In the past two years, nearly 500 billion VND has been lent by the Agribank system nationwide to agricultural, forestry and fishery raw material areas that meet development standards according to the project of the Ministry of Agriculture and Rural Development .

| Agribank is the key bank providing capital for the development of 1 million hectares of high-quality rice. Agribank has disbursed 7,183 billion VND, leading the preferential credit program for forestry and fisheries. |

According to information from Agribank, in the past two years, the implementation of cooperation agreements between this credit institution and the Ministry of Agriculture and Rural Development (MARD) in supporting credit for the "Pilot project to build a standard agricultural and forestry raw material area for the period 2022-2025" has achieved many positive results.

Accordingly, with the proactive participation of Agribank branches in 13 provinces and cities implementing the above pilot project, up to now, the bank has approached hundreds of customers who are enterprises, cooperatives, and farming households participating in the project development. Outstanding loans to large enterprises, such as Tan Long Group, Loc Troi Group, Dong Giao Joint Stock Company, Kim Nhung Company, etc., reached about 482.7 billion VND.

Agribank's level 1 branches in the Mekong Delta region have approached customers to open payment accounts and use services at the bank. Since then, the bank has lent capital to cooperatives with outstanding loans of about VND6 billion. In addition, according to the customer list provided by the Department of Cooperative Economics (Ministry of Agriculture and Rural Development), Agribank has approached, connected and lent to more than 30 cooperatives and farming households with outstanding loans of about VND14 billion.

In Tien Giang and An Giang, cooperatives participating in the project to build rice and fruit material areas, such as Binh Thanh Cooperative, Vinh Kim Cooperative, Hung Thinh Phat Cooperative, Tan Binh Cooperative, Green Vina... have all accessed loans with outstanding loans of 2-3 billion VND.

According to Agribank's leaders, the cooperation in developing the pilot project to build 5 agricultural raw material areas not only brings positive results from credit financing but also helps the bank effectively deploy many accompanying financial products and services, especially providing multi-channel payment services, financing financial management solutions for the closed production-consumption chain of agricultural products.

|

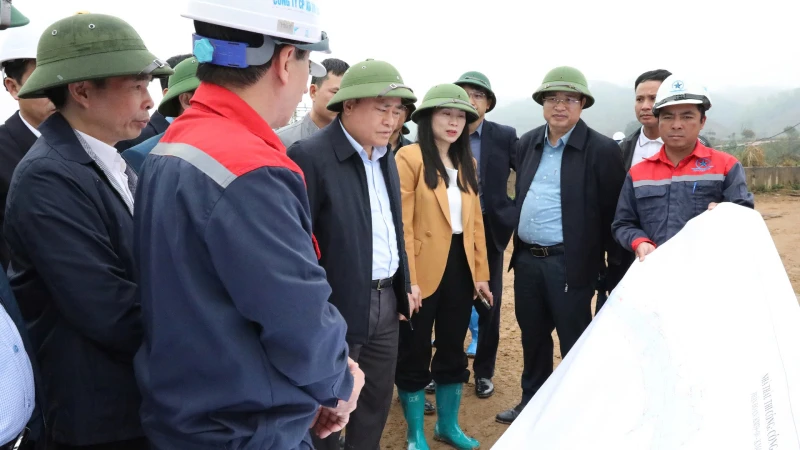

| Many agricultural raw material areas have access to preferential loans to develop production and export processing. |

Reaching thousands of large enterprises, corporations, cooperatives and cooperative groups participating in the raw material area project also helps Agribank branches significantly develop their customer base in many other services and products such as: opening payment accounts, saving deposits, etc. For example, among the 14 large enterprises participating in this project, 7 customers have opened payment accounts and registered to use the deposit service with a deposit balance of about 250 billion VND. Enterprises such as Tan Long, Vinh Hiep, Loc Troi, Dong Giao, Kim Nhung, Chanh Thu, etc. have all become large corporate customers of the bank with deposit balances ranging from 10 billion to several hundred billion VND.

According to the report of the Ministry of Agriculture and Rural Development, by the end of July 2024, the pilot project to build 5 agricultural and forestry raw material areas meeting basic standards had basically completed 62.5% of the infrastructure construction work. Localities participating in building raw material areas have also built 81 linkage chains, with the area of agricultural raw material areas linked to consumption with key enterprises reaching nearly 104,000 hectares.

A representative of the Department of Economic Cooperation (Ministry of Agriculture and Rural Development) said that the total funding requirement for implementing this project from 2022-2025 is about 2,470 billion VND. Of which, the central budget: more than 942 billion VND, local budgets: 410 billion VND, counterpart capital of enterprises and cooperatives: 572.2 billion VND and credit loans: more than 552.3 billion VND.

Up to now, the total budget of the Central, local and enterprises and cooperatives allocated for raw material area projects has reached about 564.2 billion VND. Meanwhile, Agribank branches have lent with outstanding loans of nearly 500 billion VND. This shows that the bank has been very close and proactive in funding capital for the raw material areas of the project.

Mr. Hoang Minh Ngoc, Deputy General Director of Agribank, said that the project is currently entering phase 2 with components requiring a lot of capital to complete and expand. The bank is committed to continuing to accompany the implementation of preferential credit programs and expanding financial support for localities to complete the project.

However, in order to operate the cash flow connection in the raw material supply chain smoothly and effectively, Agribank recommends that the Ministry of Agriculture and Rural Development and localities cooperate closely and develop unified lending regulations in the direction that all entities in the supply chain must conduct monetary transactions related to that supply chain using accounts opened at the same credit institution. This will help control cash flow, ensure that cash flow is used for the right purpose and increase the efficiency of credit financing.

On the bank side, in addition to the credit capital of more than 552.3 billion VND committed to disburse in cooperation with the Ministry of Agriculture and Rural Development, Agribank will also combine funding for raw material areas with capital from other preferential credit programs, such as: short-term personal loan program with 2% interest rate reduction (scale of 50,000 billion VND); 2,000 billion VND OCOP loan program; 50,000 billion VND SME loan program (1.5% interest rate reduction); preferential credit packages with 2% interest rate reduction such as: 20,000 billion VND for large enterprises; 15,000 billion VND for preferential loans to finance investment projects... Therefore, preferential loan capital to serve the needs of developing and expanding agricultural raw material areas in the coming time is not lacking and there are many options to access.

Source: https://thoibaonganhang.vn/hop-suc-xay-dung-vung-nguyen-lieu-nong-lam-san-154367.html

Comment (0)