Widespread sell-off, hundreds of codes racing to hit the floor

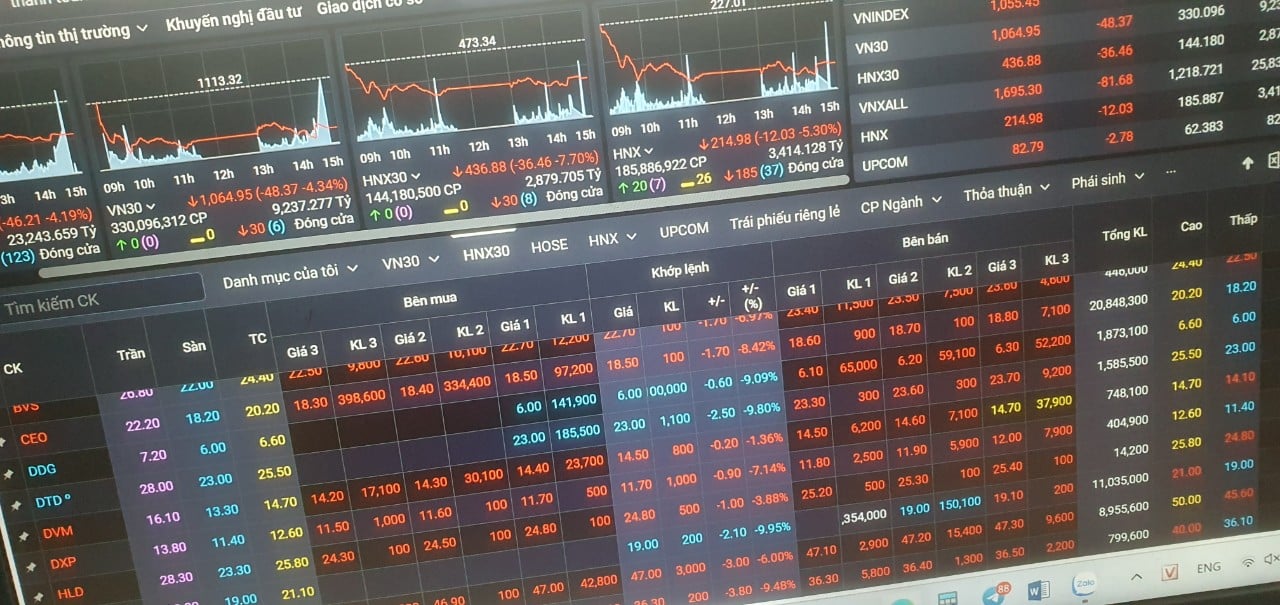

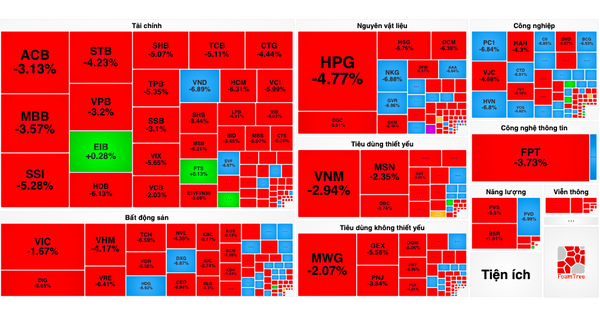

The stock market session on October 26 became a “Black Thursday” right from the opening hour when red completely dominated. Investors rushed to sell off, causing the VN-Index to drop more than 50 points at some points.

Notably, at the beginning of the stock market session on October 26, although the sell-off was strong, the bottom-fishing demand was also quite strong, so at many times the VN-Index limited its decline and created expectations for investors to get green.

However, by mid-morning, the cash flow suddenly “slowed down”, causing the VN-Index to continue its downward trend. At one point, the entire Ho Chi Minh City Stock Exchange had about 150 stocks hitting the floor.

