3 things to do immediately if you suspect you have been scammed

As the year comes to an end, online scams increase in number and variety. The forms of scams are always changing, intertwining the old and the new with more sophisticated new forms.

According to the recommendations of banks, customers need to be more vigilant against sophisticated tricks such as:

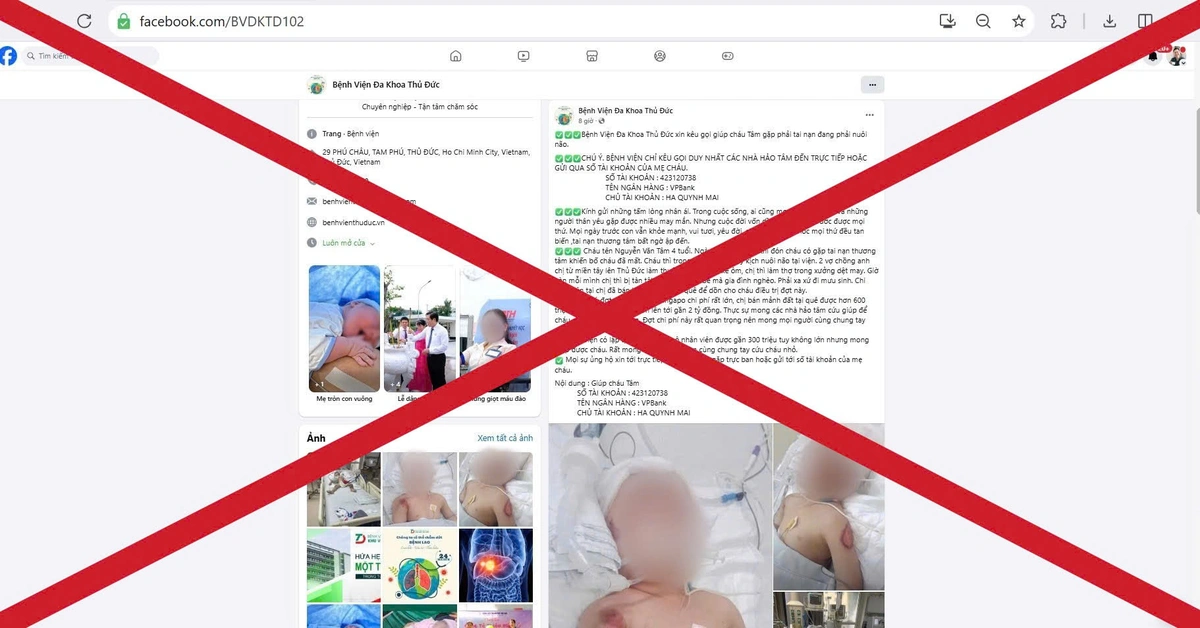

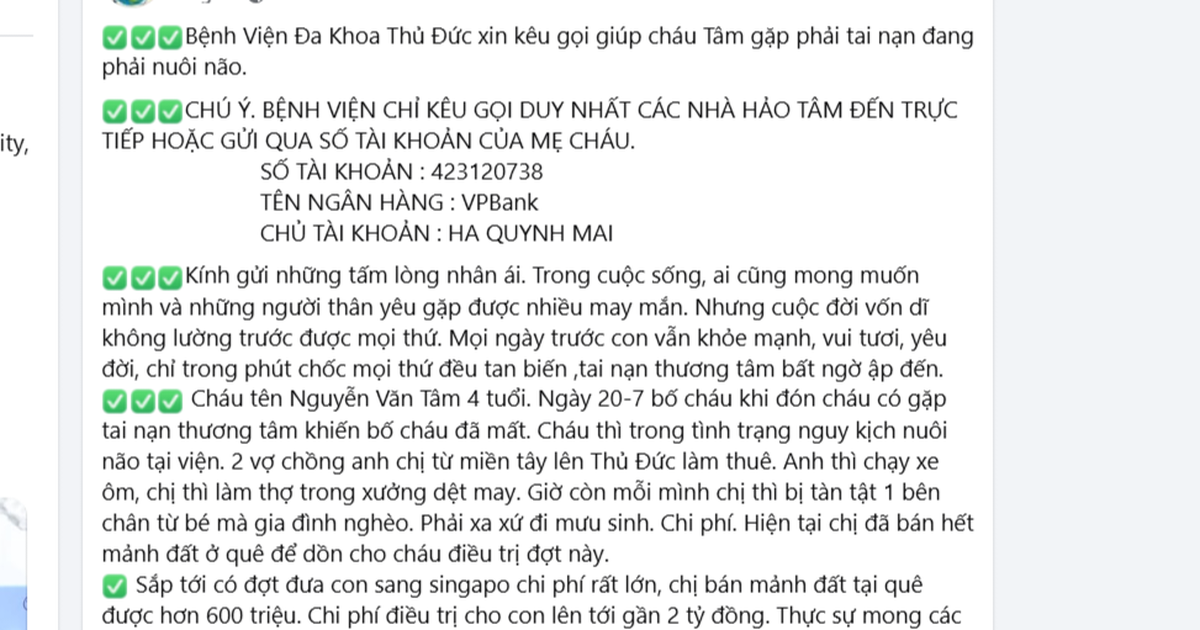

Be alert to the form of appropriating the right to use social network accounts that is popular today (Zalo, Facebook, Tiktok,...) then sending messages, making video calls with the account owner's image displayed to build trust with the account owner's friends and relatives for the purpose of borrowing money or transferring money.

Warning about the scam "Play online games to earn real money".

Online recruitment traps scam job seekers on Telegram.

Impersonating bank employees to offer attractive interest rates and gifts when making online savings deposits to lure customers to log in at fake links to steal customer information.

In particular, banks recommend that customers be absolutely vigilant against solicitations and enticements on social networks and should not provide any personal information to strangers.

Absolutely do not click on strange links, provide account information, personal information, passwords, and e-banking usernames to others, including bank employees or people claiming to be investigators. Bank officers never contact customers to request personal security information or account or card information.

Do not take pictures of the card or card code information to send via email or post on social networking sites. If this information is revealed, criminals will take advantage of the loophole to find a way to steal money from your account.

Do not save passwords on your web browser as they can be stolen by malware.

According to Vietcombank 's recommendation, in case of suspected fraud, users need to do the following 3 things immediately: Lock the service or change the service password immediately (select the password change feature on the app); immediately call the bank via hotline or go to the nearest bank transaction point for support; report to the nearest police station.

Banks strengthen defenses with biometric technology

In order to enhance security and ensure a higher level of safety for bank account holders, the State Bank has issued Decision 2345 replacing Decision 630 and will take effect from July 1, 2024.

Accordingly, bank money transfers (to different account holders) or deposits into e-wallets of over VND 10 million or total value of money transfers and payments in a day exceeding VND 20 million must be authenticated by biometrics (can use a chip-embedded citizen identification card, VneID account or biometric data stored in the bank's database).

