| What factors support the recovery of steel consumption in the second half of the year? Many solutions to overcome difficulties for the steel industry |

Vietnam imports the most iron and steel from the Chinese market.

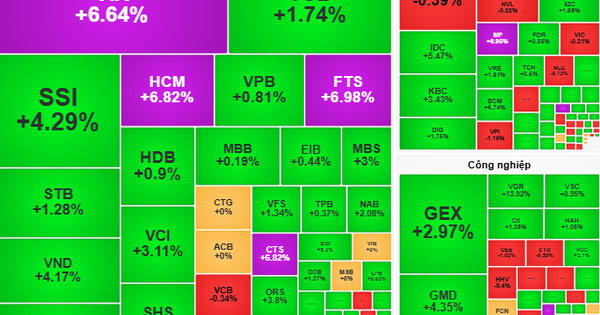

According to preliminary statistics from the General Department of Customs, in May, Vietnam imported over 1.54 million tons of iron and steel, equivalent to nearly 1.3 million USD, with an average price of 730 USD/ton, up 20.6% in volume and 34.1% in value compared to April 2024. In the first 5 months of the year, 6.9 million tons of iron and steel were imported to Vietnam, worth more than 5 billion USD, with an average price of 724 USD/ton, up sharply by 50.1% in volume and 27.6% in value but down 15.1% in price compared to the first 5 months of 2023.

|

| According to the Ministry of Industry and Trade , by the end of May 2024, out of a total of 252 foreign trade defense investigations with Vietnam, about 30% of the cases were related to steel products. |

The largest amount of iron and steel imported into Vietnam in the past 5 months came from China, with 4.77 million tons, equivalent to more than 3 billion USD, up 91% in volume and 62% in turnover compared to the first 5 months of 2023; accounting for 69% of the total volume and 61% of the total iron and steel import turnover of the whole country.

The average import price in the first 5 months of 2024 reached 641 USD/ton, down 15% over the same period last year. In May alone, China exported more than 1.1 million tons to our country, equivalent to 702 million USD, up 154% in volume and 105% in value compared to May 2023. This is also the month with the highest output since the beginning of 2023.

Although Vietnam's crude steel production currently ranks 13th in the world and first in the ASEAN region. However, the steel industry still has long-term bottlenecks. Production capacity is still limited, Vietnam continues to be a country with a steel trade deficit. Crude steel production is only basically meeting domestic production needs, there is still a shortage of high-quality steel products and technical steel.

Vietnam continues to import rolled steel (accounting for over 50% of total import turnover), mainly hot-rolled steel. In addition, Vietnam continues to import shaped steel, some metal-coated and color-coated steel products (accounting for about 20-25% of domestic consumption demand).

Meanwhile, due to the difficult domestic construction market, China - the "powerhouse" of steel production has a policy to boost exports by supporting prices and taxes. The wave of Chinese steel flooding into Vietnam makes businesses worried, especially when the domestic market is showing signs of recovery after a long period of stagnation due to the impact of the real estate downturn.

Mr. Nghiem Xuan Da - Chairman of the Vietnam Steel Association (VSA) commented that with the current recovery momentum, it is forecasted that finished steel production in 2024 could reach 30 million tons, an increase of 7% compared to 2023. However, with China continuing to increase steel exports, Vietnamese steel producers face the risk of losing the domestic market.

“The rise of production protectionism worldwide as countries strengthen technical barriers and trade defense to prevent imported steel to protect domestic production is also a significant obstacle to Vietnam's steel exports today. In addition, the "oversupply" of many domestic steel products and the increase in imported steel will make the price competition of domestic finished steel products more fierce," said Mr. Nghiem Xuan Da.

Faced with current difficulties, the Vietnam Steel Association has recommended that the Government direct relevant agencies to continue to develop and improve the system of technical management standards, quality management standards, and technical barriers to prevent steel products that do not meet technical safety and environmental standards from flooding the Vietnamese market. The Ministry of Industry and Trade promptly applies trade defense measures (self-defense, anti-dumping, anti-subsidy, and trade avoidance measures) to prevent unfair competition and protect domestic production.

At the same time, accelerate the synchronization of stimulus channels for steel products such as the real estate market, construction market, the program to build 1 million social housing, promote public investment...

The Vietnam Steel Association recommends that the Ministry of Industry and Trade continue to guide and support steel exporting enterprises to promptly and effectively respond to trade defense cases against steel production abroad. The Ministry of Industry and Trade needs to accelerate the development and submission of the Vietnam Steel Industry Development Strategy to 2030, with a vision to 2050, in conjunction with specific policies for the steel industry to grow green and sustainably.

During the time when there is no Steel Industry Development Strategy, it is necessary to have measures to manage investment in large-scale steel projects to control the balance of supply and demand, avoid wasting resources, land capital, protect the environment, reduce greenhouse gas emissions, and convert to green production and consumption;...

The Prime Minister will soon issue the Steel Industry Development Strategy.

