Một tuần dồn dập tin tốt

Giới đầu tư vừa trải qua một tuần đón nhận nhiều tin vĩ mô quan trọng và khá tích cực. Dòng vốn đầu tư trực tiếp nươc ngoài (FDI) tiếp tục đổ vào Việt Nam mạnh mẽ. Qua đó cho thấy sự tin tưởng của các nhà đầu tư ngoại vào nền kinh tế có quy mô 100 triệu dân.

Các hiệp định thương mại tự do đa phương và song phương, mối quan hệ với các nền kinh tế lớn nhất thế giới từ Mỹ, Trung, Ấn Độ, EU, Nhật được nâng lên tầm cao mới khiến Việt Nam trở thành tâm điểm thu hút dòng tiền quốc tế.

Vốn FDI đăng ký trong tháng 1/2024 tăng hơn 40% so với cùng kỳ, vốn FDI thực hiện tăng 9,6%. Các chỉ số sản xuất công nghiệp (IIP) và xuất nhập khẩu đều cải thiện tích cực.

Xuất nhập khẩu có bước chạy đà rất tốt trong tháng đầu tiên của năm 2024, trong bối cảnh sức cầu thị trường thế giới có dấu hiệu hồi phục. Xuất khẩu tháng 1 tăng 4% so với cùng kỳ, nhập khẩu tăng 6,8%.

Đây là tín hiệu cho thấy, doanh nghiệp có niềm tin vào hoạt động sản xuất kinh doanh hơn, nhập khẩu nhiều hơn và tạo đà để tăng trưởng trong cả năm 2024. Khu vực doanh nghiệp trong nước có hoạt động xuất khẩu tăng mạnh hơn so với khu vực FDI. Sau một thời gian trầm lắng, đầu tư tư nhân được kỳ vọng sẽ hồi phục trở lại.

Bên cạnh đó, Chính phủ cũng đang đẩy mạnh đầu tư công với loạt các dự án đường cao tốc, sân bay, cùng với đó yêu cầu đẩy nhanh hạ tầng điện cho kinh tế phát triển. Trong tuần qua, Thủ tướng tiến hành thị sát và yêu cầu đẩy nhanh tiến độ dự án đường dây 500kV mạch 3 Quảng Trạch đến Phố Nối.

Thị trường cũng đón nhận thông tin tích cực từ chỉ số hoạt động sản xuất. Chỉ số PMI của Việt Nam vượt mốc 50 điểm lần đầu tiên sau 5 tháng. Trong khi đó, tỷ giá USD/VND trong nước hạ nhiệt từ ngưỡng 24.700-24.800 đồng/USD, xuống còn 24.520 đồng/USD (giá Vietcombank bán ra 5/2).

Trong khi đó, Cục dự trữ liên bang Mỹ (Fed) giữ nguyên mức lãi suất điều hành kỳ họp tháng 1 ở đỉnh cao 23 năm là 5,25-5,5%. Fed cho biết khả năng cắt giảm lãi suất vào tháng 3 không cao, điều này không ảnh hưởng tới tỷ giá tại Việt Nam.

Cùng với các tín hiệu tích cực từ FDI và xuất nhập khẩu, các thông tin đầu tư công và điện lưới có tác động tích cực đến các nhóm ngành như bất động sản công nghiệp, vật liệu xây dựng, điện lực, doanh nghiệp xuất khẩu… Dòng tiền dịch chuyển khá nhanh vào cổ phiếu các ngành này.

