On May 29, the Investigation Police Department of Dong Nai Province Police issued a decision to prosecute the case at the Tan Thinh residential area project, which illegally built nearly 500 houses, to investigate the act of "abusing position and power while performing official duties". This is a project invested by LDG Investment Joint Stock Company (LDG).

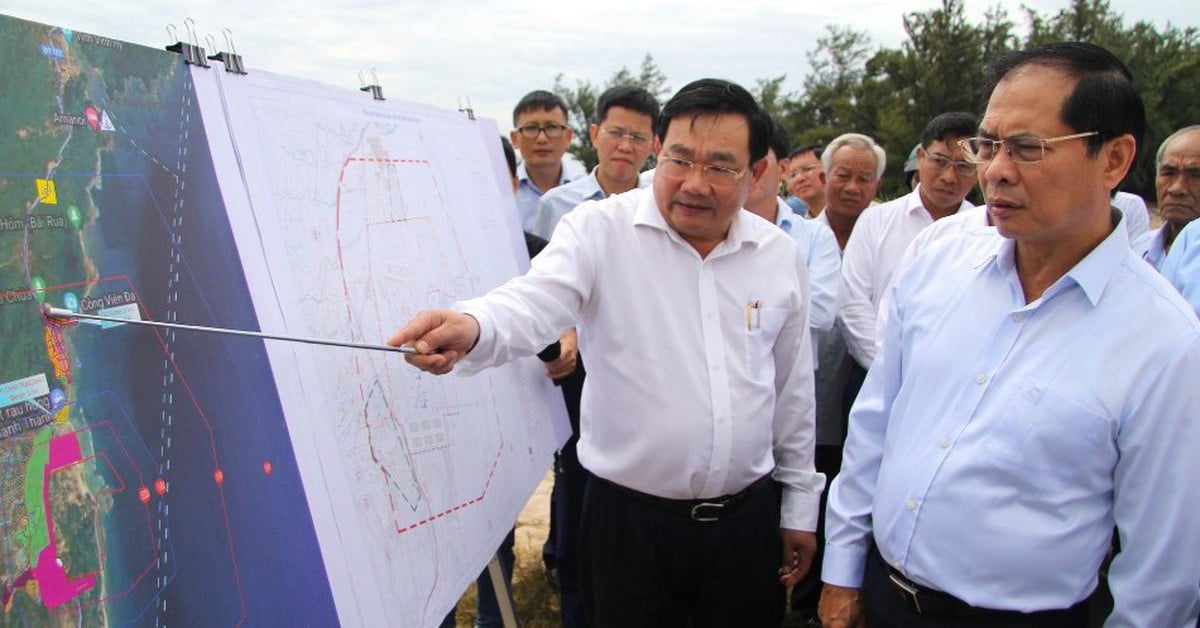

The project was approved in principle and introduced to the investment location by the Dong Nai Provincial People's Committee in 2016, with a total area of about 18.22 hectares. In 2018, the Dong Nai Provincial People's Committee approved the policy for LDG to invest in building a residential area in Doi 61 commune.

