Every morning at 5 a.m., as he prepares for the day, billionaire builder Pat Neal ponders the financial markets. “The thought process usually starts in the shower and ends by 8 a.m.,” he says. The question he asks himself is: “What will the yield on the 10-year Treasury note do today?”

But here’s the strange thing: Neal doesn’t own a single Treasury bond. In fact, he doesn’t own any publicly traded stocks or bonds in his estimated net worth of $1.2 billion. He watches these markets for one purpose: to predict the sentiment and spending habits of his homebuyers.

As for himself, almost all of his fortune is poured into one place, the construction company Neal Communities, which he has built since 1970, with more than 25,000 homes built across Florida.

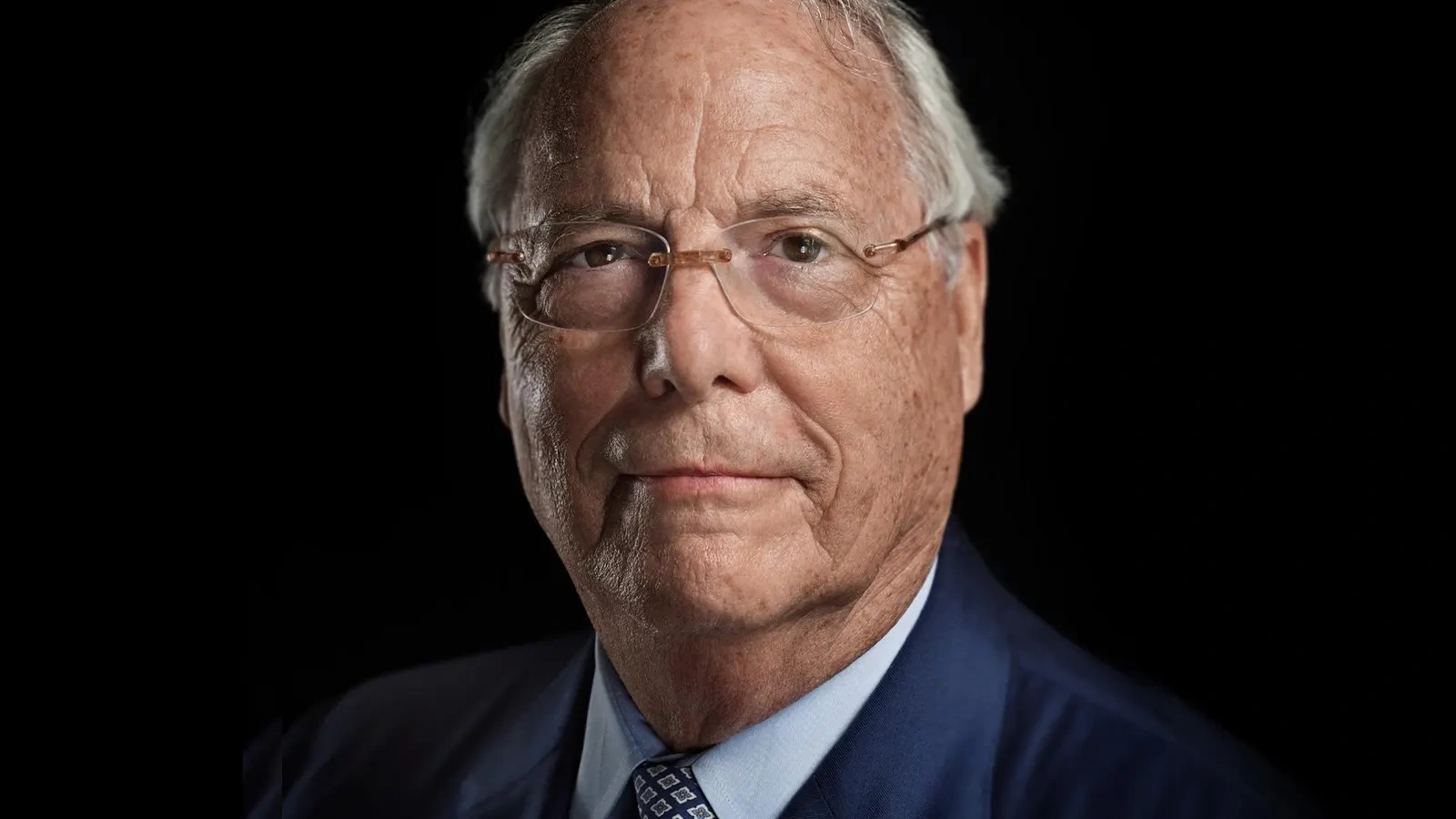

“I like to control my own future,” explains Neal, 76. This philosophy explains why he continually reinvests in his own business. “I don’t live lavishly. And my retirement plan is my business. We don’t need a pension fund because we don’t plan to retire.” When he needs extra cash, he sells off undeveloped lots from his vast land bank.

The path to this philosophy of “self-control” was not a smooth one. It was shaped by painful falls in the stock market, a place he once believed in.

Fall from Wall Street and Vow to Leave the Market

Before he became a real estate mogul, Pat Neal was a brilliant businessman. Growing up in Iowa in the 1950s, he learned early on how to make money: bottling laundry detergent, mowing lawns, delivering newspapers, and starting a cleaning service. By high school, he was making thousands of dollars a year, sometimes more than his mother, a teacher.

