VN-Index lost the 1,290 point mark, the market is under short-term pressure, investor cash flow from VNDirect is expected to return today, Aqua City project updates progress, dividend payment schedule,...

VN-Index shines but quickly loses 1,290 points

VN-Index continued to experience a volatile week when a large amount of investors' money from VNDirect was "stuck".

Surpassing the 1,290 point mark in the session of March 28, but not for long, at the end of the week, VN-Index "went back" with 6.09 points, down to 1,284.09 points, ending the 3-session consecutive increase streak. Thus, after 1 week of trading, VN-Index only increased by more than 3 points compared to the previous week.

HNX floor reached 242.58 points, UPCoM floor reached 91.57 points.

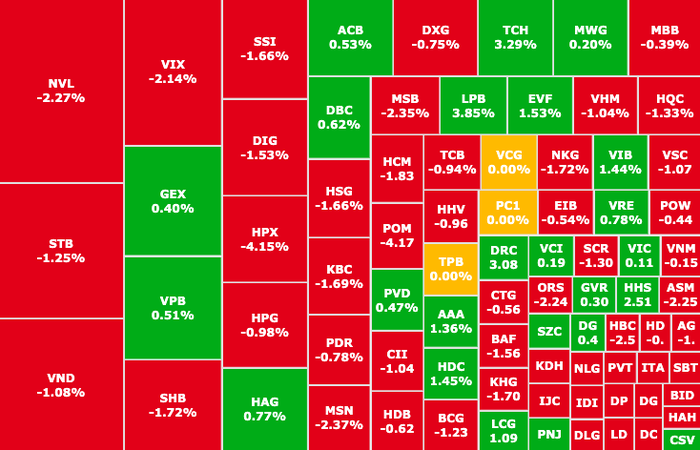

A series of large stocks, belonging to the VN30 group, reversed and decreased: MSN (Masan Group, HOSE) decreased by 2.37%, HPG (Hoa Phat Steel, HOSE) decreased by 0.98%,SHB (SHB Bank, HOSE) decreased by 1.72%, BID (BIDV Bank, HOSE), SSI (SSI Securities, HOSE),...

The group of small and medium-sized stocks that went against the market trend increased positively in the chemical, rubber, oil and gas, and real estate groups.

A series of large stocks turned down sharply last weekend.

Foreign investors continued to sell strongly for the 14th consecutive session, reaching VND800 billion in the last session of the week. Selling pressure focused on MSN ( Masan Group, HOSE) with VND219 billion, VND (VNDirect, HOSE) with VND190 billion, VHM (Vinhomes, HOSE) with VND150 billion,...

Last week, the entire market lacked a large amount of cash flow from investors at VNDirect as the system was unable to trade all week.

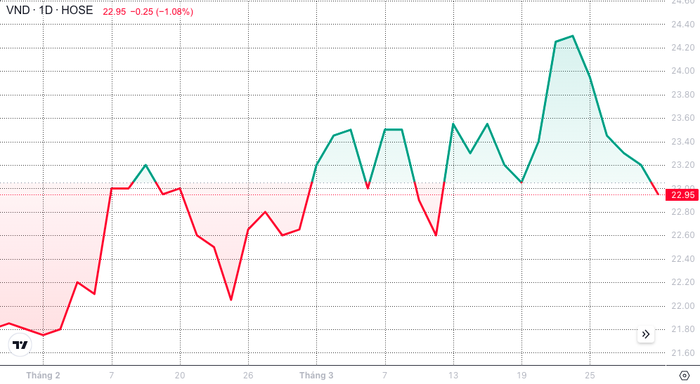

VND shares recorded 5 consecutive sessions of adjustment, decreasing 5.5% of market price after 1 week, down to 22,950 VND/share.

The average liquidity in the past 5 sessions on the HOSE floor alone was about 21,213 billion VND, a significant decrease compared to the previous week.

VNDirect returns after 1 week of attack

After a week of continuous troubleshooting, VNDirect announced last weekend that it had completed procedures with the Information Security Management Agency to officially connect with the two Stock Exchanges on March 29. The system is expected to return on April 1.

The company is committed to ensuring the safety of customer information and assets.

At the same time, the performance of VND stocks on the floor was not very positive as they were continuously under pressure to sell off and plummet (Source: SSI iBoard)

In addition, the company also officially announced a customer appreciation program with preferential policies in the second quarter of 2024, to partly overcome the losses, thank customers for their companionship, sympathy and support during the past difficult time.

Specifically, with policies such as: free transactions in April, applying a margin trading loan interest rate of 9.3% in April 2024,...

Chairwoman of VNDirect Securities Company, Ms. Pham Minh Huong, said that the company is researching reasonable support policies and will share them with investors as soon as possible.