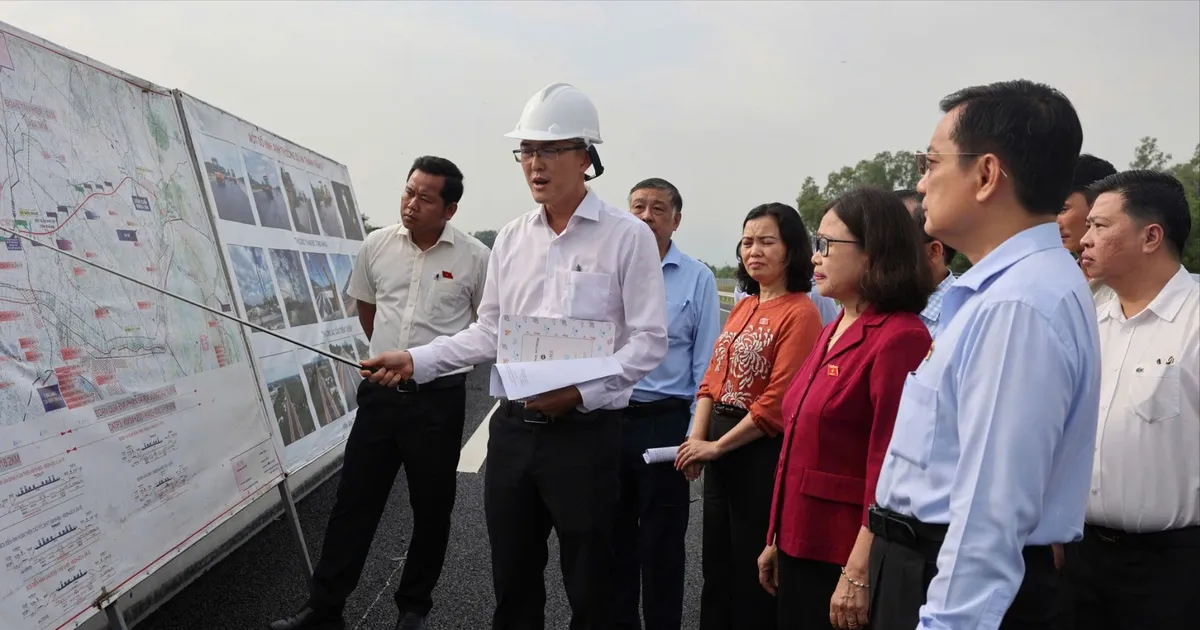

According to the inspection conclusion, LDG has not yet carried out procedures to apply for land allocation, land lease, permission to change land use purpose and has not been granted a construction permit to carry out project investment. However, from 2018-2020, the investor has organized the construction of roads, green parks, rainwater drainage systems, wastewater drainage systems, water supply systems and power supply systems...

According to the inspection conclusion, some individuals involved have signs of criminal offenses.

Previously, the People's Committee of Dong Nai province requested LDG to supplement the missing procedures on construction activities, land procedures and related legal procedures to promptly complete administrative procedures according to regulations and report to relevant authorities on the progress of implementation. At the same time, no transactions of the project are allowed until the completion of procedures related to the sale of future houses.

"White seat" major shareholder

LDG Investment JSC was officially established by changing its name from Long Dien Real Estate JSC in 2015. Its charter capital increased from 50 billion VND to 750 billion VND and was listed on the Ho Chi Minh City Stock Exchange.

In 2016, Le Ky Phung, Chairman of the Board of Directors and founder of LDG, withdrew. Mr. Phung was replaced by Mr. Nguyen Khanh Hung, who was then a member of the Board of Directors and Deputy General Director of Dat Xanh Real Estate Services and Construction JSC (currently Dat Xanh Group).

Since then, Dat Xanh has been the largest shareholder group at LDG Group. Since then, LDG Group has been considered the "shadow" of Dat Xanh Group.

Since 2017, LDG has entered the apartment segment in Ho Chi Minh City by launching apartment projects under the Intela brand such as Saigon Intela, High Intela and West Intela. There are also projects in neighboring provinces.

One noteworthy point is that LDG currently no longer has a major shareholder - a rare phenomenon among thousands of listed and registered enterprises trading on the centralized stock market.

LDG Company lost its major shareholder after Chairman of the Board of Directors Nguyen Khanh Hung had nearly 5 million additional shares sold for collateral in 2 days, May 18-19.

According to the 2022 annual report, Mr. Hung is the only major shareholder of LDG, holding 7.23% of capital at the end of last year.

Since the beginning of the year, Mr. Hung has had his shares mortgaged many times. On April 13-14, Mr. Hung also had more than 3.5 million LDG shares mortgaged after the results of the inspection of the "illegal construction" project in Dong Nai were announced.

In November 2022, Mr. Hung was sold millions of LDG shares. Within 5 days, Mr. Hung was sold 7.7 million LDG shares. The Chairman of LDG clearly stated that this was a transaction to sell LDG shares by a securities company.

According to the financial report, by the end of 2022, the inventory of Tan Thinh residential project was 463.5 billion VND, accounting for 38.4% of LDG's total inventory. This is the project with the largest inventory value of this enterprise.

In mid-2020, Dat Xanh divested from LDG. Accordingly, DXG decided to sell all of nearly 63 million shares, equivalent to 26.27% of capital at LDG. At the same time, DXG's subsidiary, Ha Thuan Hung Construction Trading Service Co., Ltd., also registered to sell all of more than 25 million LDG shares, equivalent to 10.45% of LDG Investment's charter capital. In total, Dat Xanh's large group sold 88 million LDG shares, equivalent to 36.72% of LDG's charter capital and lost hundreds of billions of VND.

This is quite a surprising development because the investment in LDG is considered a strategic investment of Dat Xanh (DXG). LDG has a real estate development investment industry, similar to Dat Xanh and also has quite good prospects with the ownership of many large projects.

Source

Comment (0)