Citing national security, the US government is considering tightening regulations on foreign capital, but enforcement will be challenging.

In recent months, the debate on tightening regulations on investment in China has become heated in American politics. In March, the US Treasury and Commerce Departments released drafts of this plan.

In April, National Security Adviser Jake Sullivan unveiled the policy in a speech. President Biden is expected to issue a related executive order. US allies are also considering similar restrictions. On June 20, the European Commission announced the plan, but did not provide details.

The specific content of the US policy has not been announced. However, the Economist predicts that Mr. Biden's executive order is likely to focus on controlling investment in three types of technology considered to play a role in "strengthening" the country's power: advanced semiconductors, artificial intelligence (AI) and quantum computing. Paul Rosen, in charge of overseeing investment security at the Treasury Department, revealed that the regulations will focus on "investment capital associated with know-how and expertise".

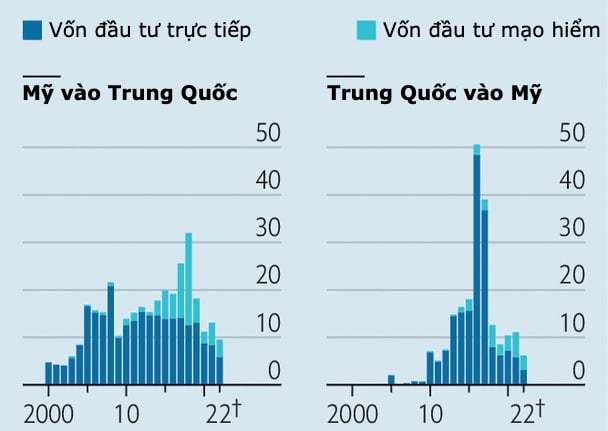

Economist graphic on US plans to tighten foreign capital rules.

These areas of investment control are not entirely new ideas. Some companies with ties to the Chinese military have been restricted from receiving investments. The US Chip Act also prohibits companies that receive government subsidies from making investments that could benefit China’s semiconductor industry.

According to the Economist , the tightening of regulations will likely only affect a small fraction of US investments in Chinese companies, which totaled more than $1 trillion by the end of 2021. According to data from research firm Rhodium Group, US companies have made $120 billion in foreign direct investment in China and $62 billion in venture capital (VC) investments over the past decade.

But tightening the rules for investors still comes with risks. One is that setting rules that are too broad could restrict capital flows and burden investors without good reason. Two, figuring out which investments are likely to leak technological know-how is difficult.

A tech giant looking to expand its advanced computing efforts in China might easily identify a regulatory violation. But venture capital funding is more complicated. For example, a fund might buy a company but not bring any operational advantage. A small venture capital investment, on the other hand, might come with technical expertise that is worth protecting.

According to the Center for Security and Emerging Technology, a Washington-based policy research unit, in the period 2015-2021, capital from US investors - including venture capital funds of Intel and Qualcomm - accounted for 37% of the $110 billion raised by Chinese AI companies.

The appetite of U.S. pension funds for returns has made them beneficiaries of such investments. GGV Capital, for example, is one of the most active U.S. investors in Chinese AI companies, according to data from PitchBook. GGV Capital has also received about $2 billion from six other funds with $600 billion in assets over the past decade.

The national security risks posed by such investments to the United States are an open question. Could domestic Chinese investors step in to provide financing if U.S. investors were restricted?

Some say the Biden administration should provide more definitive answers before asking asset managers and pension funds — which typically deal with hundreds of global investment funds — to look for traces of Chinese tech companies in their portfolios.

Another danger is the potential for confusion. Under Mr Biden, economic policy and national security are becoming increasingly indistinguishable, according to the Economist .

Last year, the president directed the Committee on Foreign Investment in the United States (CFIUS), which oversees investment in the United States, to review broader factors including supply chain resilience.

With foreign investment, it can be difficult to thoroughly evaluate deals based on general national interest standards. It is concerns about bureaucracy that have led some to propose controls through existing sanctions policies.

Graphics: Economist

Another problem is that while Mr. Biden’s initial foreign investment policy was supposed to limit deals that threatened national security, there was no shortage of hawks outside the White House who used it as a tool for broader industrial policy intervention.

In 2021, a bipartisan group of lawmakers introduced a foreign investment screening bill that was broad enough to affect more than 40% of U.S. investment in China, according to Rhodium Group. Last month, an updated version was released that would restrict investments not only in advanced technology but also in industries including auto manufacturing and pharmaceuticals, and give the White House the power to expand the list.

The rise in trade restrictions is not limited to the US. There was a commitment at the G7 summit in May. The impact on Western investment in China will depend on the extent of the restrictions that are ultimately agreed.

Despite these projections, US investment has actually declined. Venture capital flows to China have plunged more than 80% since their peak in 2018. One reason is the deteriorating business environment in China.

This month, Sequoia, a major US venture capital firm, announced that it would spin off its China operations by 2024. Hawkish policymakers are now reassured that capital flows have slowed without them having to intervene.

Phien An ( according to The Economist )

Source link

Comment (0)