At the close of the stock market session on October 26, although it no longer decreased by 50 points, the VN-Index still maintained its lowest point of the day when it closed at 1,055.45 points after decreasing by 46.21 points, equivalent to 4.19%; the VN30-Index decreased by 48.37 points, equivalent to 4.34% to 1,064.95 points.

The stock market on October 26 became “Black Thursday” when the HNX30-Index “plummeted freely” and recorded the sharpest decline in the Asian and European markets. Screenshot

Liquidity on the Ho Chi Minh City Stock Exchange more than doubled compared to the October 25 session but still did not reach a billion dollars. The Ho Chi Minh City Stock Exchange recorded nearly 1.2 billion shares, equivalent to VND23,244 billion, successfully traded. The VN30 group had 330 million shares, equivalent to VND9,237 billion, transferred.

The VN30 group recorded 6 blue-chips hitting the floor. These codes mainly belonged to the real estate, petroleum and retail sectors. No large-cap stocks were lucky enough to close in the green.

On the entire Ho Chi Minh City Stock Exchange, there were only 24 stocks increasing in price, 31 stocks remaining unchanged and 505 stocks decreasing in price (123 stocks hitting the floor).

It can be seen that VN-Index and VN30-Index are both “falling freely”, but the decline of these two indices is still far behind that of HNX-Index and HNX30-Index. Of which, HNX30-Index has the fastest “falling” speed in the Asian and European stock markets.

Specifically, at the close of the stock market session on October 26, the HNX-Index decreased by 12.03 points, equivalent to 5.3% to 214.98 points; the HNX30-Index decreased by 36.46 points, equivalent to 7.7% to 436.88 points. Liquidity on the Hanoi Stock Exchange improved sharply compared to yesterday but remained at a low level. There were 186 million shares, equivalent to 3,414 billion VND, successfully transferred.

Asian and European stocks fall

In the stock market session on October 26, not only did Vietnamese stocks "collapse", but the entire Asian and European markets were also in red.

Asian markets saw a broad sell-off, with benchmark indices in Japan and South Korea leading the declines in the region, while Australian shares closed at lows not seen in more than a year.

South Korea's Kospi index fell 2.71% to 2,299.08, its lowest since Jan. 6, while the Kosdaq index fell 3.5% to 743.85, its lowest since Jan. 31.

This comes as shares of South Korean chipmaker SK Hynix fell after it posted a net loss of 2.18 trillion won ($1.61 billion) in the third quarter, compared with a net profit of 1.11 trillion won in the same period a year earlier.

South Korea's gross domestic product grew 0.6 percent in the third quarter from the previous quarter, slightly higher than expected according to a Reuters poll.

Japan's Nikkei 225 fell 2.14% to 30,601.78 and the Topix index fell 1.34% to 2,224.25.

In Australia, the S&P/ASX 200 index closed down 0.61% at 6,812.30, hitting its lowest level since late October 2022.

Hong Kong's Hang Seng index fell 0.35%, while China's benchmark CSI 300 index was the only major index in positive territory, up 0.24%.

The S&P 500 closed below a key level on Wednesday following disappointing quarterly results from Google parent Alphabet and a rebound in interest rates.

The benchmark index fell 1.43% to close at 4,186.77, ending the day below the widely watched 4,200 level among chart analysts. It was the first time the S&P 500 closed below that level since May.

The Dow Jones Industrial Average fell 105.45 points, while the Nasdaq Composite lost 2.43%.

European stock markets opened sharply lower on Thursday as attention remained on third-quarter earnings and government bond yields.

The Stoxx 600 regional index was down 1.1% at 8:14 a.m. London time, with nearly all sectors in the red. Auto stocks fell 3.45% on disappointing results, while travel stocks traded 1.7% lower.

Standard Chartered fell more than 12% in early trading before paring losses to 10%. The British bank posted a huge profit loss as it disclosed a $1 billion writedown on its exposure to China’s banking and real estate sectors.

Source

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

Comment (0)