Comments and recommendations

Ending March with many fluctuations, securities companies gave cautious comments on the market.

BSC Securities said that VN-Index is facing profit-taking pressure in the morning session last weekend and fell to 1,284 points, 11/18 sectors decreased. In the short term, the index may fluctuate in the 1,280 - 1,300 point range.

KB Securities believes that VN-Index will likely continue to be under pressure to "shake" in the coming sessions. Investors should avoid chasing buying during uptrends and prioritize restructuring their portfolio to a safe level when the index or stocks they are holding exceed their peak.

DSC Securities stated that in the next 1-2 months, the market may adjust in the 1,180-1,230 point range, before catching a new wave, reaching the 1,400 point range. Investors are advised to focus on taking profits from existing stocks to preserve profits in the recent period. Next, be patient, observe the market and only disburse when the time is right.

Hoang Anh Gia Lai continues to delay debt payment

On March 30, Hoang Anh Gia Lai Joint Stock Company – HAGL (HAG, HOSE) had to pay 143.7 billion VND in interest on HAGLBOND16.26 bonds. However, the company continued to delay paying interest on the 3-party debt repayment schedule agreement and liquidated some of the company's unprofitable assets.

Thus, the amount of late interest payment of this bond lot has reached nearly 3,210 billion VND, the late principal payment is 1,016 billion VND. The total estimated principal and interest payment is nearly 4,226 billion VND.

HAGL is raising money to supplement capital for investment projects and restructure the company's debt. The company is mortgaging more than 31,000 hectares of rubber land, forest land, oil palm land,... and nearly 45 million HAG shares of Mr. Doan Nguyen Duc (Bau Duc) - Chairman of the Board of Directors, along with many other assets such as constructions, machinery, HAGL Football Academy, breeding pigs,...

Novaland Real Estate updates on Aqua City project

Considered the "survival" project of Novaland (NVL, HOSE), Aqua City has a scale of 1,000 hectares, in the East of Ho Chi Minh City, invested by Aqua City Company Limited.

Recently, NVL has updated the latest progress of this project. Specifically, at the end of March, the project continued to be constructed alongside the handover of houses and welcoming of residents.

Aqua City Project (Source: Aqua City)

Regarding this project, the Chairman of the Board of Directors of the Military Commercial Joint Stock Bank - MB Bank (MBB, HOSE) expressed optimism when NVL actively resolved the procedures for two important projects: Aqua City and Novaworld.

With a total scale of 1,000 hectares, the project includes: townhouses, shophouses, single and double villas with main subdivisions such as Phoenix - Sun Harbor - River Park - The Grand Villas - The Valencia - The Stella - The Elite - The Suite - Ever Green.

After 1 year of legal difficulties, 752 properties of the Aqua City project have been recognized by the Department of Construction of Dong Nai province as eligible to sell future housing.

Hot stock price, Quoc Cuong Gia Lai puts subsidiary up for sale

Quoc Cuong Gia Lai Joint Stock Company (QCG, HOSE) decided to sell all of its affiliated company, Quoc Cuong Lien A Joint Stock Company.

The company has a charter capital of VND250 billion, QGC currently owns 31.39%. By the end of 2023, this ownership value is VND135.1 billion, the price the company wants to sell is VND150 billion.

QCG has positive performance in the market (Source: SSI iBoard)

It is known that Quoc Cuong Lien A was established in 2010, operating mainly in the field of housing construction. The representative is Mr. Dao Quang Dieu, who is currently the Head of the Board of Supervisors of QCG. In 2023, this company made a profit of 2.9 billion VND, an improvement over 2022 when it lost 426.5 million VND.

QGC stock value has continuously increased sharply in recent times. In March 2024, QCG stock increased by 38% to VND 12,600/share.

Dividend schedule this week

According to statistics, there are 6 businesses that announced dividend closing rights this week. Of which, all businesses paid dividends in cash, the highest rate was 6%, the lowest was 3%.

Cash dividend payment schedule of enterprises from 1 – 7/4

* GDKHQ: Ex-rights transaction - is the transaction date on which the buyer does not enjoy related rights (right to receive dividends, right to buy additional issued shares, right to attend shareholders' meeting...). The purpose is to close the list of shareholders owning the company's shares.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| GIC | HNX | 2/4 | April 15 | 12% |

| VGR | UPCOM | 2/4 | April 15 | 60% |

| BHA | UPCOM | 3/4 | 12/4 | 3% |

| HAM | UPCOM | 4/4 | April 26 | 5% |

| BWA | UPCOM | 5/4 | 9/5 | 4.5% |

| HEM | UPCOM | 5/4 | April 26 | 5% |

Source

Comment (0)