Biometric technology is a method of identifying and verifying individuals through biological characteristics such as facial images, fingerprints, iris patterns, voice, etc. This technology is considered to minimize the possibility of counterfeiting and has the highest security. Currently, most banks authenticate biometrics through facial recognition, because iris and voice data are not yet collected and stored.

In addition to the change when transferring money, individual customers must also be biometrically identified before making their first transaction using a banking application (mobile banking) or before making a transaction on a device other than the one they last made the transaction on. In addition, banks need to have additional OTP authentication methods sent via text message/voice or Soft OTP/OTP Token.

Along with that, the bank needs to send SMS or email to customers (according to the customer's registered information), notifying about the first login to the Internet Banking/Mobile Banking application or logging in on a different device from the last login device.

However, there is no need to wait until July 1, 2024, LPBank has recently added a facial authentication feature when logging in to the LienViet24H app on new devices.

This feature not only helps protect customers' accounts if their information is accidentally leaked and taken over by criminals, but also helps customers flexibly log in on different devices.

Not only online scams target bank accounts, in reality there are scams that few people pay attention to because the amount of money scammed is usually not too large. Tran Tuan Truong, a fourth-year student at the Academy of Posts and Telecommunications Technology, said that after he posted on Facebook groups about his lost wallet on his way home from school, a fake account sent him a message via Facebook Messenger. This person said that he had information about the person who found Truong’s wallet and was willing to provide the information on the condition that Truong transfer 200,000 VND to this person as a “thank you”. “I looked at the personal page and saw that it was a fake account. I suspected that this was a scam so I did not transfer the money as requested,” said Mr. Truong. |

Source

![[Photo] Phu Quoc: Propagating IUU prevention and control to the people](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/f32e51cca8bf4ebc9899accf59353d90)

![[Photo] Party and State leaders meet with representatives of all walks of life](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/8/24/66adc175d6ec402d90093f0a6764225b)

Comment (0)