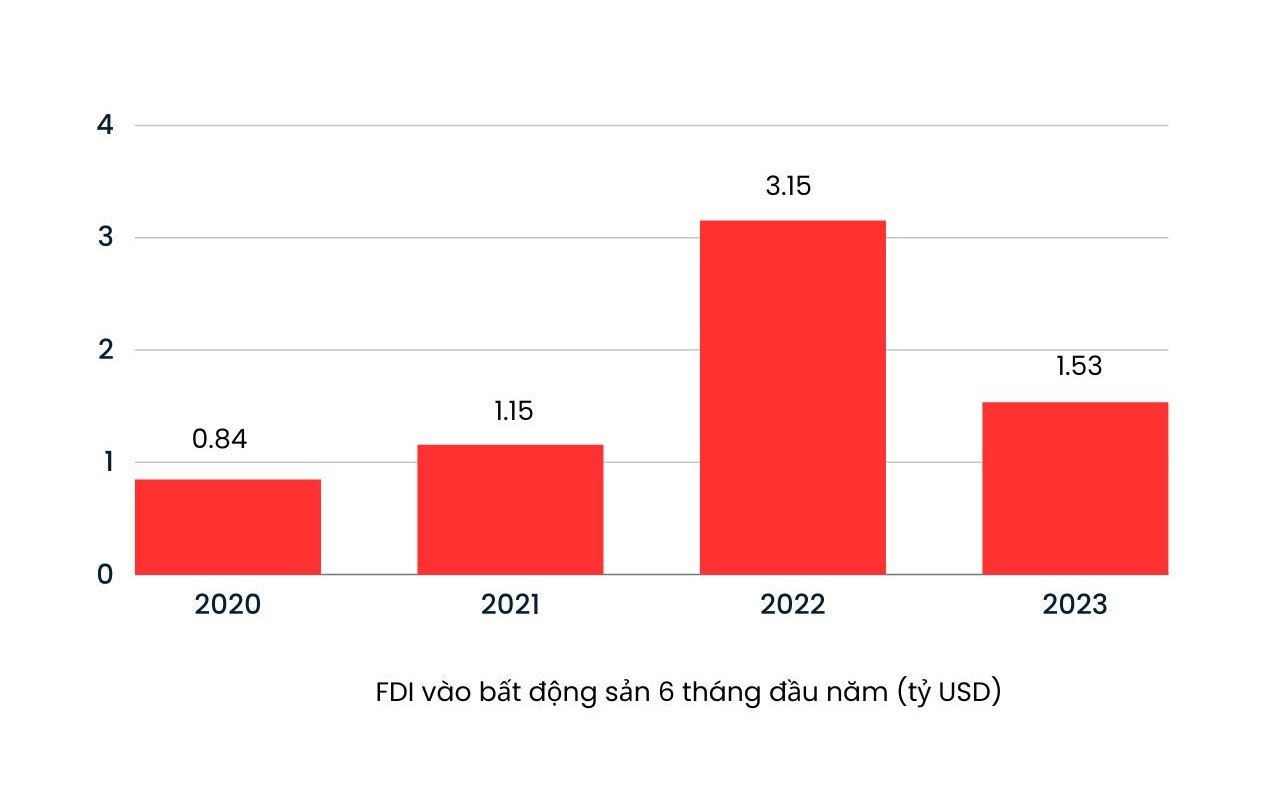

FDI disbursement into real estate decreased sharply

According to the General Statistics Office, as of June 20, the total registered FDI capital in Vietnam reached 13.43 billion USD, down 4.3% compared to the same period last year. Of which, the real estate business continued to hold the third position compared to the total registered capital of 1.53 billion USD, down 51.5% compared to the same period.

Regarding newly registered capital and adjusted registered capital of projects, foreign direct investment in real estate reached 592.1 million USD (accounting for 6.3%). Regarding the form of capital contribution and share purchase by foreign investors, investment capital in real estate business activities reached 938.6 million USD (accounting for 23.4%).

In the first 6 months of the year, foreign direct investment in Vietnam was estimated at 10.02 billion USD, up 0.5% over the same period last year. Of which, real estate business activities only reached 502.1 million USD (accounting for 5%), down 43% over the same period last year (reaching 881.3 million USD).

Up to now, although foreign investors in the Vietnamese real estate market still only account for a small market share, in the current context, the sharp decrease in FDI capital flows could negatively affect the market which is waiting for positive signals.

FDI disbursed into real estate activities in the first 6 months of the year decreased by 43% compared to the same period.

According to experts, the appearance of FDI in real estate in recent years has made this market have positive changes with the appearance of many types and improved operating models in projects. Therefore, the fact that the cash flow from foreign enterprises disbursed into the market shows signs of decreasing is a bad sign. Because this is considered a "lifebuoy" for many domestic enterprises in difficult times, through mergers and acquisitions (M&A).

Data from the Vietnam Association of Realtors (VARS) shows that in recent times, many businesses have encountered difficulties in funding and had to save themselves through M&A deals. However, very few domestic real estate developers are still able to arrange capital to buy projects, especially in the context of declining liquidity and rising financial costs. Therefore, large deals worth up to billions of dollars are expected to increase from foreign capital flows.

Meanwhile, the number of foreign investors interested in learning about M&A real estate projects has increased sharply. Notable among them are foreign investors from Singapore, Korea, Taiwan, Japan, Malaysia... However, most of the deals are still in the process of appraisal and negotiation.

M&A deals from foreign-invested enterprises are expected to "save" the market.

The reason is that the negotiations for price pressure have not reached an end. Foreign investors want to buy projects with good legal status, good locations, and future potential, but at a price reduction of up to 20%. Meanwhile, domestic enterprises do not accept selling assets at low prices, and even require profits in these deals, leading to difficulties in reaching a successful agreement.

In addition, the real estate market still has many barriers that prevent M&A activities from breaking through, one of the reasons why FDI capital disbursed into the market is gradually decreasing. In particular, legal problems of projects are one of the biggest reasons why many foreign enterprises feel hesitant, not to mention that the market is still in a low liquidity phase.

Need to quickly untie the knot

Responding to this issue, experts from Savills Vietnam said that in order to attract FDI capital into the real estate sector, Vietnam still has to focus on factors such as promoting the completion of legal procedures for investment, improving the quality of infrastructure serving production, serving the development of real estate, improving the quality of human resources to be able to absorb foreign investment capital, especially in the manufacturing sector...

Vietnam is one of the most open economies in Southeast Asia. As the economy grows and opens up more rapidly, the need and urgency to improve factors such as administrative procedures, infrastructure quality, and human resource quality will become more important.

Real estate used to be the top market attracting FDI capital.

It is necessary to determine that improvements in administrative procedures and processes must be implemented in practice, not on paper. The level of competition among countries in the region is very fierce, Vietnam must speed up this issue to promptly attract FDI capital.

Foreign enterprises that are new to the market can only implement projects after paying land use fees and obtaining construction permits. Therefore, for these enterprises, legal procedures are the most important thing to consider before investing. Because the investment process is too long, it will affect the investment efficiency and the high selling price will not be suitable for the majority of people.

Many opinions say that legal issues are currently the biggest reason for the decline in the attractiveness of the Vietnamese real estate market to foreign investors. Although this issue has been mentioned many times in the media as well as in conferences or “rescue” meetings of the Government . However, up to now, the removal of these bottlenecks is still in the beginning stage.

To become an attractive investment destination for foreign investors to participate in the Vietnamese market. It is necessary to quickly improve existing weaknesses so that the real estate market can soon recover after months of difficulty.

Source

Comment (0)