|

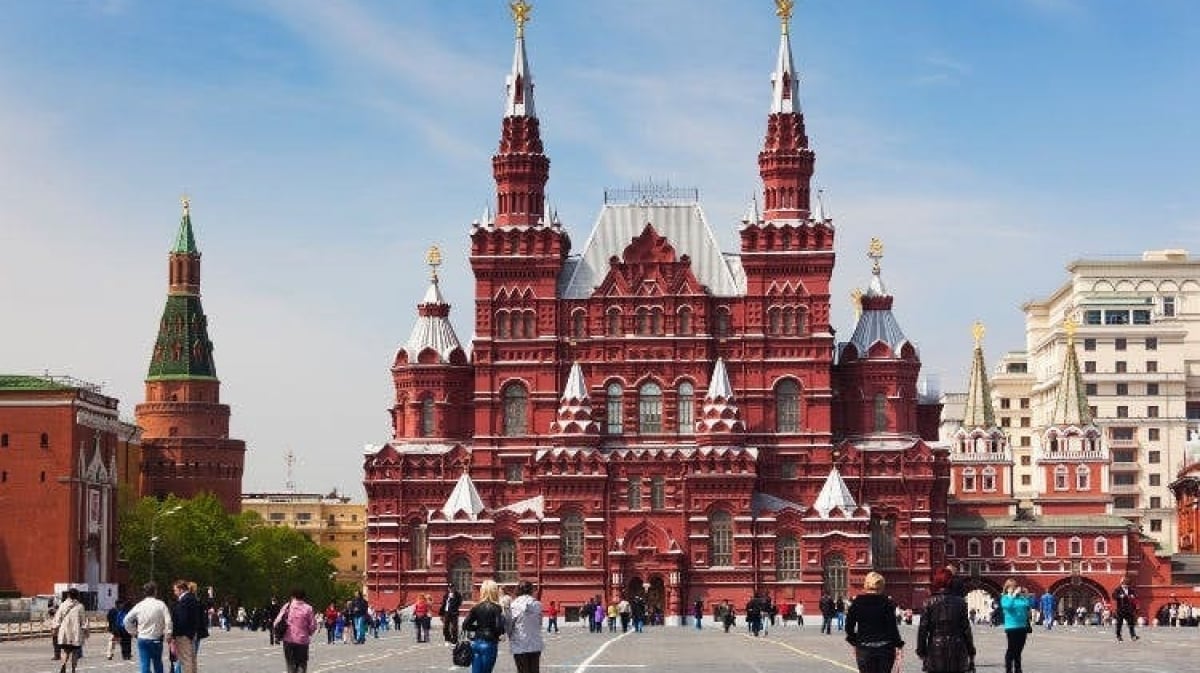

| By the end of 2022, the West will impose a price ceiling on Russian seaborne crude oil at $60 per barrel. (Source: Reuters) |

“We want market participants to know that the United States takes this price ceiling very seriously,” Ms. Yellen said.

Previously, on September 29, in an interview with Bloomberg news agency, Minister Yellen admitted that the Group of Seven (G7), the European Union (EU) and Australia's attempts to impose a ceiling on Russian oil prices were not as effective as the West had hoped.

"The effectiveness of the price cap has diminished, with Russian crude hovering around $80 to $90 a barrel, well above $60. Moscow spends a lot of money, time and effort to support oil exports. We are prepared to act. The G7 will consider over time how to make the price cap mechanism more effective," the official said.

In September, Russia's Urals crude oil exports averaged $85 per barrel, about $25 higher than the G7 and EU price ceilings.

At present, a large volume of this country's crude oil is still being transported on Western ships.

Figures from the Center for Research on Energy and Clean Air (CREA) show that between September 29 and October 1, 37% of Russia’s fossil fuel exports were shipped on vessels owned or insured by G7 or EU countries. Russia’s fossil fuel revenues totaled $4.68 billion during that period.

In its progress report on the price cap earlier this month, the US Treasury Department assessed: “Despite initial market skepticism, market participants and geopolitical analysts acknowledge that the price cap is accomplishing two goals: reducing Russia’s revenues and keeping its crude oil out of the world. The price cap has already reduced Russia’s oil tax revenue by 44%.”

However, according to Bloomberg, Moscow has succeeded in establishing a network of shipping and insurance companies to replace Western businesses.

At the same time, some experts believe that a large "dark fleet" of oil tankers has helped Russia transport oil above the ceiling price to the world market.

In August 2023, about 75% of fuel shipments by sea were carried out without marine insurance by Western companies, which is Moscow's main tool for enforcing the embargo, according to analytics firm Kpler.

Shipping experts estimate that Russia will acquire around 600 off-contract tankers to bolster its “shadow fleet” by 2022, at an estimated cost of at least $2.25 billion.

The Wall Street Journal said it was "an expensive feat." The cost of the "dark fleet" tankers and the additional insurance that Russia must underwrite could add $36 a barrel to the cost of oil exports.

Another loophole in Western sanctions is that it allows countries to buy oil through third parties. India, for example, has opted out of the price cap and has been buying more discounted Russian oil. Not only has it become a major buyer of Moscow oil, New Delhi is on track to become Europe’s largest supplier of refined fuels.

The South Asian country's refineries take advantage of buying oil at cheap prices, refining it into fuel and selling it to the EU at competitive prices.

"Russian oil is finding its way back to Europe despite all the sanctions," said Viktor Katona, chief crude oil analyst at Kpler.

In December 2022, the EU, G7 and Australia imposed a price ceiling on Russian seaborne crude at $60 a barrel. The US and its allies banned Western companies from providing insurance and other services for Russian crude shipments unless the cargo was purchased at or below the price ceiling. The mechanism is intended to force Russia to continue exporting large volumes of oil to prevent global prices from spiking, but reduces the revenue Moscow earns from selling crude. |

Source

![[Photo] Party and State leaders meet with representatives of all walks of life](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/66adc175d6ec402d90093f0a6764225b)

![[Photo] Phu Quoc: Propagating IUU prevention and control to the people](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/f32e51cca8bf4ebc9899accf59353d90)

Comment (0)