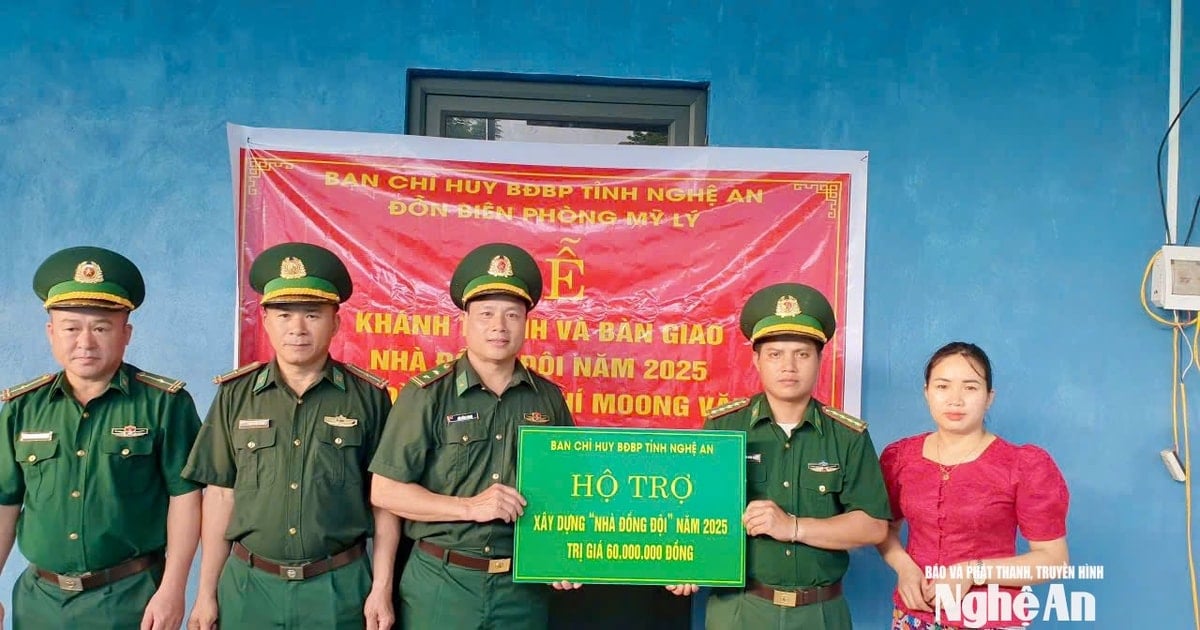

To prevent the massive influx of steel into Vietnam, affecting domestic steel, on June 14, 2024, the Ministry of Industry and Trade also issued Decision No. 1535/QD-BCT on the investigation and application of anti-dumping measures on some galvanized steel products originating from China and Korea.

Also on June 14, 2024, the Ministry of Industry and Trade also issued a notice on the receipt of a complete and valid dossier requesting an investigation into the application of anti-dumping measures on hot-rolled steel products (HRC) from India and China.

Previously, on March 19, 2024, the Department of Trade Remedies (Investigation Agency) received the dossiers of companies representing the domestic manufacturing industry (Requesting Parties) - including Hoa Phat Group (HPG) and Formosa Ha Tinh Steel Corporation, requesting an investigation to apply anti-dumping measures on hot-rolled steel products from India and China.

To continue to remove difficulties for the steel industry, Minister of Industry and Trade Nguyen Hong Dien said that the Ministry of Industry and Trade is developing and is expected to soon submit to the Prime Minister for promulgation the Strategy for the Development of Vietnam's Steel Industry to 2030, with a vision to 2050. The Ministry is also completing the draft to report to the Government to submit to the National Assembly for promulgation of the Law on Key Industrial Development. Accordingly, the long-term goal is to develop the steel industry into a national foundation industry, meeting domestic demand and rapidly increasing exports.

Regarding loan support, the Ministry of Industry and Trade has proposed that the Ministry of Finance review, update and have appropriate import tax regulation policies for a number of steel products with large price fluctuations; proposed that the State Bank direct and encourage commercial banks to implement preferential credit packages to support investment, production and trading of steel.

Regarding the issue of massive steel imports into the market, the Ministry of Industry and Trade has regularly reviewed and assessed the impact of steel imports, received feedback from the business community and promptly protected businesses in the domestic market through trade defense measures (anti-dumping, anti-tax evasion, anti-subsidy, trade defense) and technical measures. In addition, the Ministry also provided guidance and support for steel exporting businesses to promptly and effectively respond to steel product trade defense cases abroad.

At the same time, this agency also affirmed that it has been and will continue to support steel production and trading enterprises to develop markets, especially expanding and diversifying export markets; promoting trade promotion activities; building and protecting brands for Vietnam's steel industry; supporting enterprises to protect their interests in domestic and foreign markets...

According to the Ministry of Industry and Trade, by the end of May 2024, of the total 252 foreign trade defense investigations with Vietnam, about 30% of the cases involved steel products. The investigated steel products are quite diverse, including galvanized steel, cold-rolled stainless steel, color-coated steel, steel pipes, steel hangers, steel nails, etc. These lawsuits mostly occurred in Vietnam's major steel export markets such as the United States, the EU, Australia, etc., of which the United States is the country with the most investigations with Vietnam. Most recently, after a long period of not using direct trade defense measures against Vietnam, in August 2023, the EU launched an investigation against the circumvention of trade defense measures against cold-rolled stainless steel from Vietnam for allegedly evading trade defense taxes currently applied to Indonesia. |

Source: https://congthuong.vn/bo-cong-thuong-se-som-trinh-thu-tuong-chinh-phu-ban-hanh-chien-luoc-phat-trien-nganh-thep-326939.html

Comment (0)