ANTD.VN - The Ministry of Finance plans to add a number of tax incentive subjects to focus on encouraging tax incentives in industries producing products with high added value, high technology, biotechnology... However, the tax incentive areas will be narrowed to avoid spreading.

The Ministry of Finance said that it has just completed a draft proposal to develop a revised Law on Corporate Income Tax and sent it to the Ministry of Justice for review. In the draft, the Ministry of Finance proposed to complete regulations on corporate income tax incentives to both complete tax incentive policies and restructure budget revenue in a sustainable manner, while promoting the role and effectiveness of incentive policies and promptly removing obstacles and difficulties for enterprises.

Accordingly, the Ministry of Finance proposed to amend and supplement a number of regulations on corporate income tax (CIT) incentives regarding: tax rates and tax exemption and reduction periods, loss transfer; amend and supplement regulations on principles and conditions for CIT incentives.

The Ministry of Finance has proposed many solutions to implement this policy. Accordingly, the Ministry has reviewed and rearranged preferential tax sectors and tax incentive areas to contribute to changes in resource allocation, expanding the revenue base; focusing on encouraging tax incentives for industries producing products with high added value, supporting industries, using high technology, and biotechnology.

|

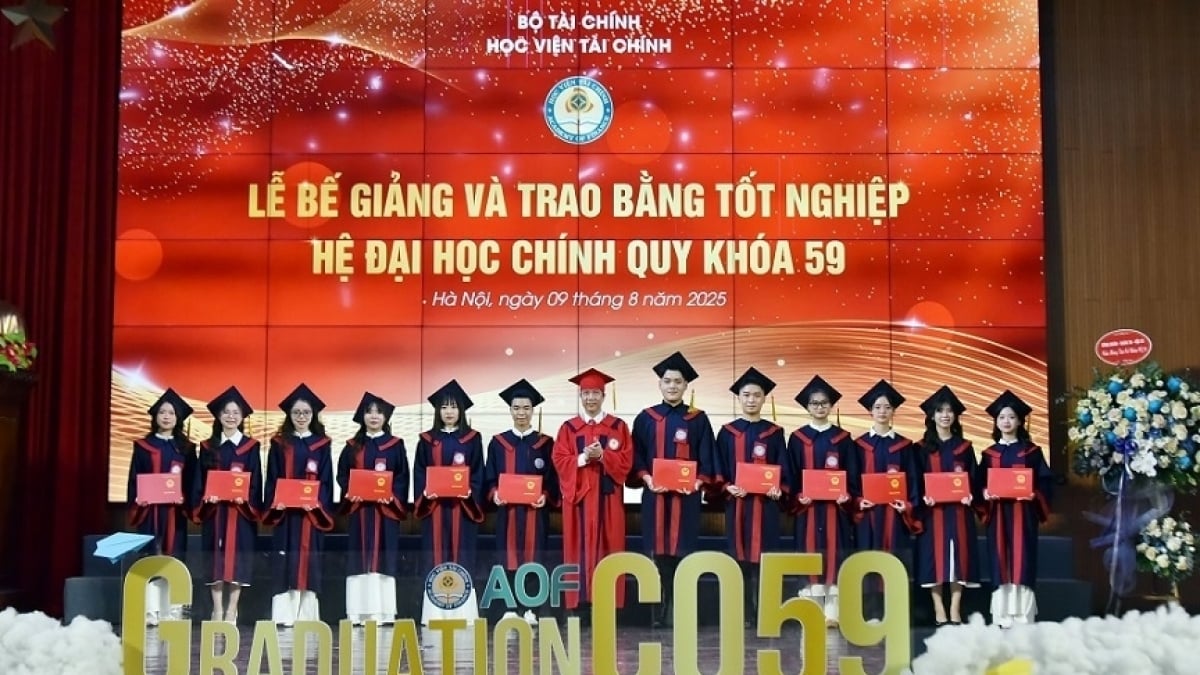

This revised Corporate Income Tax Law will cover all tax incentives in legal documents. |

In addition, the policy focuses on encouraging tax incentives in the following sectors: high-quality services, encouraging innovation, socialization, environmental protection, related to agriculture, farmers, rural areas and investment in areas with difficult and especially difficult socio -economic conditions.

Specifically, for the fields with special incentives on corporate income tax, the draft supplements the fields specified in the Investment Law 2020; adds activities of providing some important software services and producing digital information content products that need to be prioritized for development according to Government regulations...

Regarding the field of corporate income tax incentives, the Ministry of Finance proposes to rearrange in the direction of adding the following fields: investment in technical facilities to support small and medium-sized enterprises (SMEs), SME incubators; investment in co-working spaces to support innovative start-up SMEs according to the provisions of law on supporting SMEs, to ensure consistency with the Investment Law.

In addition, the draft omits the fields of "refining animal, poultry and aquatic feed" and "developing traditional industries" because these are fields where the preferential subjects do not have clear criteria for implementation.

Regarding tax incentive areas, the Ministry of Finance said it has reviewed to arrange and reduce tax incentive areas, ensuring incentives are targeted to the right subjects, overcoming the problem of widespread incentives. These new incentives aim to encourage investors to invest in areas with difficult or especially difficult socio-economic conditions, ensuring even development, and resolving the situation of equal incentives causing waste of resources.

In addition, the regulations on incentives for economic zones (EZs) will be amended in the direction of not applying the same preferential policy level uniformly but with distinction based on the development level and conditions of each area in the EZ. For industrial zones (IZs), incentives will only be applied to the area of the IZ located in tax incentives or special tax incentives.

Tax incentives are not applicable to investment projects in high-tech zones that are not in the high-tech sector. Investment projects in the trade and service sectors implemented in tax-incentive areas are only eligible for tax incentives for income generated in tax-incentive areas.

According to statistics from the Ministry of Finance, although the number of cases enjoying corporate income tax incentives only accounts for about 3% of the total number of enterprises (3.02% in 2016, 3.12% in 2017, 3.01% in 2018, 2.93% in 2019 and 3.25% in 2020), the amount of corporate income tax exempted and reduced accounts for a large proportion of corporate income tax revenue (37.18% in 2017, 30.67% in 2018, 27.38% in 2019 and 27.01% in 2020).

The current practice of implementing preferential corporate income tax policies has also revealed shortcomings and limitations that need to be studied and reviewed for appropriateness.

Many experts believe that the current tax incentive policy is still integrated into specialized laws. In the process of developing specialized laws in recent times, some legal documents continue to have provisions on tax incentive policies that have affected the consistency and synchronization in the legal system, increasing the spread and reducing the neutrality of taxes. Therefore, the revised Law on Corporate Income Tax must cover all tax incentives in legal documents.

Source link

Comment (0)