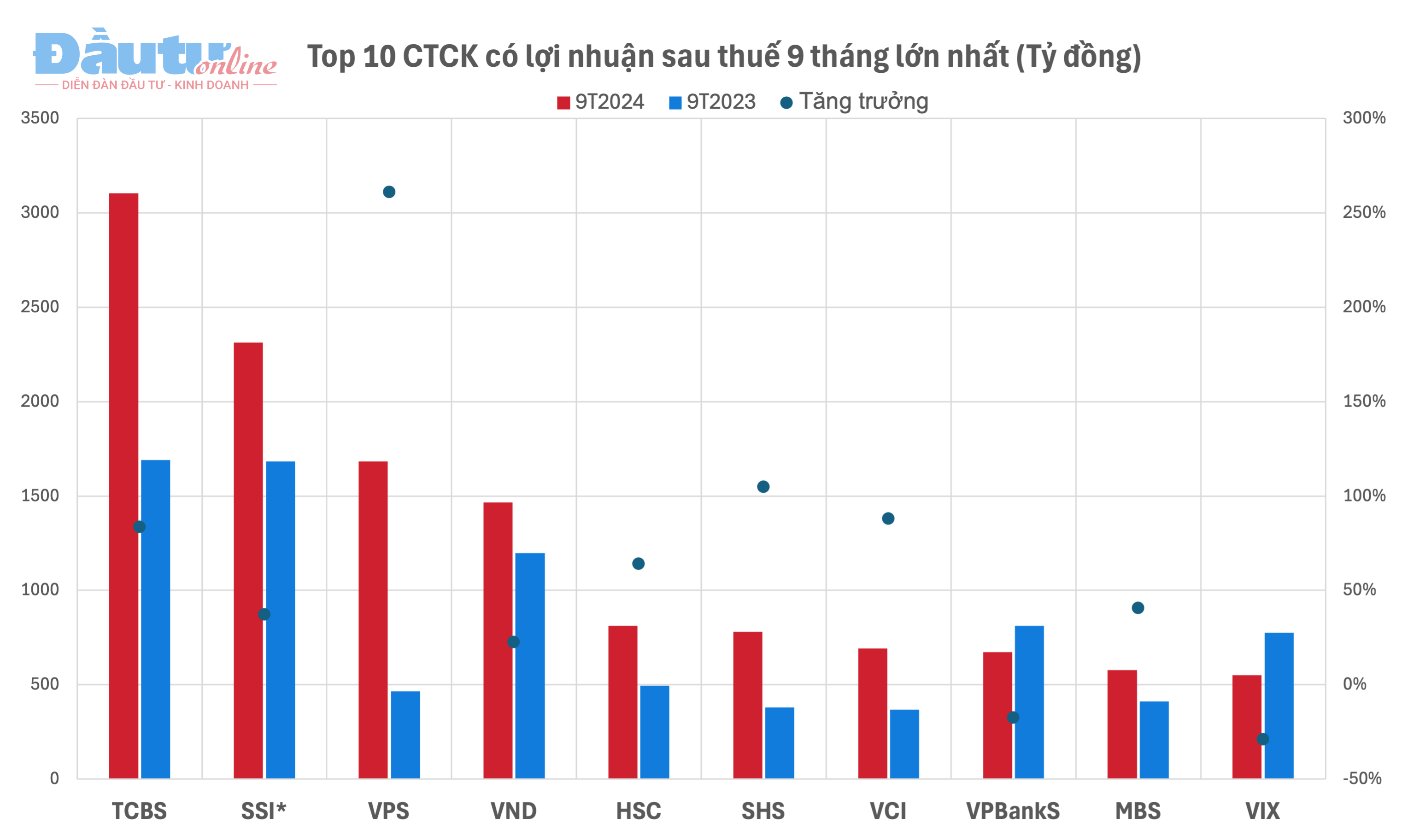

Although the third quarter may be a "lowland" due to market impacts, positive growth in the first two quarters of the year has helped securities companies maintain good profit growth. In the first nine months, 20 out of 27 companies had positive growth in after-tax profits. The total after-tax profits of the 27 companies were recorded at more than VND 16,900 billion, up 41% compared to the first nine months of 2023.

Compared to the same period last year, the first 9 months of this year recorded VPS in the group of over trillion profit, along with TCBS, SSI and VND. TCBS had the highest profit with 3,103 billion VND after tax, equal to the total profit of the 3rd and 4th ranked companies, VPS and VND.

|

Source: https://baodautu.vn/cong-ty-chung-khoan-nao-kiem-bon-nhat-tu-tu-doanh-margin-d228847.html

![[Photo] Scientific workshop "Trade unions with the task of participating in state management and building a socialist rule of law state"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/22/789f6384ec37466098a8bcb531deb281)

Comment (0)