His first investment came at age 16: 100 shares of Iowa Beef Packers for $1,500. He sold it in college for $3,000, doubling his initial investment. The early success convinced him that the stock market was a lucrative game.

The good fortune didn’t last, however. In early 1970, Neal’s first broker advised him to buy 100 shares of Delta Corporation, a mobile home loan company, at $28 a share. After a brief rally, the stock plummeted following a bad earnings report. The broker advised him to “average down” at $14. Neal did so, only to watch helplessly as his entire investment evaporated as the company went bankrupt and the stock plummeted to zero.

Ironically, the broker later left the industry and became a butcher.

After “not getting any better” with his second broker, Neal made a career-changing decision, stopping buying stocks altogether after 1972. He realized that by investing in stocks, he was putting his financial destiny in the hands of strangers. From the ashes of those experiences, a new investment philosophy was born, a strategy that he could steer and control himself.

After two failed stock investments, Neal left the stock market and focused entirely on real estate (Photo: Donald Gregory).

The "Eagle" Hunting Philosophy: Buy Land Before the Road Is Formed

Pat Neal left Wall Street and focused his energy, mind, and finances on what he knew best: building homes. His strategy, while seemingly simple, was one of mastery and foresight: spotting opportunities before the masses did.

“My sons and I know more about land opportunities than anyone else,” he says. This is not a boast, but a testament to the relentless work involved. He doesn’t sit in an office analyzing charts. Instead, he and his sons spend their days trawling the land, calling local contacts, reading obituaries to find heirs who want to sell, and keeping a close eye on every small planning decision.

“My strategy is to buy land before it is developed,” he asserts. “Investing is a knowledge-based business. Unique knowledge will help you achieve higher than average returns.”

This tactic has brought him some of the most memorable deals. A classic example is when Neal bought the 1,087-acre LeBamby hunting estate in the late 1980s for about 10 cents per square foot. What the seller didn’t know, but Neal did, was that an interstate highway was about to be built right next to it. “When the connecting roads were finished,” he recalls, “I was able to sell some of the land for $57 per square foot.”

Another big deal came in 2014, when he and his son bought a bank-foreclosed plot of land for just $6,000 an acre. They saw potential that the bank didn’t see. After developing it, they sold a portion last year for as much as $250,000 an acre. Neal’s comment underscores the importance of deep understanding: “They don’t know the real value of their land.”

From billionaire strategy to modern investor's guide

Of course, not everyone has the capital, time, and connections to make large-scale land deals like Pat Neal. But his story is not for us to admire from afar, but to learn from his core thinking. Fortunately, in the age of technology, applying Neal’s principles has become easier than ever, even with modest capital.

Neal’s first rule is access. He gets access to prime real estate with a lot of capital. Today, small investors can access potential real estate through crowdfunding platforms. In developed markets like the US, platforms like Arrived (backed by Jeff Bezos) allow you to buy a share of rental properties for just a few hundred dollars. You become a “co-owner,” benefiting from appreciation and rental income without having to directly manage the property.

Neal’s second principle is to create stable value. He builds residential communities that generate sustainable cash flows. For individual investors, finding similar stability can come from commercial real estate with “golden tenants” – large, reputable brands.

Imagine you own a portion of a space that is leased to a leading retail chain like WinMart+, Circle K, or a major bank on a long-term basis. This is the essence of investing in commercial real estate with national brand tenants. Platforms like First National Realty Partners (FNRP) in the US specialize in this model, allowing investors to own a portion of shopping centers with large supermarkets as the anchor tenant.

The appeal of this model, especially with Triple Net Lease (NNN) contracts, is that almost all operating costs, maintenance, taxes, etc. are paid by the tenant. Investors just "sit still" and receive a stable rental cash flow. This is an extremely effective passive income strategy, minimizing the risk from unreliable tenants.

Individual investors can fully apply Neal's core principles thanks to the support of modern tools and platforms (Photo: Guerin Blask).

Neal’s final and most important principle is strategic management. He doesn’t just buy and hold. He plans, develops, and optimizes everything from legal, tax, to financing strategies. The modern investor needs such a comprehensive asset management “brain.”

Digital wealth management platforms like Range in the US are designed to integrate every aspect: from investing to tax planning to estate planning to retirement advice. For real estate investors, these tools help answer tough questions: What legal structure should I use for this deal? How will buying another property affect my cash flow and taxes? When should I refinance my loan?

Even if you don’t need a complex platform, this mindset is crucial. Before making any decision, do a detailed plan, consult with tax, legal, and financial experts. Look beyond the purchase price and potential appreciation, and consider the full picture of cash flow, costs, and risks.

The control is in your hands

Pat Neal's story is a powerful reminder that the path to wealth doesn't just include a "stock" path. Real estate, when approached with the right mindset, offers something that paper assets can't: control.

Pat Neal took control with his vast capital and tireless field trips. Today, you can take control with other tools: knowledge, technology, and strategic thinking. The path of the real estate "eagle" is no longer the exclusive domain of billionaires.

By learning from those who have gone before and taking advantage of modern tools, you can absolutely start building your own financial empire, solid and durable, from the "bricks" that you choose and build yourself.

Source: https://dantri.com.vn/kinh-doanh/bo-qua-pho-wall-ty-phu-tu-than-dung-de-che-12-ty-usd-tu-dat-bi-lang-quen-20250811211323418.htm

Comment (0)