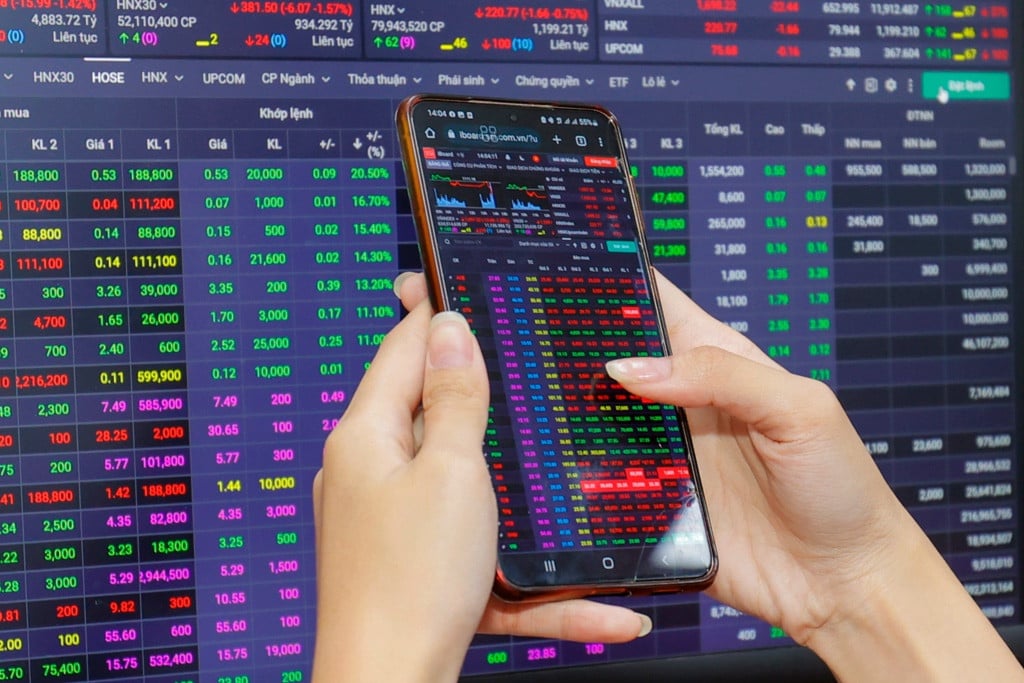

Trên thị trường chứng khoán, tâm lý chốt lời ngắn hạn trước dịp Tết Nguyên đán khiến chỉ số VN-Index trong cả tuần giảm nhẹ 0,3% xuống còn 1.172,6 điểm. Chỉ số HNX-Index tăng 0,5% lên 230,6 điểm. Upcom-Index tăng 0,8% đóng cửa tại 88,4 điểm.

Bán lấy tiền, hay gom hàng chờ sóng sau Tết?

Ông Đinh Quang Hinh, Trưởng Bộ phận Chiến lược thị trường, Khối Phân tích Chứng khoán VnDirect, cho rằng thị trường vừa trải qua một tuần giao dịch biến động giằng co giữa bên mua và bên bán, trong bối cảnh kỳ nghỉ Tết đến gần. Một bộ phận nhà đầu tư có tâm lý “nghỉ Tết sớm” và bán ra để thu tiền về. Chiều ngược lại, nhiều nhà đầu tư tranh thủ cơ hội “nhặt nhạnh” cổ phiếu, nhằm chuẩn bị cho giai đoạn sau Tết. Điều này giúp giao dịch trên thị trường diễn ra khá nhộn nhịp.

Một số công ty chứng khoán cho rằng, các nhà đầu tư có tỷ trọng tiền mặt cao có thể tận dụng những dịp rung lắc để mua tích lũy cổ phiếu tốt cho tầm nhìn trung, dài hạn.

Theo Chứng khoán SHS, về trung hạn, thị trường đang vận động trong khu vực cân bằng để hình thành nền tích lũy mới và kỳ vọng sẽ hình thành nền tích lũy trong biên độ 1.150-1.250 điểm.

Gần đây, nhiều doanh nghiệp lớn có kết quả kinh doanh khá ấn tượng như Tập đoàn Hòa Phát (HPG) của ông Trần Đình Long, Masan (MSN) của ông Nguyễn Đăng Quang, FPT của ông Trương Gia Bình,…

Trong tuần qua, khối ngoại mua ròng nghìn tỷ đồng, trong đó tập trung gom cổ phiếu xây dựng AIC sàn UPCoM. Một số cổ phiếu khác được các nhà đầu tư nước ngoài gom mạnh như: PNJ, SSI, HPG, PDR, STB, NVL,… Khối ngoại bán ròng Vincom Retail (VRE), Vinhomes (VHM) và Vingroup (VIC),…

Chứng khoán CSI cho rằng "sau cơn mưa trời lại sáng". Sự tăng trưởng mạnh về thanh khoản ở cổ phiếu thuộc nhiều nhóm ngành cho thấy, tín hiệu tích cực vẫn đang ưu thế hơn. CSI duy trì sự kỳ vọng, VN-Index sẽ tiến tới mốc kháng cự (1.200-1.210) điểm trước dịp nghỉ Tiết âm lịch.

Ông Đinh Quang Hinh cho rằng, các nhà đầu tư có thể cân nhắc tận dụng những phiên giảm trước kỳ nghỉ lễ để tích lũy cổ phiếu. Điều này được hỗ trợ bởi những thông tin vĩ mô trong nước tích cực thời gian qua như chỉ số PMI lần đầu vượt mốc 50 điểm sau 5 tháng, lạm phát và lãi suất trong nước duy trì xu hướng giảm.

Đáng chú ý, đà tăng gần đây của tỷ giá có dấu hiệu kết thúc, giúp giải tỏa áp lực tâm lý đối với một bộ phận nhà đầu tư.

Dòng tiền của nhà đầu tư trong nước, đặc biệt nhà đầu tư cá nhân, có thể sẽ quay trở lại thị trường mạnh mẽ sau kỳ nghỉ lễ và thúc đẩy các chỉ số chứng khoán đi lên.

Nguồn

![[Photo] Phu Quoc: Propagating IUU prevention and control to the people](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/f32e51cca8bf4ebc9899accf59353d90)

![[Photo] Party and State leaders meet with representatives of all walks of life](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/66adc175d6ec402d90093f0a6764225b)

Comment (0)